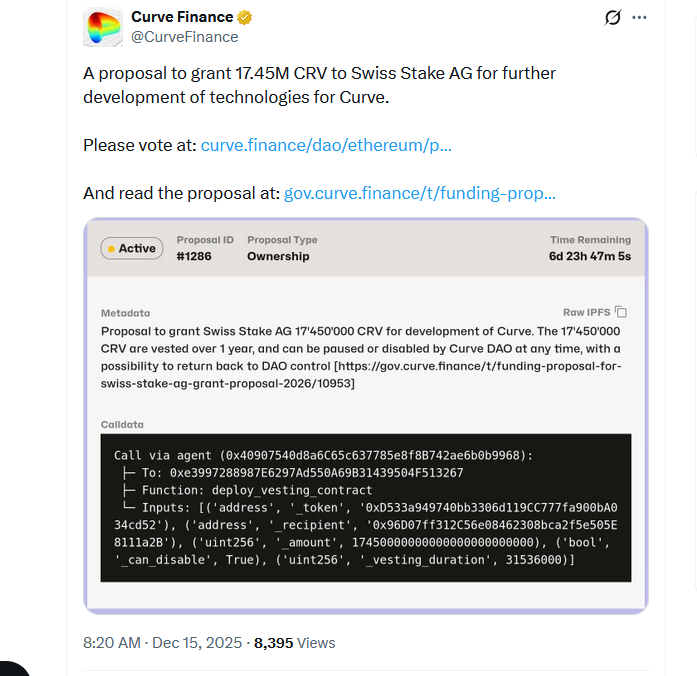

Curve Finance founder Michael Egorov has proposed a 17.45 million CRV token grant to support ecosystem growth, research and tech development of the lending protocol.

The grant, worth approximately $6.6 million at current prices, would be awarded to Swiss Stake AG, the firm behind Curve, and follows a previous grant awarded in late 2024.

In a proposal posted on the Curve DAO governance forum on Sunday, Egorov said that the funds would be used to support a range of tech and security enhancements for the lending protocol, as well as to sustain its contributor team.

“This grant will fund software research and development, infrastructure, security, and ecosystem support, ensuring that the 25-member team at Swiss Stake AG can continue its ongoing contributions to Curve,” Egorov said.

The founder provided a long list of objectives that Swiss Stake AG is eyeing for Curve in 2026. The list includes launching and scaling a new version of its lending system, Llamalend, creating an onchain foreign currency swap and improving Curve’s user interface.

“This proposal seeks to continue funding the development and maintenance of Curve’s smart contract ecosystem and software repositories, support further integrations, crosschain functionalities, and user interface improvements, strengthen the governance and operational infrastructure of Curve DAO,” Egorov said.

The firm will also release any IP created via the use of the grant as “under an open-source license compatible with the Curve software repositories.”

Related: DeFi is already 30% of the way to mass adoption: Chainlink founder

If approved, Swiss Stake AG will be permitted to stake some of the received CRV to generate additional yield for its ventures, but cannot use the funds for any purpose listed in the proposal. The firm says it will commit to “bi-annual reports on the spending of the GrantAmount.”

Swiss Stake AG pushes for self-sustainability

In the proposal, Ergorov outlined that while Swiss Stake AG has generated several revenue streams via CRV, it “remains largely dependent on community support to continue its work.”

As such, the funding will help keep the team afloat as it builds out the Curve ecosystem and pushes for self-sustainability.

“Swiss Stake AG has managed to establish some ancillary income streams, mainly through Curve Lite deployments on other networks. We have additionally earned system fees by staking veCRV via several wrapper protocols (Convex, StakeDAO, Yearn) as a minority participant,” he said.

“All such revenues have been used strictly in line with the purposes outlined in the grant. However, this revenue does not yet make the company sustainable at this stage,” the founder added.

Founded in early 2020, Curve Finance has a total value locked of around $2.2 billion, according to DefiLlama data, making it the 21st-largest DeFi protocol on the market.

Magazine: Have your stake and earn fees too: Tushar Aggarwal on double dipping in DeFi