Author: Prathik Desai

Compiled by: Block unicorn

Credit is the time machine of the economy. It allows businesses to bring future cash flows into today's decision-making.

I believe this is one of the most underrated aspects of the financial world.

People rarely notice credit at work, but it manifests in how businesses operate. An effective credit system enables businesses to restock shelves before they are empty, allows factories to upgrade equipment before it becomes obsolete, and lets founders to hire new employees before a human resource redundancy crisis erupts.

The gap between a good idea and its execution often stems from limited access to credit. And banks promise to bridge this gap.

Banks accept deposits from customers through bank accounts and provide credit to those who need loans. They pay a lower interest rate to depositors and charge a higher interest rate to borrowers, with the difference being their profit. However, bank credit also faces many challenges. The mismatch between credit supply and demand is one of the most significant among them.

Private credit fills the areas that bank credit cannot cover, but the gap remains. This gap reflects investors' current unwillingness to lend in the credit market.

In March 2025, a joint report by the International Finance Corporation and the World Bank, "Financing the Micro, Small, and Medium Enterprise (MSME) Gap," estimated the financing gap in 119 emerging markets and developing economies (EMDEs) to be approximately $5.7 trillion, accounting for about 19% of their combined GDP.

In this context, I find last week's developments in the on-chain credit space exciting. On-chain lending is not new. We experienced a crazy cycle in 2022, and people are still discussing it for various reasons today. But the current cycle feels different.

In this article, I will delve into all the changes happening in the on-chain credit market and explain why I believe it could revolutionize the credit industry.

Let's begin.

Money markets have existed on Ethereum for years. Over-collateralized lending, liquidation bots, interest rate curves, and occasional cascading liquidations are not new. Therefore, what truly caught my attention with last week's credit-related announcements was not the money markets themselves, but the players involved and how they are repackaging credit.

What excites me is that these sporadic partnership announcements collectively signal a broader trend of convergence. The fragmented DeFi landscape of summer 2022 is converging into a powerful force. Features like vault infrastructure, non-custodial wrapping, professional risk management, and automated yield optimization are being integrated and promoted.

Kraken launched DeFi Earn, a platform for retail users that can channel lenders' deposits into vaults (in this case, Veda). The vaults would then direct the funds to lending protocols like Aave. Chaos Labs would act as the risk manager, monitoring the entire engine. Kraken promises lenders an annual percentage yield (APY) of up to 8%.

What do vaults change? They offer lenders self-custody and fund visibility. Unlike traditional credit markets where you hand over funds to a fund manager and wait for monthly disclosures, vaults integrate smart contracts that mint claims on the funds and show the fund deployment in real-time on the blockchain.

Around the same time, Bitwise, the world's largest crypto fund manager, launched a non-custodial vault strategy on the on-chain lending platform Morpho.

This is not the first time on-chain lending has received institutional endorsement. In 2025, Coinbase launched its USDC lending service, enabling smart contract wallets to connect and route deposits via on-chain vaults to the Morpho platform. Steakhouse Financial used the platform for cross-market fund allocation to optimize yields.

This coincides with the on-chain lending market being on the verge of explosive growth, and the data confirms this.

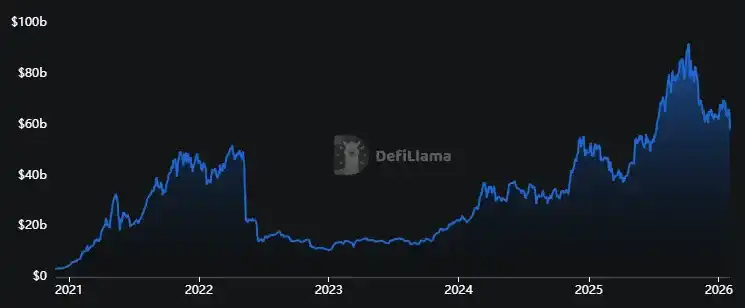

The total value locked (TVL) in lending protocols reached $58 billion, a 150% increase in two years. However, this figure is only 10% higher than the peak in 2022.

