Source: The Defi Report

Author: Michael Nadeau

Compiled and Edited by: BitpushNews

Some of the best-performing "altcoins" in this cycle aren't tokens at all—they are crypto-related stocks. The standout performer has undoubtedly been Robinhood.

Its stock price has surged 17-fold in less than two years, turning one of our most contrarian investments (HOOD was down 80% from its IPO price in '22) into a major victory for our portfolio.

We first accumulated shares during the last bear market (average cost $21.49) and exited in October, locking in gains of over 550%.

Now, with accelerating product momentum and a more diversified revenue mix compared to two years ago, Robinhood is officially back on our "Watch List" (our bear market shopping list).

This report provides an update on the company's fundamentals, valuation, and its deepening strategy into crypto assets and prediction markets, based on data.

Disclaimer: The views expressed are the author's own and should not be relied upon as investment advice.

Revenue & Revenue Growth

Data: Yahoo Finance, Robinhood

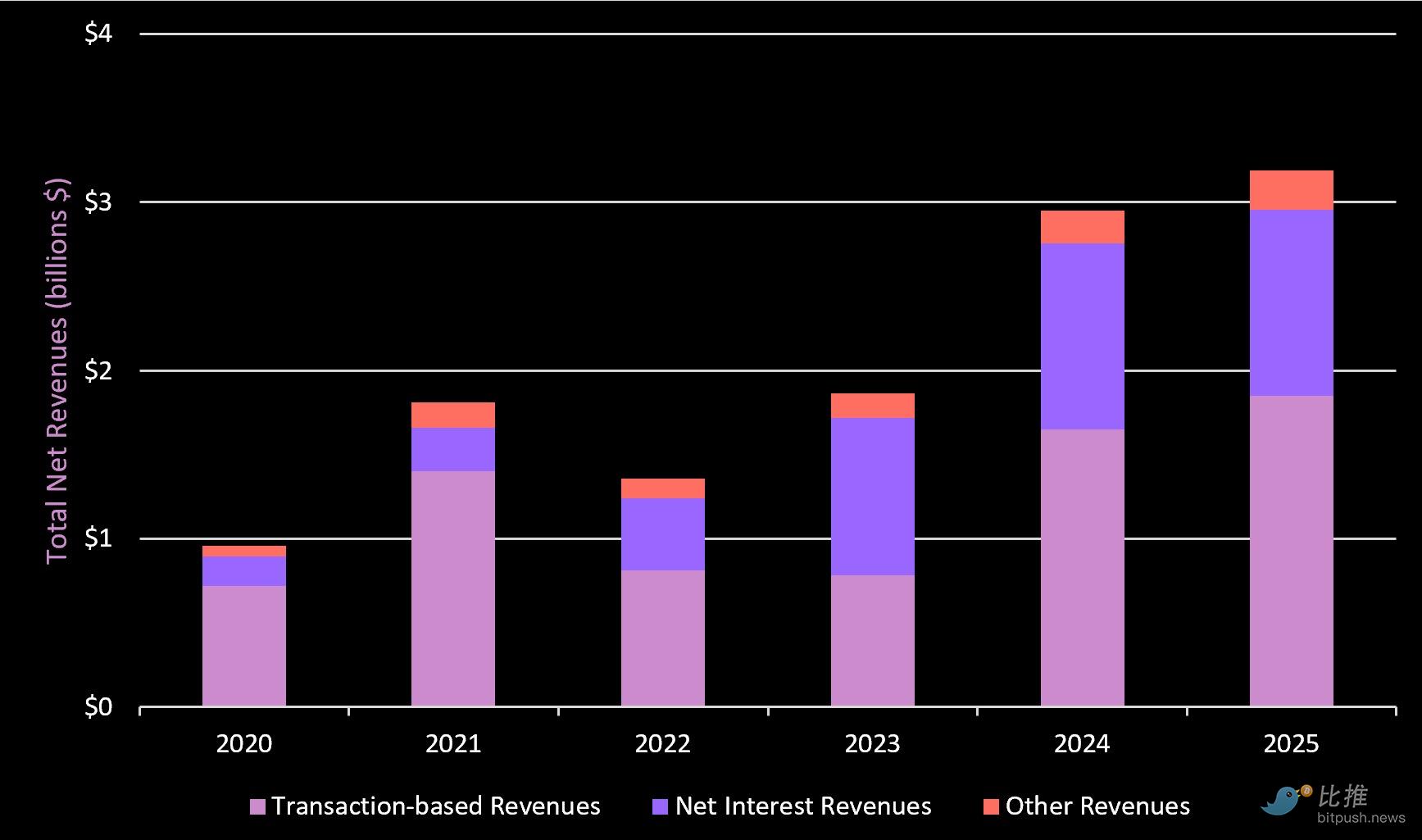

Robinhood generated $2.95 billion in revenue in 2024, a 58% increase from '23. As of Q3 this year, it has already produced $3.19 billion in revenue—surpassing the total for all of last year.

Over the past twelve months, the company's revenue reached $4.2 billion (a 31% year-over-year increase).

Below, we break down the revenue sources and growth by business line.

Revenue Composition Analysis

Data: Robinhood 10Q

Key Takeaways

-

Over the past five years, Robinhood's revenue has grown at a compound annual growth rate (CAGR) of 34%. It posted a record net profit of $565 million in Q3 (a 271% year-over-year increase).

-

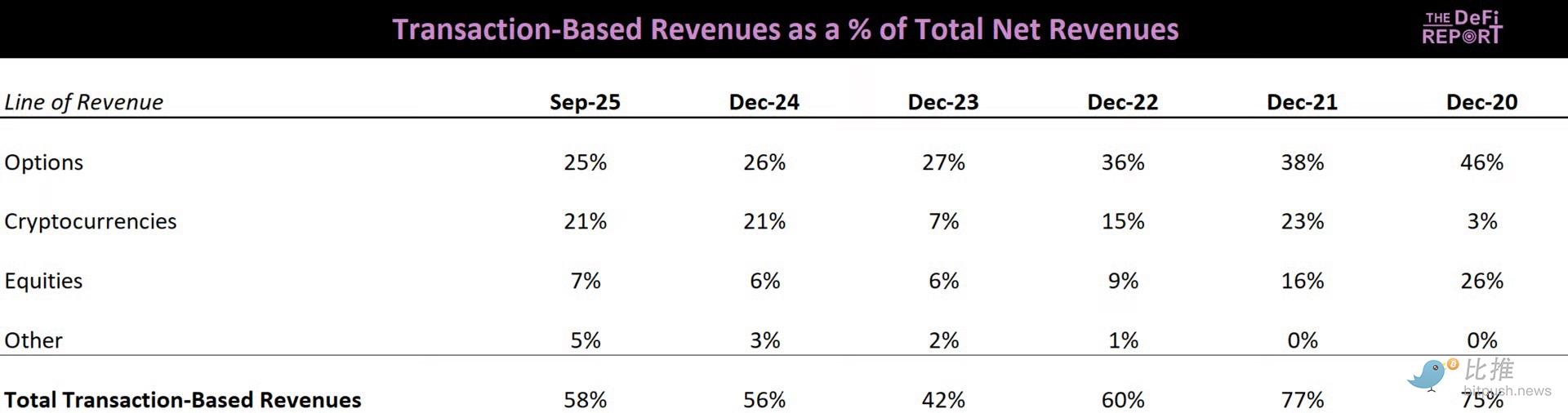

Cryptocurrency accounted for 21% of Robinhood's total year-to-date revenue (same as last year).

