XRP (XRP) is facing renewed downside pressure as derivatives activity and onchain positioning continue to weaken across December. These signals point to a market still in risk-off mode, even as price hovers near a key technical support around $2.00.

Key takeaways:

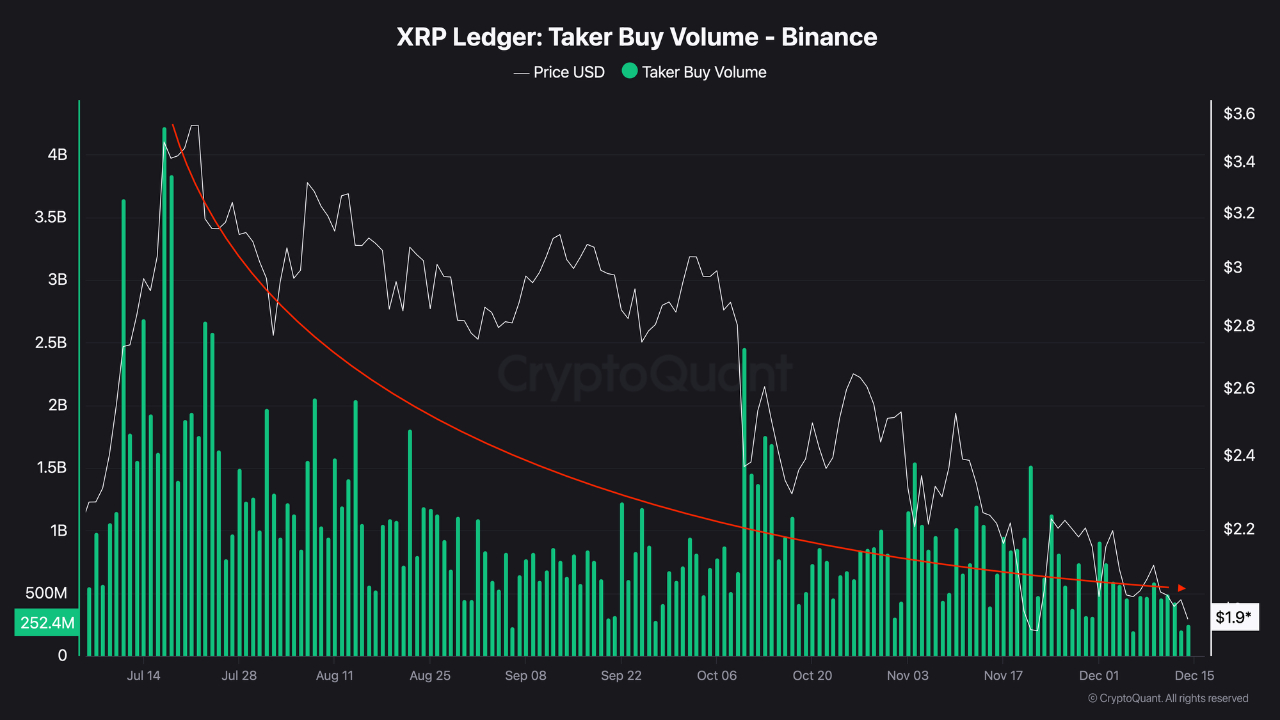

XRP futures taker buy volume on Binance has decreased by 95.7% since July, indicating a decline in demand.

