While Bitcoin’s price faced heightened bearish pressure in the last few days, Ethereum’s price experienced significant upside action, which led to a new all-time high during the weekend. In addition to outperforming Bitcoin in terms of price action, ETH is demonstrating notable on-chain activity when compared to BTC.

Bitcoin Is Lagging Behind Ethereum

Ethereum’s strength is becoming increasingly evident in the current bull market cycle, with new on-chain data highlighting its edge over Bitcoin. CryptoMe, a market expert, has outlined a key metric that underscores the disparity in momentum between the two crypto giants in a quick-take post on the CryptoQuant platform.

According to the market expert, Ethereum is giving strong signals compared to Bitcoin, as Wall Street is starting to adopt the altcoin. Considering the trend, ETH fundamentals appear to be painting a clear picture of resilience and market dominance.

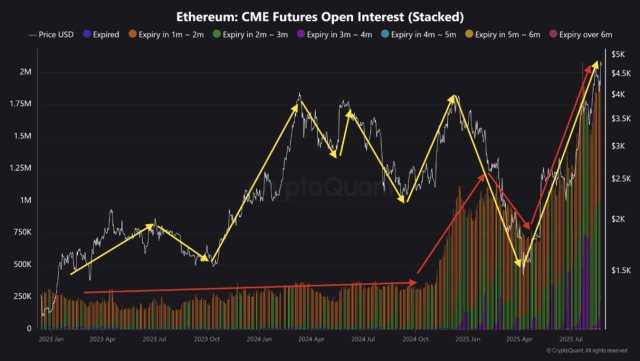

In the last 3 months, ETH has outperformed, and this disparity may continue for some time. CryptoMe’s analysis is based on a comparison of the Open Interest (OI) data for Bitcoin and Ethereum futures contracts traded on the Chicago Mercantile Exchange (CME).

Delving into BTC’s performance, the expert highlighted that Bitcoin hit an all-time high of $110,000 in January, then fell to $74,000 in March and April before rising to $124,000 for a new all-time high. However, the open interest did not retest its old levels during this period.

Therefore, even if the price of Bitcoin increased, it would not be able to draw the same amount of institutional interest as CME options. Meanwhile, the circumstances are different for ETH. In 2024, ETH made several attempts to break past the $4,000 mark, but failed each time due to its weak open interest.

However, CryptoMe noted that the open interest in CME has started to increase in this current trend. The development implies that the ongoing uptrend is bolstered by fresh liquidity inflows and shows that the altcoin is diverging from Bitcoin.

ETH Rallies To New Highs: The Top Is Not In

ETH may have risen sharply to new highs, but CryptoMe foresees a continued uptrend due to the absence of retail investors on centralized exchanges. Typically, retail investors enter close to the top and give the major players exit liquidity. Nonetheless, since retail is still absent in the current move, it shows that ETH’s price action is healthy and has room to grow.

In the overall picture, ETH is showing a more bullish outlook compared to BTC lately. According to the market expert, the increase in CME open interest and the absence of retail participation indicate that this disparity might persist in the near to medium future.

At the time of writing, ETH was trading at $4,414, demonstrating a nearly 5% in the last 24 hours. Despite the waning price action, CoinMarketCap data reveals that investors’ sentiment is slowly turning bullish, as evidenced by a more than 10% increase in trading volume in the past day.