-

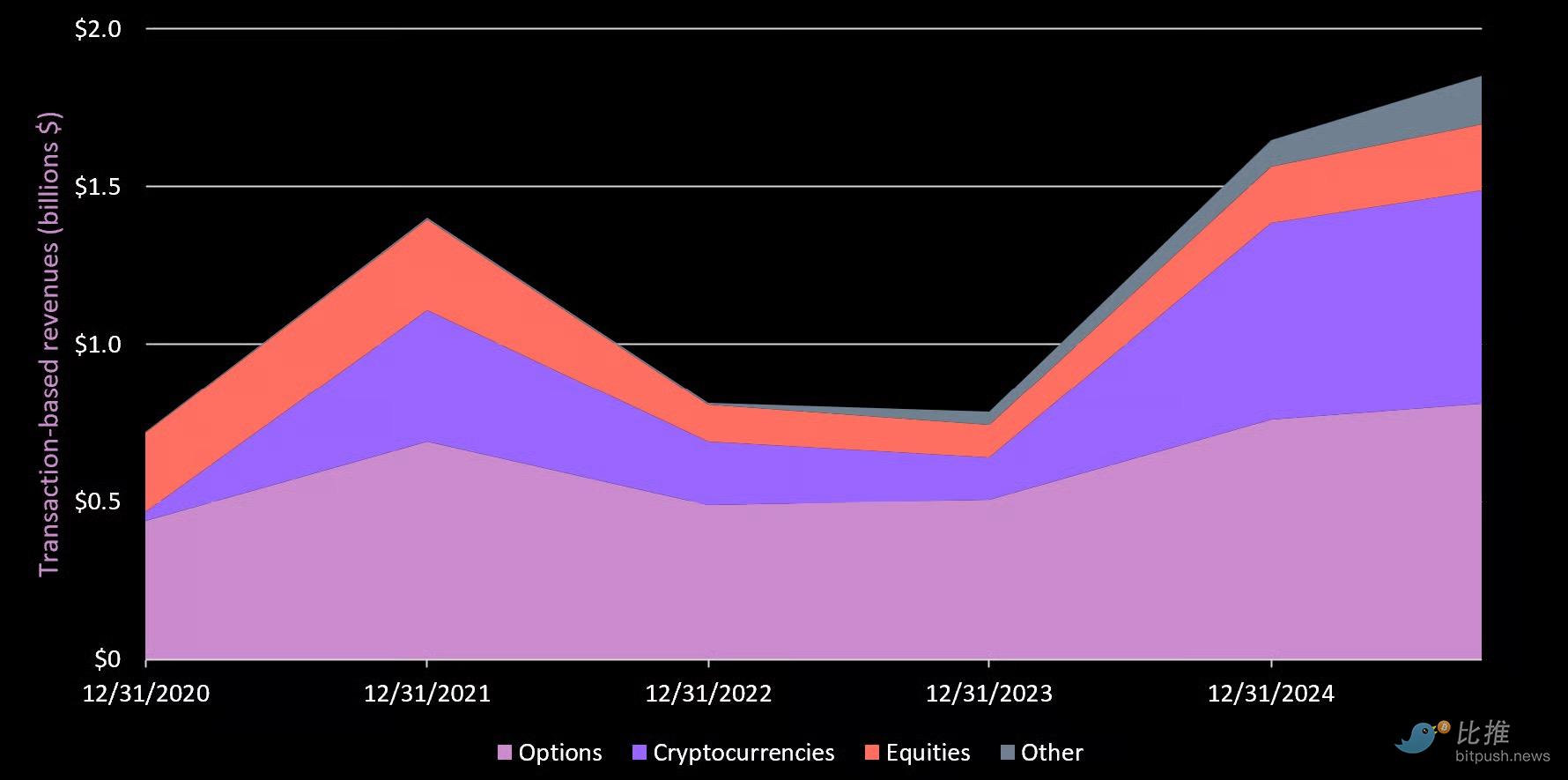

Transaction-based revenue year-to-date is $1.85 billion (up from $1.65 billion in 2024). Overall, transaction-based revenue makes up 58% of total revenue (down from 77% in 2021).

This tells us that 1) transaction-based revenue is growing (including stocks, options, and crypto),

and 2) Robinhood has been adding new revenue streams.

What are these new revenue streams? Prediction markets (via Kalshi) have reached an annualized revenue of $100 million. This is their fastest-growing business line ever.

Robinhood Gold now has 3.9 million users paying $5 per month, generating $234 million in annual subscription revenue. We use this product ourselves.

Instant withdrawal fees, futures markets, and interchange revenue (Robinhood credit card) contribute to "Other Revenue."