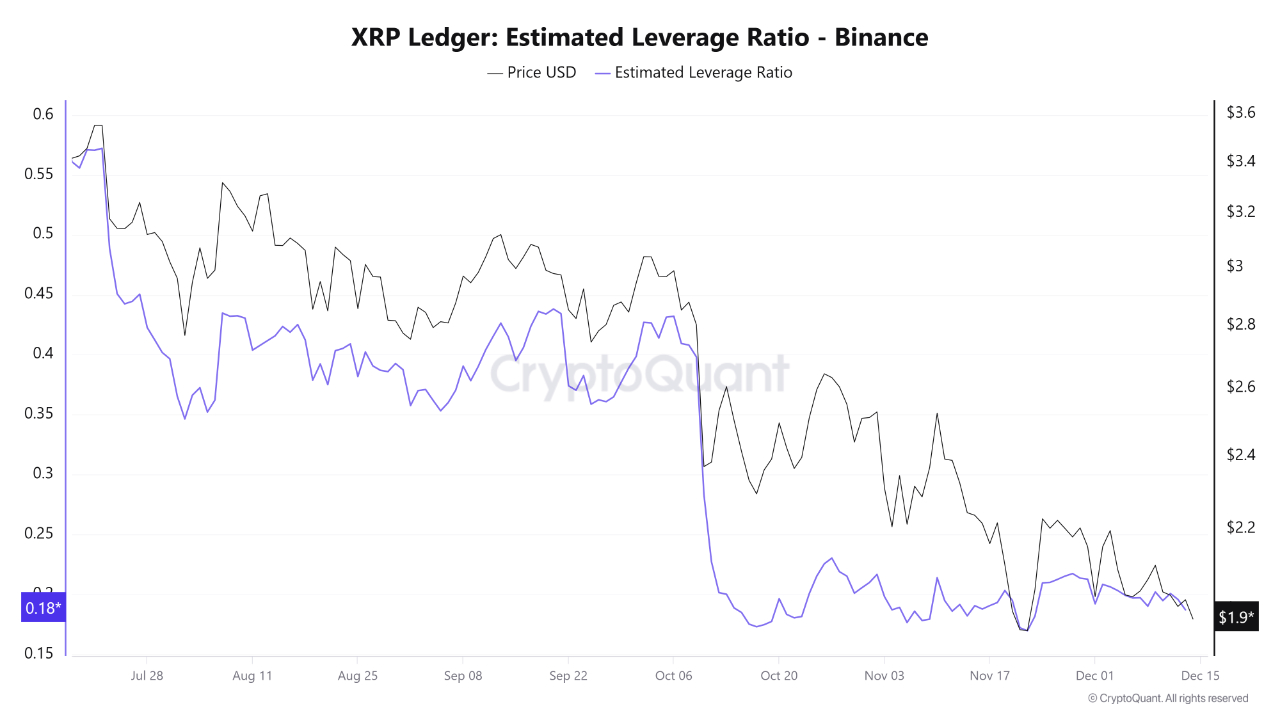

XRP’s Estimated Leverage Ratio (ELR) has fallen to 0.18, reflecting widespread deleveraging and reduced speculative risk.

Retail, mid-sized, and large wallets all show negative cumulative volume delta through December, confirming broad-based selling pressure.

XRP futures demand collapses as liquidity dries up

Data from CryptoQuant noted that XRP’s futures taker buy volume on Binance peaked above $5.8 billion in July but has since fallen to roughly $250 million, a decline of nearly 96%. This collapse highlighted a severe contraction in buying pressure, not just for XRP but across the broader altcoin market.

The taker buy-sell ratio has remained negative for most of this period, indicating that sellers have consistently dominated XRP derivatives flow. With liquidations accumulating and confidence still fragile after the Oct. 10 event, the lack of sustained bid-side activity suggests that downside risks remain elevated. Even ETF-related optimism has failed to materially revive demand.

XRP leveraged positions reset with strong market de-risking

Binance data shows XRP’s Estimated Leverage Ratio declining to around 0.18, one of the lowest readings of the current cycle, coinciding with price slipping from above $3.00 toward the $2.00 level. This drop suggests traders have actively reduced or closed leveraged positions, a reaction to the prolonged market dip.

While lower leverage reduces the risk of cascade liquidations, it also reflects subdued speculative interest. Such environments mark transitional phases where markets rebalance before establishing a clearer directional trend.

Related: Most crypto sectors lagged Bitcoin over past 3 months: Glassnode

Profit-taking and wallet data indicate blank order books

Glassnode senior researcher CryptoVizArt reported that on Dec. 11, a 5 to 7-year-old XRP wallet with a cost basis of $0.40 realized over $721.5 million in profit, which is a large-scale distribution event occurring as the price weakened at the $2.00 level.

Order-flow data from Hyblock Capital reinforced this bearish context. XRP’s cumulative volume delta for December is negative across all participant classes: retail wallets ($0–$10,000) at -$8.68 million, mid-sized wallets ($10,000–$100,000) at -$6.89 million, and large wallets ($100,000–$10 million) at -$34 million. The data shows consistent net selling, with no cohort exhibiting sustained buying pressure.

Overall, XRP remains in a low-demand, low-leverage environment, with data indicating consolidation or further downside unless liquidity conditions improve materially.

Related: Ripple pilots RLUSD on Ethereum L2s in multichain push

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.