Bitcoin’s (BTC) short-term holders (STHs) have spent 229 out of 345 days in profit, an outcome that appears contradictory given that BTC is at a negative year-to-date (YTD) return and struggles to trade above $100,000.

However, beneath the weak headline performance, the structure of onchain positioning tells a different story.

Key takeaways:

Bitcoin short-term holders logged profits for 66% of 2025, even while BTC traded below its yearly open.

The STH realized price at $81,000 acted as a sentiment pivot, which divided phases of panic and recovery.

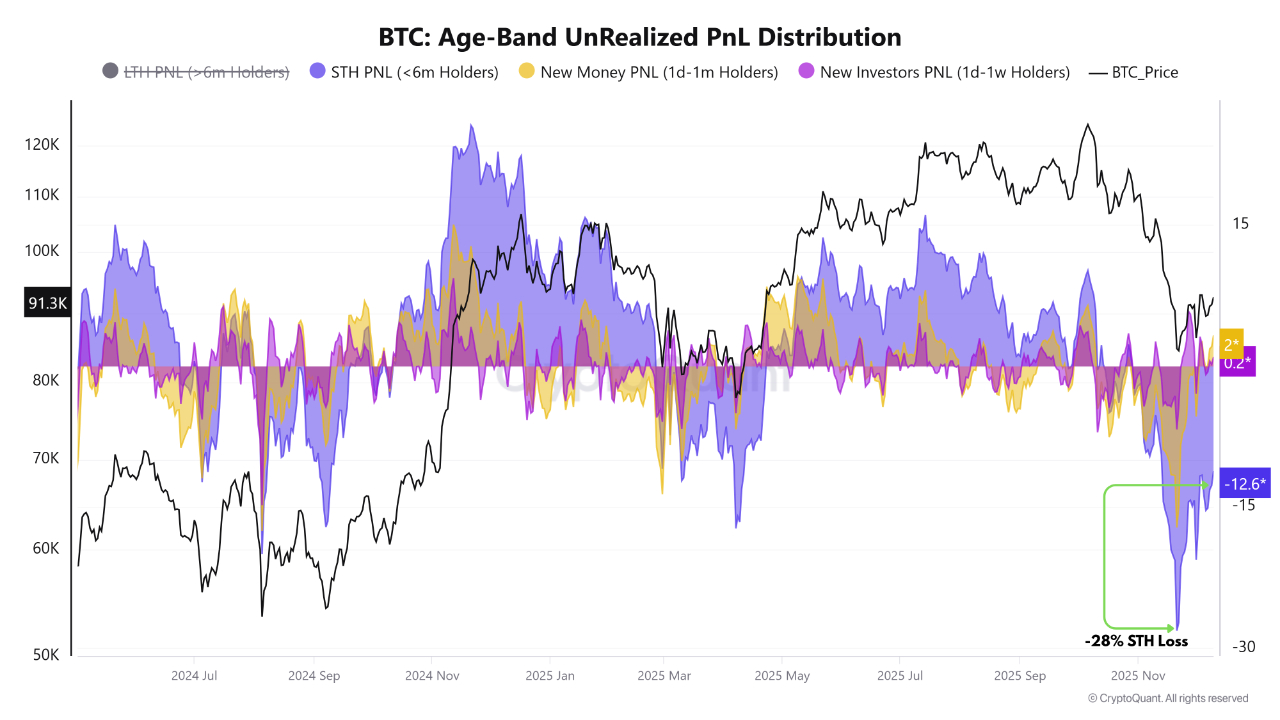

Unrealized losses narrowed from -28% to -12%, signaling fading capitulation.

