Tensions between blockchain platform Mantra and crypto exchange OKX are rising after Mantra accused the exchange of posting incorrect information about its token migration.

In a Monday X post, Mantra CEO John Patrick Mullin urged users of centralized cryptocurrency exchange (CEX) OKX to withdraw their Mantra (OM) tokens and cut their “dependency” on the platform.

“Users should consider withdrawing their OM tokens from OKX[...]. Avoid OKX Exchange Dependency: Complete migration without relying on potentially negligent or malicious intermediaries,” said Mullin.

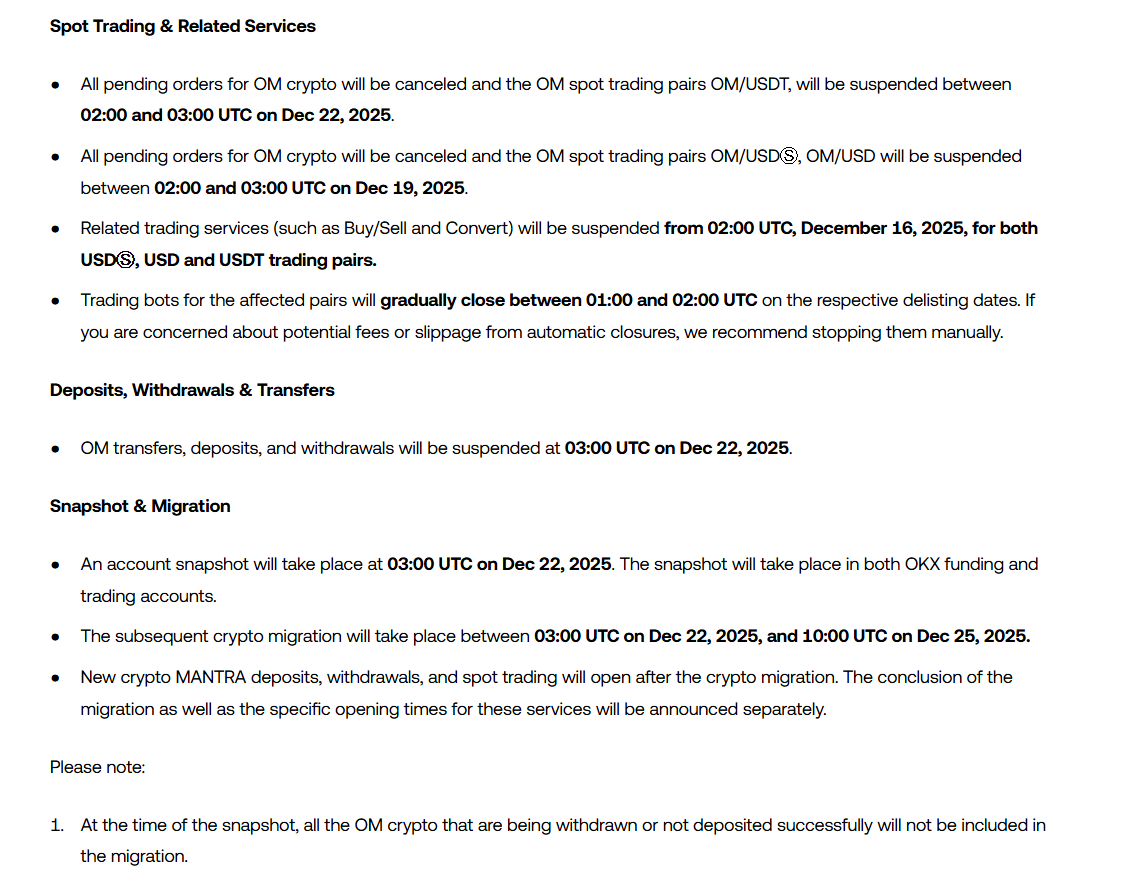

His warning came in response to a Friday announcement from OKX about supporting the incoming OM token migration.

Related: BitMine buys $199M in Ether as smart money traders bet on ETH decline

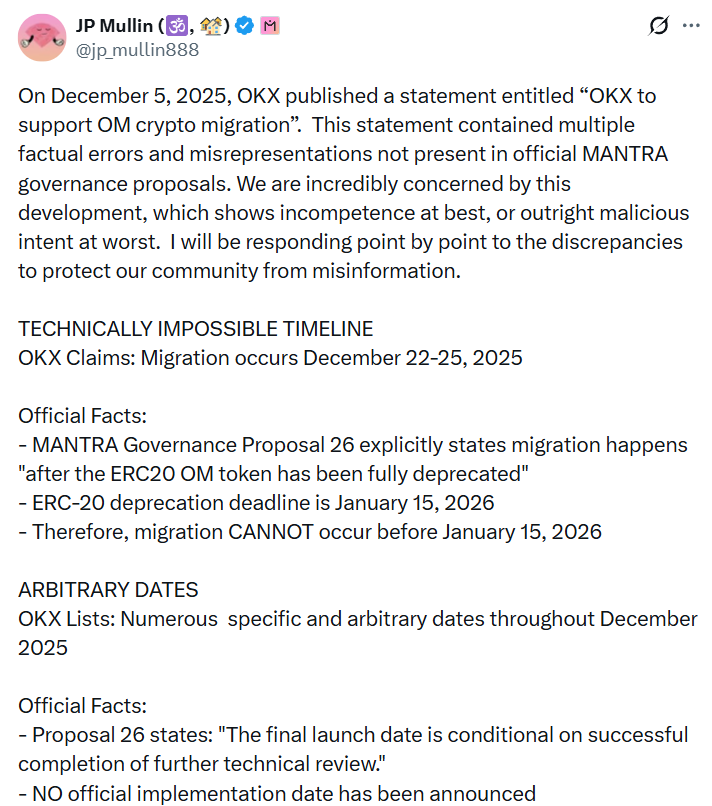

According to Mullin, the OKX post contained multiple inaccuracies, including false migration and implementation dates.

