Bitcoin is struggling to reclaim the $70,000 level after several days of recovery from the recent $60,000 low, reflecting a market still searching for stability. The rebound offered temporary relief following intense selling pressure, yet momentum appears fragile as resistance continues to cap upside attempts. Volatility remains elevated, and sentiment has yet to fully recover from the sharp drawdown that pushed prices toward multi-month lows.

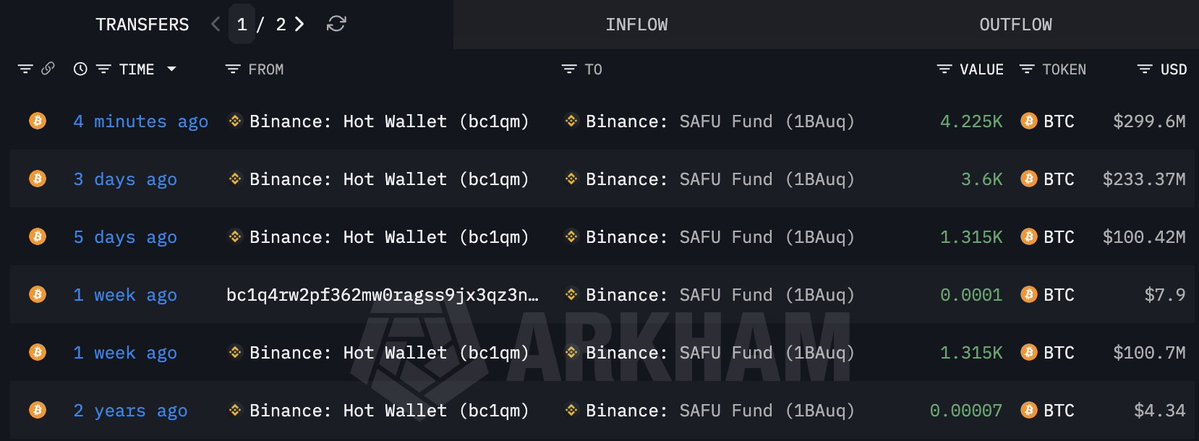

Amid this uncertain backdrop, fresh data indicate that the Binance SAFU Fund has purchased an additional 4,225 BTC, valued at roughly $299.6 million. The move comes at a time when broader market confidence remains subdued, immediately drawing attention from analysts tracking institutional positioning and liquidity dynamics. Historically, large strategic purchases during periods of weakness have sometimes preceded stabilization phases, although they do not guarantee an immediate reversal.

Market participants are now debating whether this accumulation reflects long-term confidence from major players or simply opportunistic positioning within an ongoing corrective cycle. While some analysts interpret the purchase as a constructive signal, others remain cautious, noting that macro conditions, exchange flows, and derivative positioning continue to exert pressure on price. For now, Bitcoin’s ability to sustain recovery above key resistance levels will likely determine whether this rebound evolves into a trend shift or remains a temporary bounce.

Institutional Accumulation Signals Amid Fragile Market Conditions

Data from Arkham indicates that Binance’s SAFU Fund has now accumulated a total of 10,455 BTC, worth roughly $734 million at current prices. This expansion of reserves is notable because it occurs during a period of persistent market fragility, when liquidity conditions remain tight, and investor sentiment is still recovering from recent drawdowns. Such activity from a major exchange-linked fund tends to attract attention, as it can reflect both strategic treasury management and broader confidence in Bitcoin’s long-term market structure.

From a market perspective, these purchases matter primarily due to their signaling effect rather than immediate supply impact. While the acquired volume represents only a fraction of circulating supply, institutional accumulation during corrective phases has historically coincided with stabilization periods, particularly when retail flows remain defensive.

However, this should not be interpreted automatically as a bullish catalyst. Exchange inflows, derivative positioning, and macroeconomic uncertainty continue to influence short-term price behavior.

Currently, the market remains in a transitional phase characterized by elevated volatility, cautious positioning, and selective accumulation. Large entities adding exposure while prices consolidate below key resistance levels can indicate long-term confidence, but confirmation typically requires improving liquidity conditions, declining exchange sell pressure, and stronger spot demand. Until those factors align, Bitcoin’s recovery remains tentative despite visible institutional participation.