Beyond its transaction-based revenue and new streams, Robinhood generated over $1.1 billion in net interest income through Q3 (35% of total revenue).

Transaction-Based Revenue

Data: Robinhood 10Q

Key Takeaways

-

Options are Robinhood's cash cow.

-

Crypto ranks second, despite accounting for only 12% of stock volume.

-

This highlights the superior business model Robinhood has unlocked for crypto trading.

-

Stock trading makes up 88% of trading volume but only 7% of transaction revenue.

Fundamentals

Users

Data: Robinhood

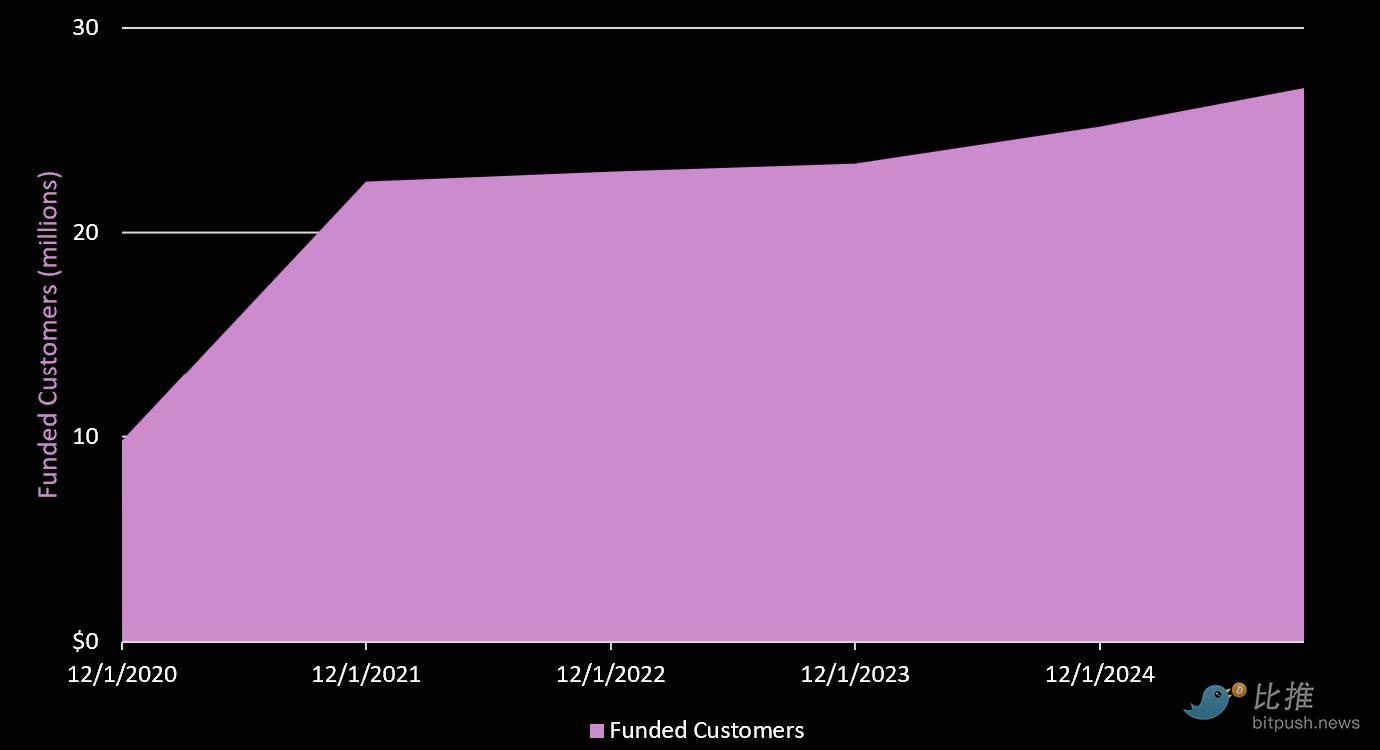

As of September 30, 2025, Robinhood had 27.1 million funded customers. The five-year CAGR for user growth is 22.6%. Most of the growth occurred in 2020.