OKX said the migration would occur between Dec. 22 and Dec. 25. Mantra’s governance proposal, by contrast, states that the migration will only take place after the Jan. 15 deprecation of the Ethereum-based ERC-20 OM token.

Mullin also said OKX’s post referenced “arbitrary dates throughout December 2025,” while Mantra has not yet announced an official implementation date.

He claimed OKX has not communicated with Mantra since “the events” of April 13, while Mantra has “helpfully [been] communicating with all other major exchanges regarding our migration.”

During the incoming migration, the OM token will migrate from an Ethereum-native ERC-20 token to a Mantra Chain-native token.

Cointelegraph has contacted OKX for comment but had not received a response by publication time.

Related: Prediction markets emerge as speculative ‘arbitrage arena’ for crypto traders

April crash still casting a shadow

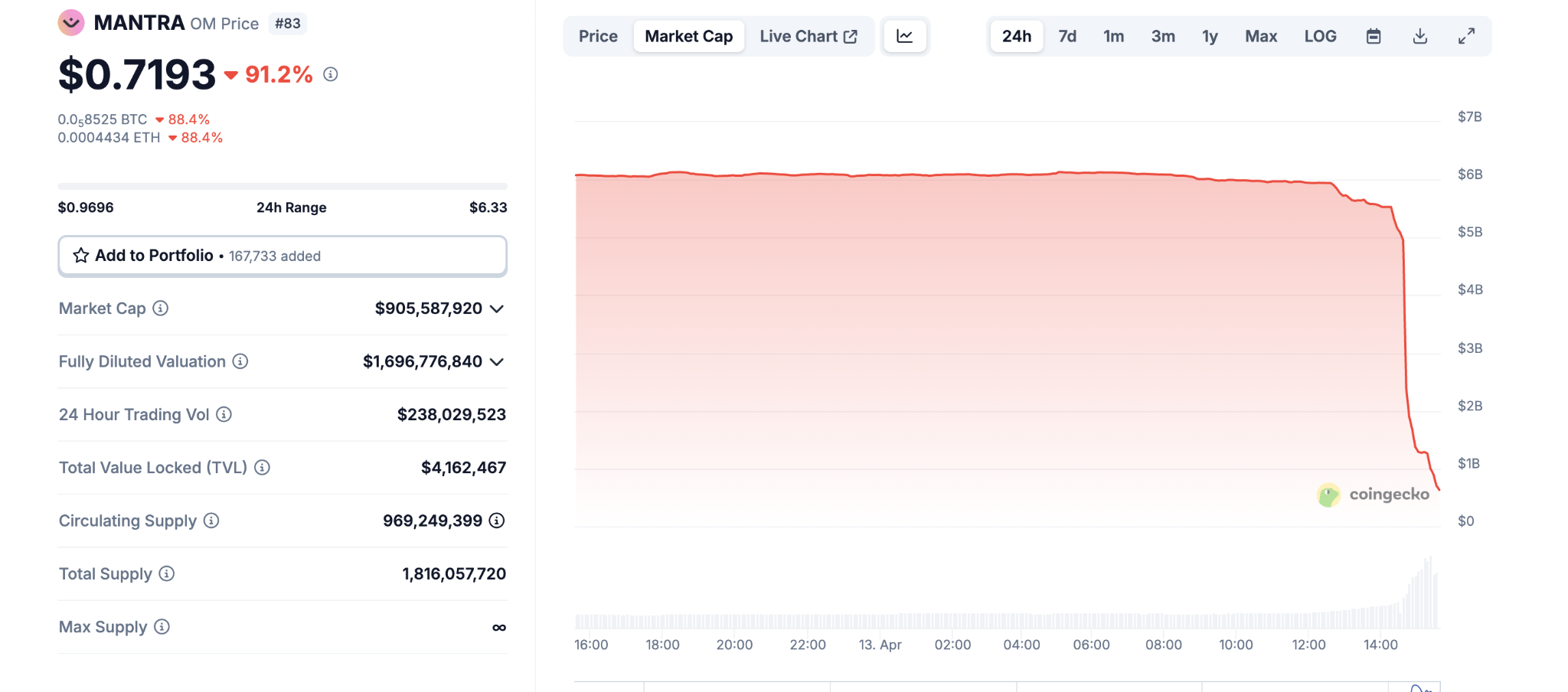

On April 13, the Mantra’s OM token price fell by over 90% from around $6.30 to below $0.50.

On April 30, Mantra published a post-mortem report that blamed the aggressive trading policies and high leverage on cryptocurrency exchanges for the token crash.

“Liquidation cascades could happen to any project in the crypto industry,” Mullin said in the post, pointing to the role of “aggressive leverage positions” on exchanges as a broader threat to investor safety.

Mullin also urged exchanges to review their leverage policies while implementing a transparency dashboard for OM tokenomics, along with announcing the burning of 150 million staked OM tokens, permanently removing them from circulation in a bid to tighten the token’s supply.

Magazine: If the crypto bull run is ending... it’s time to buy a Ferrari — Crypto Kid