Article translation: Block unicorn

A few months ago, my son's father-in-law, who lives in New York State, sent a large sum of money to his family in the UK. However, the money did not arrive on time. To make matters worse, there was no way to track where the money had gone. His bank contacted the intermediary bank involved, but was told that the recipient bank in the UK—one of the largest banks in the country—refused to respond to any inquiries. I asked my colleagues what might have happened, and they said it could be related to money laundering. Meanwhile, my father-in-law was extremely anxious. Two months later, the money suddenly appeared in his account. He had no idea what had occurred during that period.

This situation is completely different from my past experiences with transferring money between the UK and the EU. On the other side of the Atlantic, transfers have always been reliable and fast. This may be one reason why Americans are open to accepting "stablecoins" as an alternative to the banking system. Daniel Davies pointed out two other reasons: first, the relatively high cost of credit card payments in the US (about five times higher than in Europe!), and second, the exorbitant fees for cross-border transfers. Both reflect the US's failure to effectively regulate powerful oligopolies.

Gillian Tett of the Financial Times proposed another motive for the Trump administration's welcoming attitude toward stablecoins in an article last month. US Treasury Secretary Scott Bessent faces a dilemma: the US needs the world to hold massive amounts of US Treasury bonds at low interest rates. She noted that one solution is to promote the widespread use of dollar-denominated stablecoins, focusing not domestically but globally. As Tett pointed out, this benefits the US government.

However, these are not justifications for welcoming dollar stablecoins. As Hélène Rey of the London Business School stated, "For the rest of the world, including Europe, the widespread adoption of dollar stablecoins for payments is equivalent to the privatization of seigniorage by global players." This would be yet another predatory move by a superpower. A more reasonable alternative would be for the US to transition to lower-cost payment systems and reduce profligate government spending. But neither of these is likely to happen.

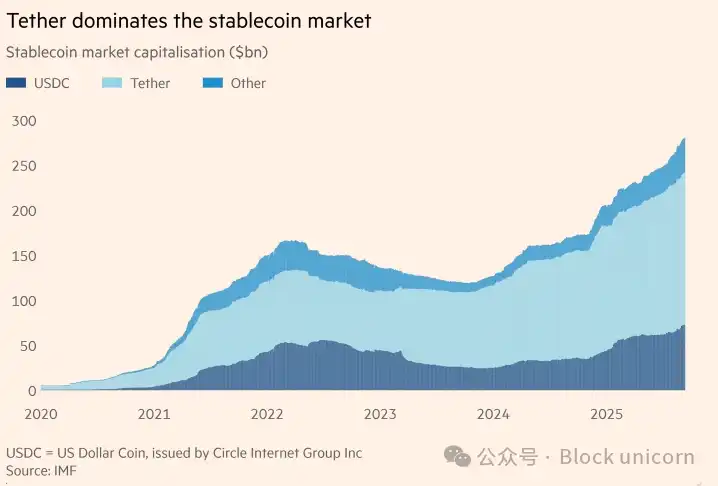

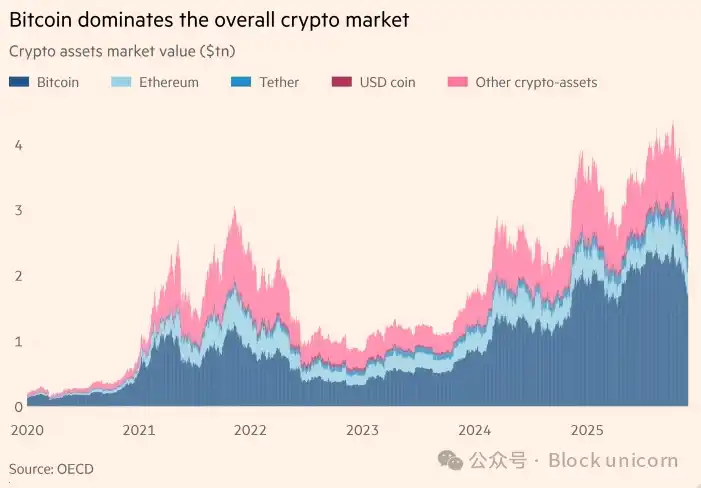

In summary, stablecoins—touted as digital alternatives to fiat currencies, especially the US dollar—seem to have a bright future. As Tett noted, "Institutions like Standard Chartered predict that the stablecoin industry will grow from $280 billion to $2 trillion by 2028."