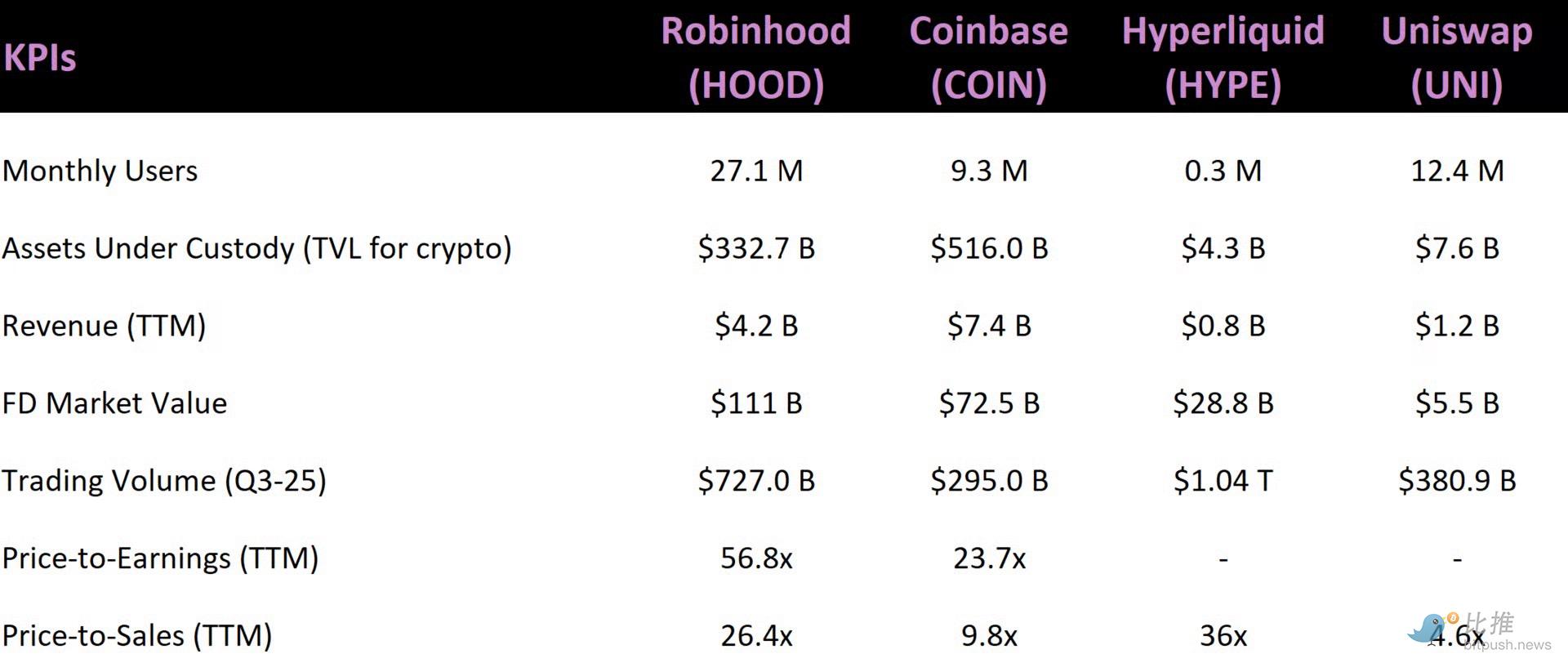

Valuation Comparison

Some Thoughts

-

Hyperliquid (perps + spot trading) crushes everyone in volume but generates the least revenue.

-

Uniswap has the hardest time monetizing users, as historically 100% of trading fees were paid to LPs (a recent governance proposal is changing this).

COIN vs HOOD

-

Coinbase's user base is 1/3 the size of Robinhood's, but its revenue is almost 2x higher.

-

Yet, in terms of market cap, Coinbase trades at a 53% discount to Robinhood's valuation.

Why?

We believe the market favors Robinhood due to:

-

A diversified business covering stocks, options, prediction markets, and crypto.

-

Robinhood is seen as a "super app" moving into consumer/retail finance. Coinbase is still seen as a "crypto exchange" (even though its business is much more).

