? In the past 24 hours, 85,716 people were liquidated globally, with a total liquidation amount of $212 million. The largest single liquidation occurred on Hyperliquid - BTC-USD, valued at $2.1421 million.

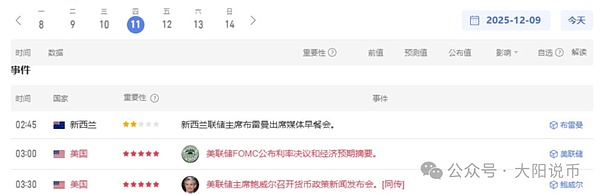

? The biggest suspense this week: The Fed will determine the market direction!

From a data perspective, the turnover rate surged at Monday's opening, indicating that short-term investor sentiment remains panicked and unstable, with high turnover directly suppressing Bitcoin's price rise. Short-term players are frequently buying and selling, mainly due to a bearish outlook on the market; however, early holders remain steady, with no disorderly selling of chips.

The overall chip structure is still relatively safe, with no widespread panic selling by loss-making investors. The biggest focus this week is the Federal Reserve's interest rate meeting. Although Powell's stance may be diluted by Hassett (Trump's economic advisor), the dot plot represents the views of all officials and will still have a significant impact on market sentiment.

If you don't understand the market trends or are unsure of the direction, remember to follow me ?

✅ Today's Market Analysis:

BTC

Bitcoin's short-term support today is near 88,100. If it pulls back again to the 85,900-85,200 range after a rebound, consider building long positions in batches. Be aware of the potential pin risk near 87,100. The key resistance above is at 93,400.

SOL

As hinted yesterday, Solana has already pulled back near 140. If the decline continues, focus on the 125.8 and 124 levels. If spot positions are stuck, consider averaging down near the 120 area to reduce the holding cost and speed up breakeven.

ETH

Ethereum needs to watch three support levels below: 2955, 2865, and 2805, with the rebound strength potentially increasing at each level. The hourly downtrend line has not been broken yet; it will be difficult to look up to the 3282 resistance before a breakout. Short-term operations should closely monitor changes in this trend line.

BNB

Focus on the 898 level today. If it can hold for 1-2 hours, a rebound is likely to start. The resistances above are at 905 (minor resistance), 913, 926, and 939. If it fails to hold 898, it indicates weak rebound momentum. Supports below can be watched at 888 (minor support), 881, 870, and 857.

? In summary, the main task for December is to patiently wait for the consolidation to bottom out, gradually build long positions, and capture波段 profits by following the short-term upward trend of the market.

However, remain cautious and avoid excessive capital consumption during fluctuations. A larger bearish trend opportunity may emerge by the end of Q1 next year, so retain sufficient positions to respond flexibly. Remember to control risks and keep enough ammunition to seize key market movements.

? The difficulty of playing shitcoin Meme coins is now reached hell level!

Various hot projects keep emerging on BSC, but they are basically one-wave plays. Whether they are蹭 news or purely speculative, none can sustain. Even if they pull back to a million市值, they can't be considered "stable" at all.

The $1抄底ed yesterday got halved today. Turns out the庄家 was pretending to bottom out just to keep割韭菜. Although it looks like it's "bottoming out" again at over 700k, I don't believe it anymore—once市值 falls below a million, it might be a bottomless fall.

In comparison, higher市值 coins like $bibi are slightly more reliable. I won't dare to easily play the second rebound wave anymore unless it's above a 5 million市值.

The SOL chain is equally brutal. For example, the庄家 of $Franklin played散户 like a fiddle: pumped to 17 million on day one, dumped to 2 million on day two, and pumped back to 20 million on day three. With洗盘 this ruthless, they might as well open a car wash.

In such market conditions, patience is particularly important. Waiting a bit longer might mean getting套 less. Set your mental stop-loss more firmly—better to miss out than to冲动抄底.

$Horse to Success

Bought $Horse to Success in batches at over 2 million! The most stable player in the Chinese market with a million市值, expectations are high for the Year of the Horse春节, super strong community consensus, K-line shows slow growth while bottoming out. With a window of less than a month,囤点 at 2 million first, add more if it pulls back to a million,毕竟 major market factors are uncontrollable.

$ZEC

ZEC has been very strong these past two days,强势 again today. It pulls back slightly and immediately recovers, giving空头 no chance at all. Feels like the second段主升 is coming. I still have some long positions. As long as it holds the neckline, breaking through $5000 is not a dream!

$RDNT

RDNT had an oversold rebound, but such coins are basically one-wave plays—however they go up, they will eventually come down the same way. I bought现货 before and lost several times,割肉 and ran away; otherwise, I wouldn't even have a chance to escape now. Don't chase the highs; those that suddenly pump with a big阳线 are mostly distributing.

$TRUMP

TRUMP basically has no chance in this bull market; it can't pump, and most tokens haven't been unlocked yet. Once the bear market hits next year, with prices plummeting + unlock dumping, the scene will be too惨. If President Trump can survive the midterm elections and remain the boss in 2027-2028, then TRUMP will be the fiercest meme king in the next bull market!

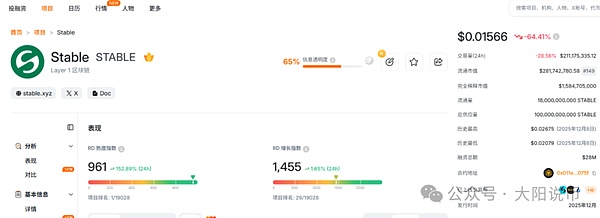

$STABLE

STABLE is阴跌 again today. Wanted to抄底, but saw its市值 is over 200 million, with a large number of tokens not unlocked yet, and exchanges are already listed—no more炒作 space left. Won't it have to fall below 100 million USD? Feels like可以直接长线做空!