With the crypto market now headed into a long weekend, investors are keeping a close eye on several mid-cap altcoins. Among all, the top five picks are: Chainlink (LINK), UNUS SED LEO (LEO), Avalanche (AVAX), Toncoin (TON), and Stellar (XLM).

As the market shows a mix of cautious optimism and uncertainty, understanding these altcoins’ trajectories could be a key to navigating through dull market sessions while preparing for an upcoming rally. Here is the weekend price analysis for top mid-cap altcoins that every keen investor will find worth exploring;

Chainlink (LINK): Steady Gains Amid Oracle Demand

The price of Chainlink (LINK), the leading decentralized oracle network, is showing signs of stability near the $12 mark. As per Coinmarketcap data, LINK is currently trading at $12.62 with a modest 1.4% increase in the past 24 hours.

This movement of LINK price aligns with Chainlink’s demand for oracle services, which facilitate secure data feeds for smart contracts across DeFi protocols. Whenever the market sees a slight pump, LINK records a notable gain.

LINK’s price has been supported by its consistent role in the blockchain ecosystem, and traders may expect this steady momentum to continue over the weekend, barring any major market shifts. If the crypto market rebounds from its current level, the price of LINK could surge to $15 while a continued bearish trend will keep it trading in the $12–$13 range.

UNUS SED LEO (LEO): A Rare Dip for the Exchange Token

UNUS SED LEO (LEO), the utility token of the Bitfinex exchange, has a noticeable presence in the crypto market with it sitting among top altcoins, having one of the largest market cap. As per CoinMarketCap data, LEO token is currently trading at $9.23 with a gain of 1.98% in the past 24 hours.

LEO’s price movements are often tied to the performance of Bitfinex and broader market sentiment toward exchange tokens. Its price action could be attributed to profit-taking or a temporary reduction in trading activity on the platform. Weekend traders might watch for a potential rebound if Bitfinex announces new major development or if market sentiment improves.

Avalanche (AVAX): Mixed Signals in a Competitive Layer-1 Space

Avalanche (AVAX), a high-performance layer-1 blockchain, is among the leading smart contract blockchain networks with it sitting in the row of Solana, Cardano and Tron. As per CoinMarketCap data, AVAX is currently trading near $19.11 with a market cap of $7.95 billion.

AVAX’s price reflects the competitive nature of the layer-1 sector, where it faces pressure from rivals like Solana and Ethereum. The upcoming weeks could see AVAX consolidating around the same price range, while having potential for a breakout if positive developments, such as new partnerships or network upgrades, emerge.

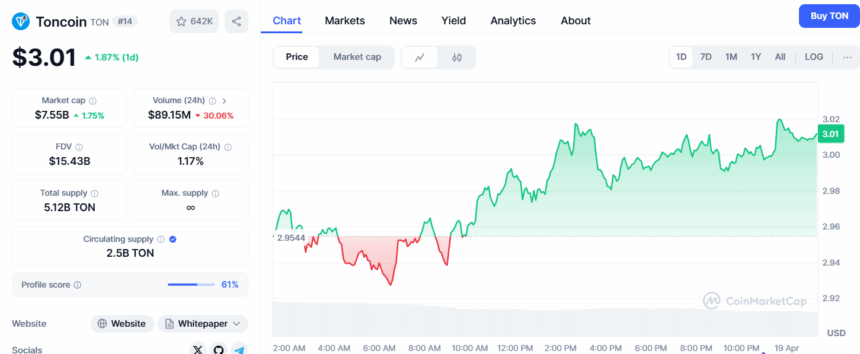

Toncoin (TON): Navigating Volatility

Toncoin (TON), the native token of The Open Network, is trading near $3.01 – up 1.87% in the past 24 hours. It could see greater price action if any Telegram-based starts gaining traction while TON being used as a centric currency.

TON has been gaining attention due to its association with Telegram and its focus on scalable blockchain solutions. The mixed price signals indicate that TON might experience choppy trading over the weekend, with traders needing to monitor broader market trends and Telegram-related news for directional cues.

Stellar (XLM): Quiet Gains in Cross-Border Payments

Stellar (XLM), known for its focus on cross-border payments, is also making waves in crypto space with coinciding substantial price gains in XRP. Currently trading at $0.2412 – it has surged a modest gain of 1.09% and has a market cap of $7.43 billion.

XLM’s steady performance reflects its niche in facilitating low-cost, efficient transactions for financial institutions. The token’s modest gains suggest a stable outlook for upcoming weeks with it potentially appealing to investors seeking less volatile assets amid a turbulent market.

Market Sentiment and Weekend Outlook

In a dim timeline, the crypto market is showing a mix of cautious optimism and volatility with altcoins like LINK, LEO, AVAX, TON and XLM being in the watchlist of millions of investors. The modest gains in these altcoins’ price over the past week suggest a stable trajectory for upcoming weeks.

Traders should keep an eye on broader market trends, macroeconomic factors, and any weekend announcements that could influence these tokens. As always, risk management remains crucial in navigating the volatile crypto landscape.

Also read: Trump Coin Token Unlock To Push Value toward $9 This Week?