-

Regulatory licenses. Robinhood is registered as a broker-dealer and regulated by FINRA and the SEC. Coinbase is not. This means Coinbase cannot offer stocks, options, margin lending, etc.

-

It has a larger, more active user base. Coinbase has struggled with user growth since 2021.

Compared to traditional finance, Robinhood's LTM revenue is 18% of Charles Schwab's. Schwab has 38 million active accounts (vs. Robinhood's 27.1 million).

Product Roadmap

Brief History of Robinhood Crypto Development:

2018

Robinhood officially launched crypto trading in select states, initially supporting BTC and ETH.

2019

Obtained a New York State BitLicense, allowing it to offer crypto trading in NY.

2020

Crypto trading volume increased significantly. This coincided with a major surge in Robinhood's user base as the COVID pandemic marked a period of renewed retail interest in stock and crypto trading.

2021

Robinhood reported that crypto trading accounted for 41% of its Q1 revenue, largely driven by Dogecoin trading (25% of all revenue!). Later that year, Robinhood filed for its IPO, noting crypto trading as a significant part of its business.

2022

Announced the launch of a crypto wallet feature, allowing users to deposit and withdraw crypto assets.

2023

Announced the addition of multiple new crypto assets for trading on the platform and plans for expansion into the EU.

2024

-

Announced a partnership with Arbitrum (Ethereum L2), allowing users to access DEX swap trades on Arbitrum. The team later announced integration with MetaMask, allowing users to buy crypto via Robinhood and fund their wallets via debit card, bank transfer, or existing Robinhood account funds.

-

Later launched staking services for European customers, as well as a crypto trading API—providing access to market data and programmatic order functionality.

-

Acquired global crypto exchange Bitstamp, which has 4.4 million users and $200 million in revenue.

-

Announced support for Base (Coinbase's L2).

-

Became a primary crypto on-ramp for retail traders (more assets, wallet on-ramps, integrations, low fees).

2025

-

Full integration of the Bitstamp exchange.

-

Launch of Robinhood Crypto Wallet v2 (cross-chain swaps, DeFi connectivity, Arbitrum functionality, potential Base and Solana swaps, Web3 wallet experience).

-

Awaiting US approval for crypto staking services.

-

Offering institutional crypto services via Bitstamp.

-

Announced plans to build an L2 on Arbitrum.

-

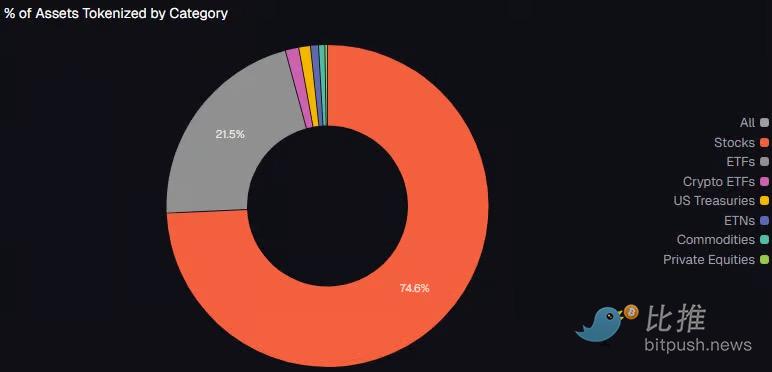

Announced plans to tokenize public and private equity (7/24 trading, instant settlement, integration with DeFi, global access for users outside the US, lower cost structure vs. traditional brokerage channels).

This last point is where Robinhood is planting the seeds to go "full crypto," leveraging its infrastructure (Bitstamp, Robinhood Crypto, Arbitrum) and user base to cover:

-

A regulated global exchange

-

Custody solutions with integrated staking

-

Tokenization integrated with DeFi

-

Wallets & payments

-

On/off ramps

The conclusion?

Robinhood is building a full-stack tokenization + crypto trading & financial services platform.