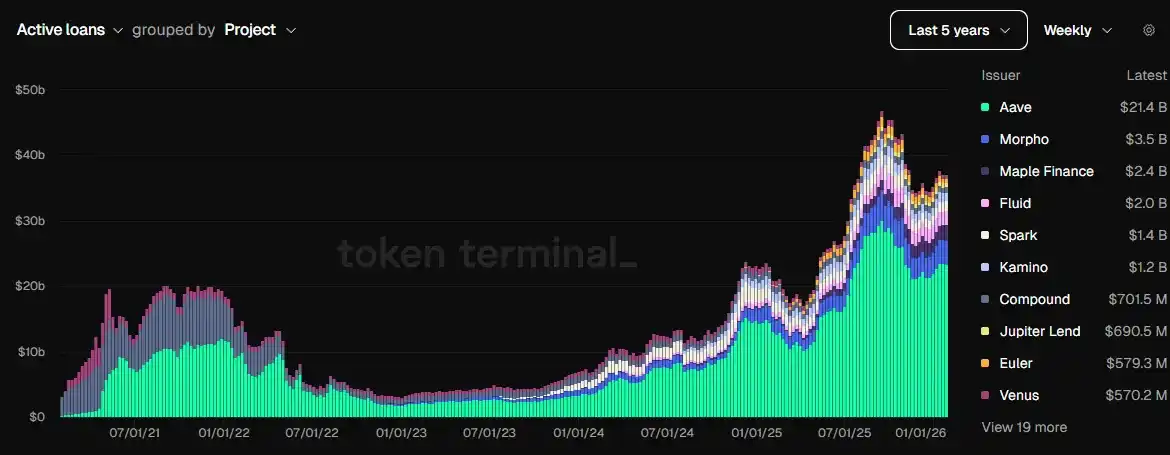

Here, the outstanding loan balance dashboard provides a more accurate picture of the actual situation.

This dashboard shows that the foundation laid by leading protocols like Aave and Morpho is very solid, with active loans exceeding $40 billion in recent months, more than double the peak in 2022.

The dashboard shows that existing institutions, including Aave and Morpho, have laid a solid foundation, with active loans exceeding $40 billion in the past few months, more than double the peak level in 2022.

Today, both Aave and Morpho's revenues are six times what they were two years ago.

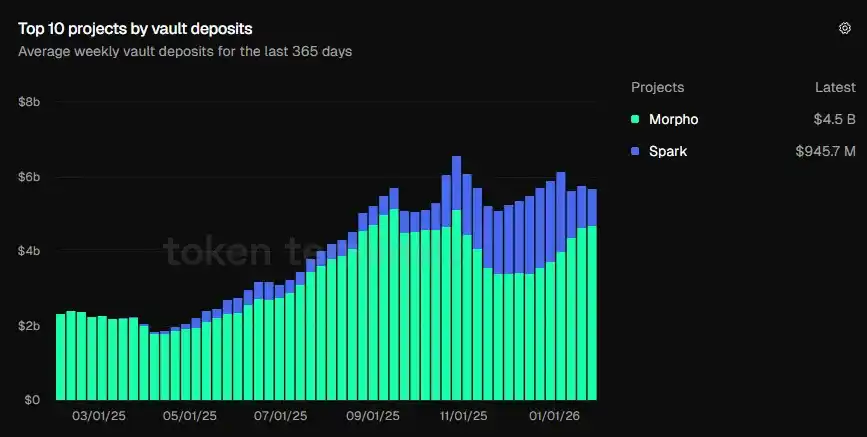

While these charts show investor confidence in lending protocols, I find the growth of vault deposits over time even more convincing.

In October 2025, total vault deposits surpassed the $6 billion mark for the first time. Today, deposits stand at $5.7 billion, more than double the amount from the same period last year ($2.34 billion).

These charts indicate that users are opting for products that offer a comprehensive ecosystem, including vaults, yield optimization strategies, risk configuration, and professional management.

This is the evolution I am optimistic about, completely different from what we observed during the DeFi summer.