The future of stablecoins may indeed be bright. But should anyone other than issuers, various criminals, and the US Treasury welcome them? The answer is no.

It is true that stablecoins are much more stable than currencies like Bitcoin. However, compared to cash dollars or bank deposits, their so-called "stability" may well be a "scam."

The International Monetary Fund (IMF), the Organisation for Economic Co-operation and Development (OECD), and the Bank for International Settlements (BIS) have all expressed serious concerns. Interestingly, the BIS welcomes the concept of "tokenization": they believe that "by integrating tokenized central bank reserves, commercial bank funds, and financial assets onto the same platform, a unified ledger can fully leverage the advantages of tokenization."

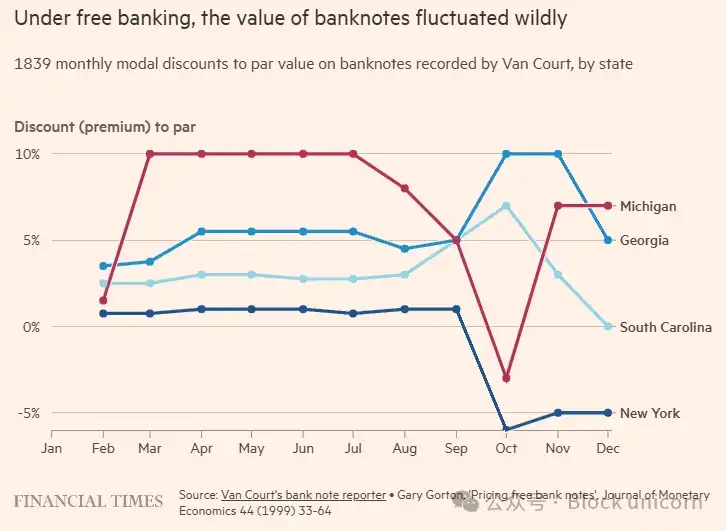

However, the BIS is also concerned that stablecoins may fail the "three key tests: singleness, resilience, and integrity." What does this mean? Singleness means that all forms of a particular currency must be interchangeable at equal value at all times. This is the foundation of trust in money. Resilience refers to the ability to facilitate payments of all sizes smoothly. Integrity means the ability to curb financial crimes and other illegal activities. Central banks and other regulators play a central role in all of this.

Current stablecoins fall far short of these requirements: they are opaque, easily exploited by criminals, and their value is uncertain. Last month, S&P Global Ratings downgraded Tether's USDT (the most important dollar stablecoin) to "weak." This is not trustworthy money. Private money often performs poorly in crises, and stablecoins are likely to be no exception.

Assuming the US intends to promote lightly regulated stablecoins, partly to consolidate the dollar's dominance and finance its huge fiscal deficits, what should other countries do? The answer is to do their utmost to protect themselves. This is especially true for European countries. After all, the US's new national security strategy has made its open hostility toward democratic Europe clear.

Therefore, European countries need to consider how to introduce stablecoins in their own currencies that are more transparent, better regulated, and safer than those the US may currently推出. The Bank of England's approach seems wise: just last month, it proposed "a proposed regulatory regime for systemic sterling stablecoins," noting that "the use of regulated stablecoins could lead to faster, cheaper retail and wholesale payments, and enhance their functionality, both domestically and cross-border." This seems like the best starting point for now.

The Americans currently in power seem very keen on the big tech mantra of "move fast and break things." When it comes to money, this could have disastrous consequences. Admittedly, there are reasons to use new technology to create faster, more reliable, and safer monetary and payment systems. The US certainly needs such systems. However, a system that makes false promises of stability, encourages irresponsible fiscal policies, and opens the door to crime and corruption is not what the world needs. We should resist it.