Bitcoin trades near its realized price

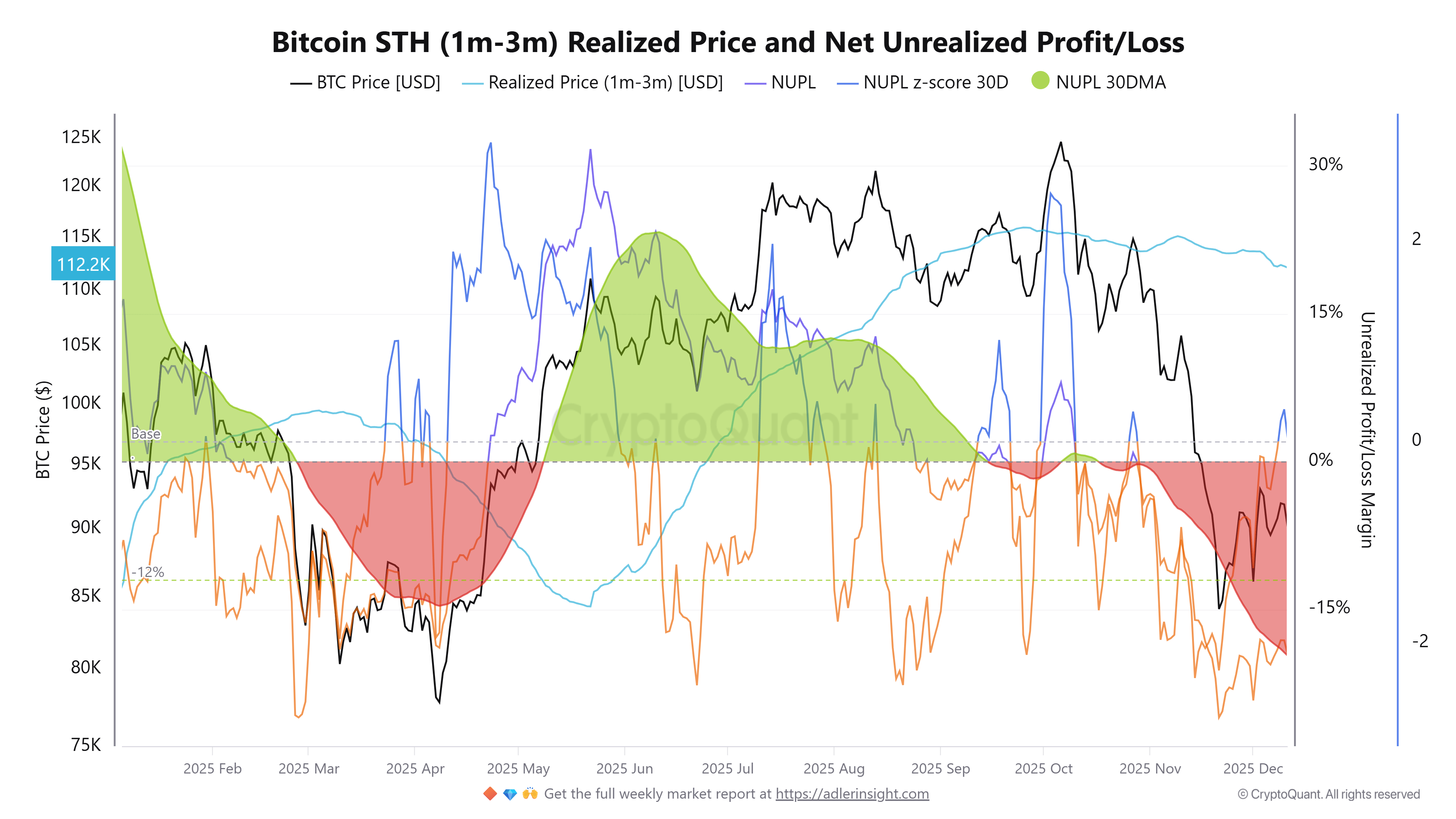

The volatility of 2025 can be explained through the lens of the 1–3 month STH cohort. As illustrated in the chart, Bitcoin’s price repeatedly interacted with its realized price, producing alternating waves of green net-unrealized profit/loss (NUPL) profitability and red NUPL losses.

Early in 2025, BTC stayed above this cost basis for nearly two months, giving STHs their first pocket of sustained profits. But the shift into February and March saw prices fall below the cohort’s realized price, dragging STH NUPL into deep red and marking one of the year’s longest loss stretches.

However, momentum reversed sharply from late April through mid-October, where the chart’s broad green zones align with Bitcoin’s 172-day period of predominantly profitable STH activity. Even though the broader trend was softening, these recoveries pushed STH profitability far higher than the market narrative implied.

Only in late October did the market slip back beneath the realized price again, triggering the ongoing 45-day period of STH losses that coincides with the swelling red NUPL region.

In effect, STH profitability in 2025 was driven less by Bitcoin’s directional trend and more by the frequency with which BTC reclaimed its cost basis. Those repeat rebounds, even within a negative YTD environment, allowed short-term holders to finish with a two-thirds profit ratio.

Related: Bitcoin decouples from stocks in second half of 2025

The BTC cost basis shift may define the next phase again

Bitcoin’s rebound toward $92,500 compressed STH unrealized losses from -28% to -12%, a sign that forced selling is easing and emotional exhaustion is setting in. The STH realized rice at $81,000 remains the psychological fulcrum, as each reclaim historically marks the transition from capitulation into stability.

New money and investors entering within days to weeks, hover near breakeven, reinforcing this stabilizing structure. If BTC continued to improve STH profitability while holding above this $81,000 foundation, the late-year correction could already be nearing completion, setting the stage for the next expansion phase.

Related: Bitcoin new year bear flag sparks $76K BTC price target next

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.