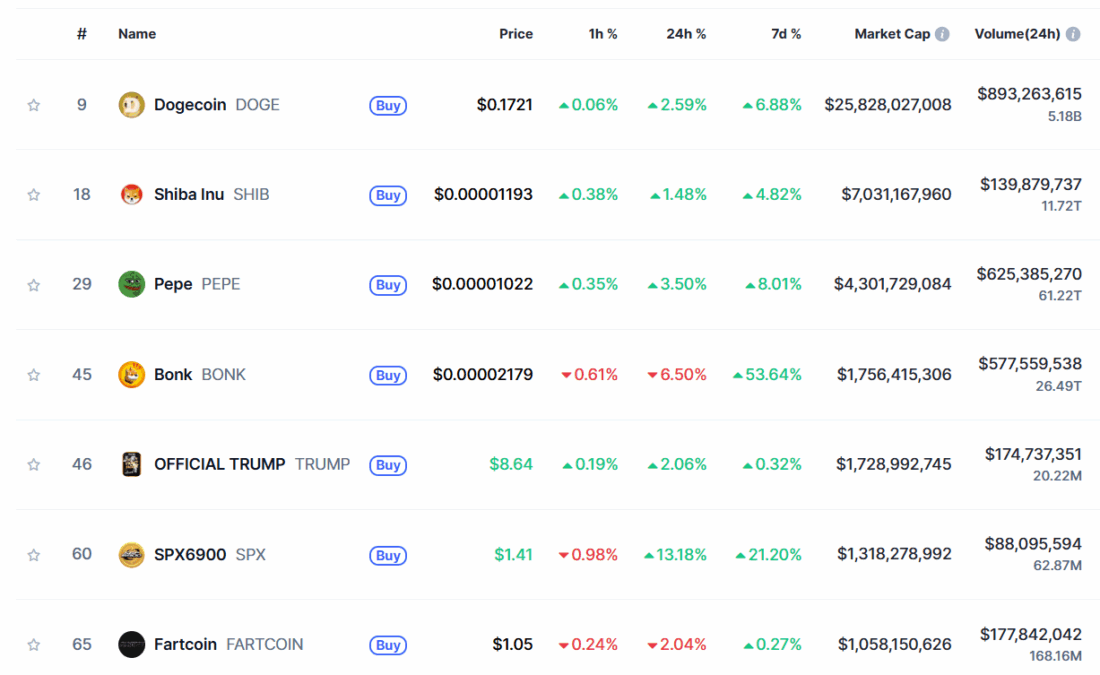

Leading meme coins like Dogecoin (DOGE), Shiba Inu (SHIB) and PEPE have shown solid gains in the past few days with attracting renewed interest from investors. On the other side, BONK and FARTCOIN took the plunge in the past 24 hours.

While this shift took place, the crypto market cap stood at $3.37 trillion, rising 0.81% for the day. Notably, the daily trading volume dipped by 1.21% and stood at a volume of $98.86 billion, indicating a feeling of caution in the market.

Dogecoin (DOGE) surged by 2.59% in 24 hours. It is trading at $0.1721 at the time of writing, pushing its market cap over $25.83 billion. The 24 hour trading volume for Dogecoin reached $893 million today.

The second most popular meme coin by market cap, Shiba Inu (SHIB) also saw a rise of 1.86%, priced at $0.000012 with a market cap of $7 billion. Meanwhile, PEPE spiked most among top 5, surging by 3.50% to $0.000010, with its market cap at $4.3 billion.

Losers in the Meme Coin Space

On the losing side, BONK took a hit after last week’s notable surge, dropping 6.50% in the past 24 hours and trading at $0.00002179 as of latest market data. Its market cap fell to $1.73 billion.

Similarly, FARTCOIN–another Solana-based meme coin—also saw a decline of 2%, settling at $1.05. Its trading volume sits at $177 million, while its market cap decreased to $1.05 billion.

Even with these setbacks, the meme coin market is holding steady. The total meme coin market cap sits at $56.40 billion, up 1.64% in the past 24 hours.