The World Liberty Financial USD (USD1) stablecoin linked to the family of US President Donald Trump gained $150 million in market capitalization on Wednesday after Binance announced a yield program centered around the token.

The stablecoin’s market capitalization climbed from $2.74 billion to $2.89 billion on Wednesday after Binance announced its “booster program,” offering up to 20% annual percentage rate (APR) on USD1 flexible products for deposits exceeding $50,000.

The “first promotion” was designed to “help USD1 holders to maximize their rewards” and runs until Jan. 23, 2026, with passive yield for the bonus tiered APR distributed directly in Binance users’ earn accounts daily, according to the announcement.

The USD1 stablecoin is part of the Trump family’s growing crypto ventures, which reportedly generated about $802 million in income in the first half of 2025.

Related: Justin Sun urges Trump-linked WLFI to unlock ‘unreasonably’ frozen tokens

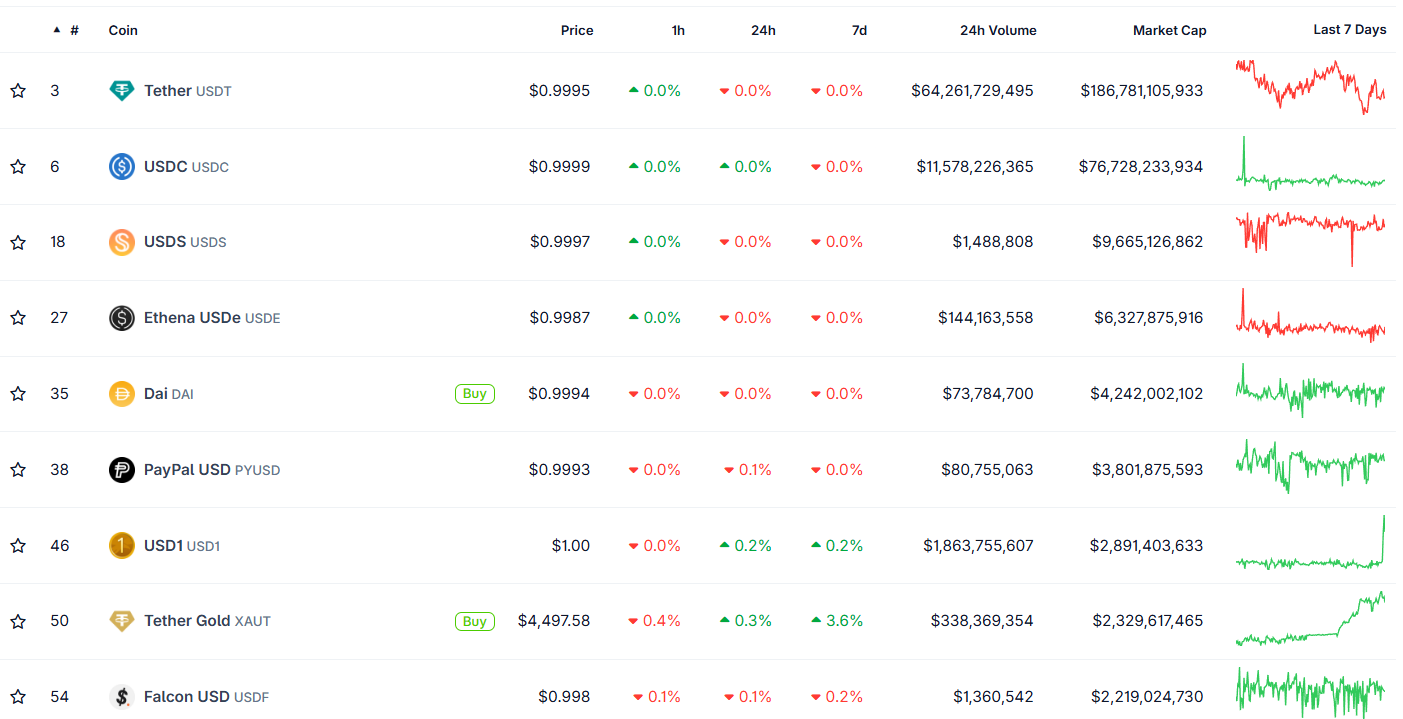

USD1 soars to become seventh-largest stablecoin

Binance has been launching increasingly more products, making USD1 a growing part of its ecosystem.

On Dec. 11, the exchange expanded support for the USD1 stablecoin by adding fee-free trading pairs for the leading cryptocurrencies and said it would convert all collateral assets backing its Binance USD (BUSD) stablecoin into USD1 at a 1:1 ratio.

In May, USD1 was used to settle MGX’s $2 billion investment into Binance Exchange, according to an announcement by Eric Trump during a panel discussion at Token2049 in Dubai.

Related: Trump-linked WLFI invests $10M in Falcon Finance for stablecoin development

The increasing ecosystem implementations from the world's biggest exchange have been part of the stablecoin’s climb to become become the seventh-largest stablecoin by market capitalization in the world, trailing PayPal USD (PYUSD).

However, some questions remain unanswered regarding the ties between Binance and WLFI, as a July Bloomberg report suggested that Binance was responsible for developing some of the code behind USD1, citing anonymous sources familiar with the matter.

In response to the article, Binance founder Changpeng Zhao claimed that it contained factual errors, and teased that he might “sue them again for defamation.”

Lawmakers have also raised concerns about the alleged relationship. In October, Connecticut Senator Chris Murphy said Binance.US, a separate legal entity of the exchange, was “promoting Trump crypto,” a week after Trump “pardoned Binance’s owner.”

Magazine: Trump’s crypto ventures raise conflict of interest, insider trading questions