Trading King

07/18 04:27

ETH as a reserve asset

ETH as a reserve asset

A new report by Electric Capital highlights Ethereum’s leadership in stablecoin issuance and settlement.

Despite declining trust in the US dollar, global demand remains strong for both individuals and businesses. And thanks to blockchains, for the first time in history, anyone with internet access can hold and use digital dollars without a bank. Since 2020, stablecoin adoption has seen a 60x increase, now amounting to over $200 billion.

These stablecoins are evolving into financial instruments. Yield-bearing versions, now exceeding $4 billion in market cap according to The Block, are the fastest-growing segment, letting users earn passive income in stable assets.

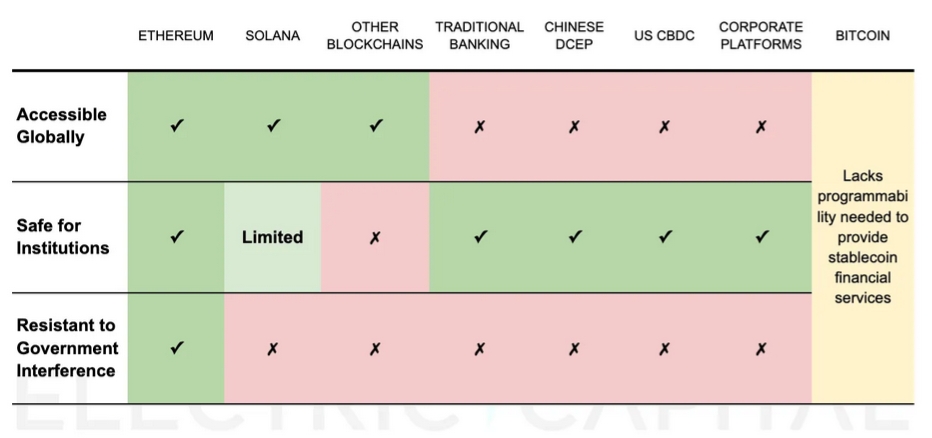

Ethereum still dominates this space, hosting over 54% of all stablecoins. Electric Capital outlines three key criteria for stablecoin platforms: global accessibility, institutional security, and political neutrality. Ethereum is the only network that consistently meets all three. Tron comes second with 32%, but its low-cost edge is eroding as usage drives fees higher. Meanwhile, Ethereum’s fees have dropped thanks to upgrades and declining congestion, giving it a chance to consolidate its role as the core layer for the onchain dollar economy.As this ecosystem grows, so does ETH’s function as a reserve asset. Like Treasurys or gold in TradFi, ETH provides collateral, settlement, and yield. It’s scarce, non-custodial, stakable, and deeply embedded in DeFi, already backing over $19 billion in loans. Electric capital believes that in the longer term, ETH could absorb a share of the $500 trillion global store-of-value market. It offers the resilience of Bitcoin, plus yield, a trait favored by US households, who now hold $32 trillion in dividend-paying equities but less than $1 trillion in gold

Semua Komentar0TerkiniHangat

Tidak ada catatan