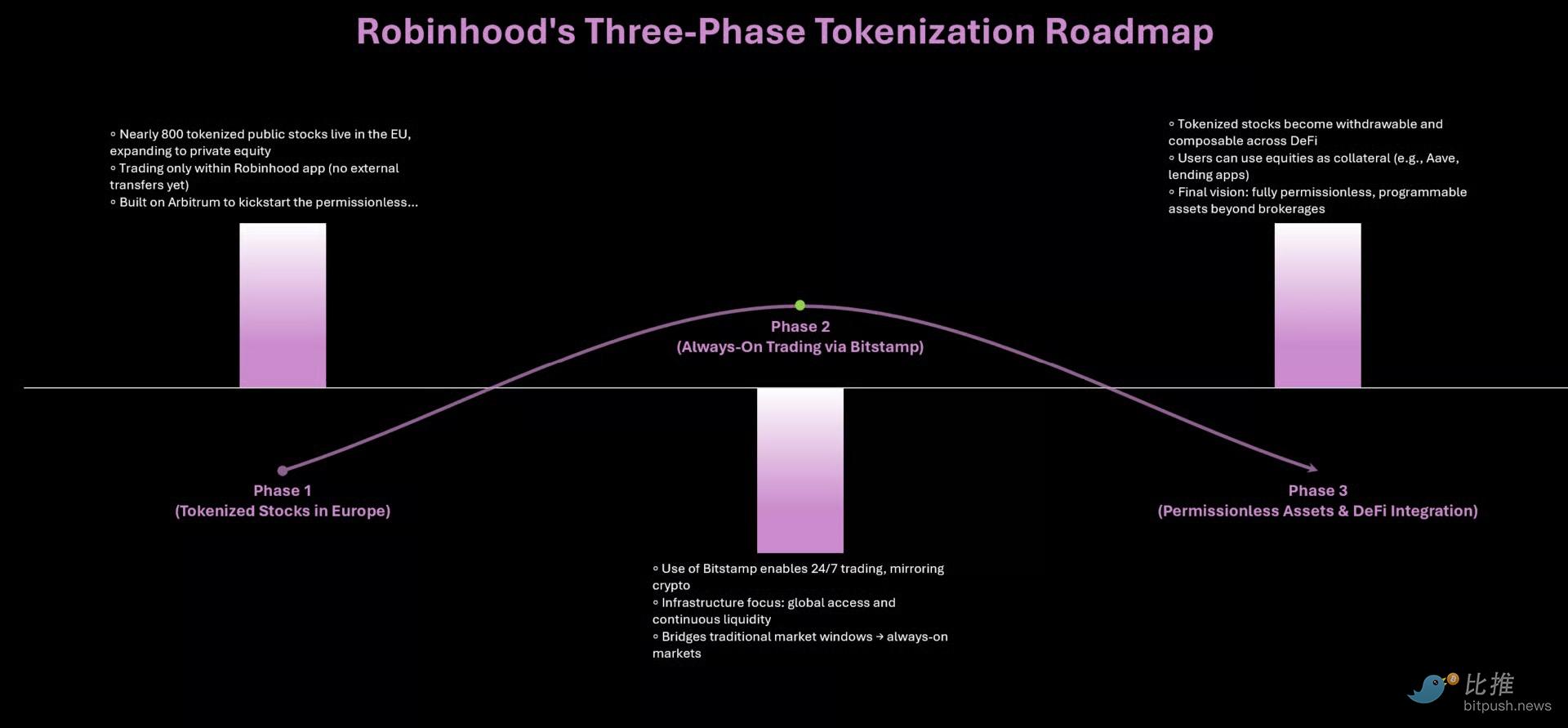

Future Roadmap

Phase 1 (Ongoing)

-

Nearly 800 tokenized public stocks are live in the EU, expanding to private equity.

-

Trading only within the Robinhood app (no external transfers).

-

Built on Arbitrum.

Phase 2 (Early '26)

-

Leverage Bitstamp for 7/24 trading, synchronized with crypto trading.

-

Global access + continuous liquidity.

Phase 3 (Late '26?)

-

Tokenized stocks become withdrawable and composable in DeFi.

-

Users can use tokenized stocks as collateral in DeFi (e.g., on Aave).

-

Ultimate vision: Fully permissionless, programmable assets beyond traditional brokerage.

Why Crypto?