Back then, the lending market seemed like a closed loop. Users leveraged this loop by depositing collateral, borrowing funds, using the proceeds to buy more collateral, and depositing again to earn higher yields. Even if collateral prices fell, these users could at least earn rewards from the platform for using its lending protocol. But when those rewards themselves disappeared, the loop broke.

Even the current cycle is built on the same basic elements—over-collateralized lending—but on a fundamentally different and much more solid foundation. Today's vaults have evolved into wrappers that turn protocols into automated asset management tools. Risk managers play a central role, setting up safety measures.

This shift changes the appeal of on-chain lending for both investors and lenders.

During the DeFi summer, lending protocols were just another way to make quick money. This model worked until the incentives failed. Users registered Aave accounts, deposited funds, borrowed against collateral, and so on, until the incentives ran out. We saw this with Aave's Avalanche deployment: incentives attracted deposits and kept the cycle running initially. But when the subsidies waned, the cycle collapsed. As a result, Avalanche's outstanding debt decreased by 73% quarter-on-quarter in Q3 2022.

Today, the lending business has evolved into a mature ecosystem with specialized players responsible for risk management, yield optimization, and liquidity management.

Here's how I assemble the entire stack.

The bottom layer is settlement funds, existing in the form of stablecoins. They can be transferred instantly, stored anywhere, deployed at any time, and crucially, are easy to account for.

On top of this are the familiar money markets, such as Aave, where lending and borrowing are enforced by software code and collateral.

Next is the world of wrappers and routers that aggregate funds and route them from lenders to borrowers. Vaults act as wrappers, packaging the entire lending product in a way that is easy for retail investors to understand. For example, it can be presented as "Deposit $X to earn up to Y% yield," as Veda wallet does on Kraken's Earn platform.

Custodians sit above these protocols, deciding which collateral to allow, liquidation thresholds, exposure concentration, and when to close positions if collateral value declines. Think of how Steakhouse Financial operates on the Morpho platform, or how asset managers like Bitwise embed their judgment directly into the vault rules.

In the background, AI systems run 24/7, managing on-chain credit risk and acting as the nervous system of the lending ecosystem when humans are not around. Manual risk management is difficult to scale. Limited risk management increases credit risk during market volatility. The best outcome is substandard returns, the worst is liquidation.

AI optimization engines track borrowing demand, oracle deviations, and liquidity depth to trigger timely withdrawals. It alerts when vault exposure exceeds preset thresholds. Furthermore, it advises on risk mitigation measures and assists risk teams in decision-making.

It is this round-the-clock optimization, de-risking, audited vaults, carefully curated strategies, institutional backing, and professional risk management that make the current market feel safer and less risky.

But none of these measures can completely eliminate risk. Among them, liquidity risk is one of the most easily overlooked.

Although vaults offer better liquidity than isolated protocols, they still operate within the same markets as these protocols. In markets with thin trading volume, vaults increase the cost of closing positions, making it difficult to exit funds.

Furthermore, there is the risk of curator discretion.

When users deposit funds into a vault, they are essentially trusting certain institutions to make investment decisions based on market conditions, choose suitable collateral, and set corresponding redemption thresholds. Credit works in myriad ways, but lenders should understand that non-custodial does not necessarily mean zero risk.

Despite these challenges, on-chain lending is also changing the cryptocurrency landscape and, consequently, the economic landscape.

The cost of running a credit market depends on time and operational costs.

Heavy investment in verification, monitoring, reporting, settlement, and execution of transactions makes traditional credit expensive. A significant portion of the interest they charge borrowers is avoidable and not necessarily related to the "time value of money."

On-chain credit saves both time and operational costs.

Stablecoins minimize settlement time, smart contracts reduce execution time, transparent ledgers reduce audit and reporting time, and vaults simplify complexity for users. These cost savings will be even more significant when addressing the SME credit gap.

On-chain credit will not fill the credit gap overnight, but lower credit costs will make verification more convenient and credit access more inclusive. And this could reshape the economic landscape.