Unlike stocks (where Robinhood relies heavily on PFOF), crypto trading uses a completely different and more profitable revenue model. Because there is no NBBO (National Best Bid and Offer) in crypto markets, Robinhood does not sell order flow to market makers. Instead, it earns revenue through spreads and routing economics, capturing the difference between the price it quotes users and the price it sources liquidity (internally via market makers or through Bitstamp).

This means they have more control over the trading economics and can retain a higher percentage of revenue from each crypto trade. The end result is significantly higher margins, higher ARPU (Average Revenue Per User), and better operating leverage.

-

Global Addressable Market. Crypto trading is 24/7 and operates across jurisdictions and time zones.

-

Staking, tokenized stocks, swaps, wallet fees, L2 fees, and programmatic crypto order flow can all expand margins and revenue.

-

Demographics. Robinhood primarily serves Millennials and Gen Z, who will inherit Boomer wealth in the coming years and increasingly prefer crypto-native services + Robinhood's top-tier mobile experience.

-

Crypto rails lower costs, create new revenue streams, and add operating leverage. With the infrastructure in place, Robinhood could become the "front door" to DeFi, staking, trading, payments, and more.

By sprinting towards crypto first, Robinhood is building a moat through its 1) user base, 2) suite of services, and 3) crypto infrastructure. We believe this will be difficult for incumbents like Charles Schwab to compete with, especially as the customer demographic shifts.

Risks

Competition

-

Every major brokerage and trading platform is now implementing crypto trading. Charles Schwab. Fidelity. Interactive Brokers. Webull. E*Trade.

-

They are all coming for those lucrative crypto trading fees. This competition could compress Robinhood's margins.

-

Meanwhile, Coinbase is the leader in crypto-native infrastructure and product suite.

Execution Risk

The team has the daunting task of integrating Robinhood's top-tier user experience and mobile app with crypto rails, which is no easy feat.

Tokenization Strategy Risk

The real benefit of tokenization comes when actual shares are tokenized.

Why?

This means the shareholder's crypto wallet (which is KYC'd) is the official record of ownership. This means dividends get paid to the wallet.

Now. Robinhood does not get to decide which stocks are tokenized and which are not. The issuer (the company) decides.

Do they have an incentive to tokenize today?

In our view, this is to be determined. We think they will if they can:

-

Lower issuance costs

-

Widen distribution channels

-

Increase liquidity

-

Reduce settlement friction

-

Unlock new investor demographics globally

Then they will want to tokenize.

Today, these benefits are not sufficient to incentivize large incumbent companies to tokenize. Certainly not before new regulations are in place.

Furthermore, their shareholders aren't asking for it today. And we think the incumbent service providers, like transfer agents, prime brokers, custodians, settlement networks, market makers, fund admins/middle-back office, are all against it.

The core takeaway?

Robinhood has a huge incentive to push tokenization. However, they have limited control over issuer adoption of tokenization. We believe this will take longer than the market currently expects.

Summary

Robinhood's revenue has grown at a 34% CAGR over the past five years. In recent years, growth has come from all trading lines (crypto, stocks, and options).

Additional revenue from Robinhood Gold, prediction markets, and crypto services (wallet, staking, transfers, EU expansion, crypto-linked card, Arbitrum L2) bodes well for the revenue outlook.

We like this leadership team. A track record of delivering a superb user experience, and a vision to go "full crypto".

By making it easy to transfer assets (the process is seamless and fast), and incentivizing transfers (2-4% cash bonus on asset value), Robinhood is effectively launching a vampire attack on Charles Schwab, Fidelity, Coinbase, and others.

Simultaneously, they are now challenging Coinbase on crypto-native services while leading on tokenization strategy.

We believe Robinhood is positioned to be a leading financial institution of the future.

That said, it currently trades at 56x P/E. We believe crypto revenue (now a significant 21% of revenue) is vulnerable in the near term, along with general risk-on sentiment among retail investors.

Given that revenue fell 25% in 2022 amid an 80% drawdown, we could see a significant correction in a risk-off environment. We believe this could provide an excellent buying opportunity for long-term holders.

That's why HOOD is on our Watch List.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush