Ether (ETH) climbed 7% in the past day, reclaiming its 50-week moving average (MA) near $3,300, an occurrence that has historically preceded strong price rallies.

Key takeaways:

Ethereum may have found a floor around $2,800, signaling a local bottom.

Ether price previously rose 100% after reclaiming the 50-week moving average.

Ethereum whales accumulated nearly 1 million ETH over three weeks.

Past breakouts led to 97%-147% ETH price rallies

Data from Cointelegraph Markets Pro and TradingView shows that the ETH/USD pair bounced from $2,800 support, rising 20% to the current price at $3,362.

This breakout has seen Ether’s price reclaim a key trendline — the 50-week exponential moving average (EMA) — increasing the likelihood of a steeper climb in the coming days or weeks.

Related: Ethereum ‘smart’ whales open $426M long bets as ETH price chart eyes $4K

Previous instances show that ETH tends to rise sharply when the price closes above the 50-week EMA (purple wave). The altcoin’s gains were 147% between October 2023 and March 2024, and 97% in Q3 2025.

“$ETH is back above its 50-day MA. I would love to see a break above the 200-day MA at $3,500 in the coming days with the bulls flipping this area as support,” said investor StockTrader_Max in a Tuesday post on X, adding:

“Once flipped to support, the ATH’s at $5,000 become the next target!”

Fellow analyst CyrilXBT said the “50-week MA is now a key line to hold” in order to increase the chances of a push toward the $4,000 area.

As Cointelegraph reported, the ETH price has ended its 5-month downtrend against Bitcoin, projecting 170% gains to 0.09 BTC in under two months.

Ethereum whale buying bullish for ETH price

Ether’s bullishness on Wednesday is preceded by increased accumulation by large investors.

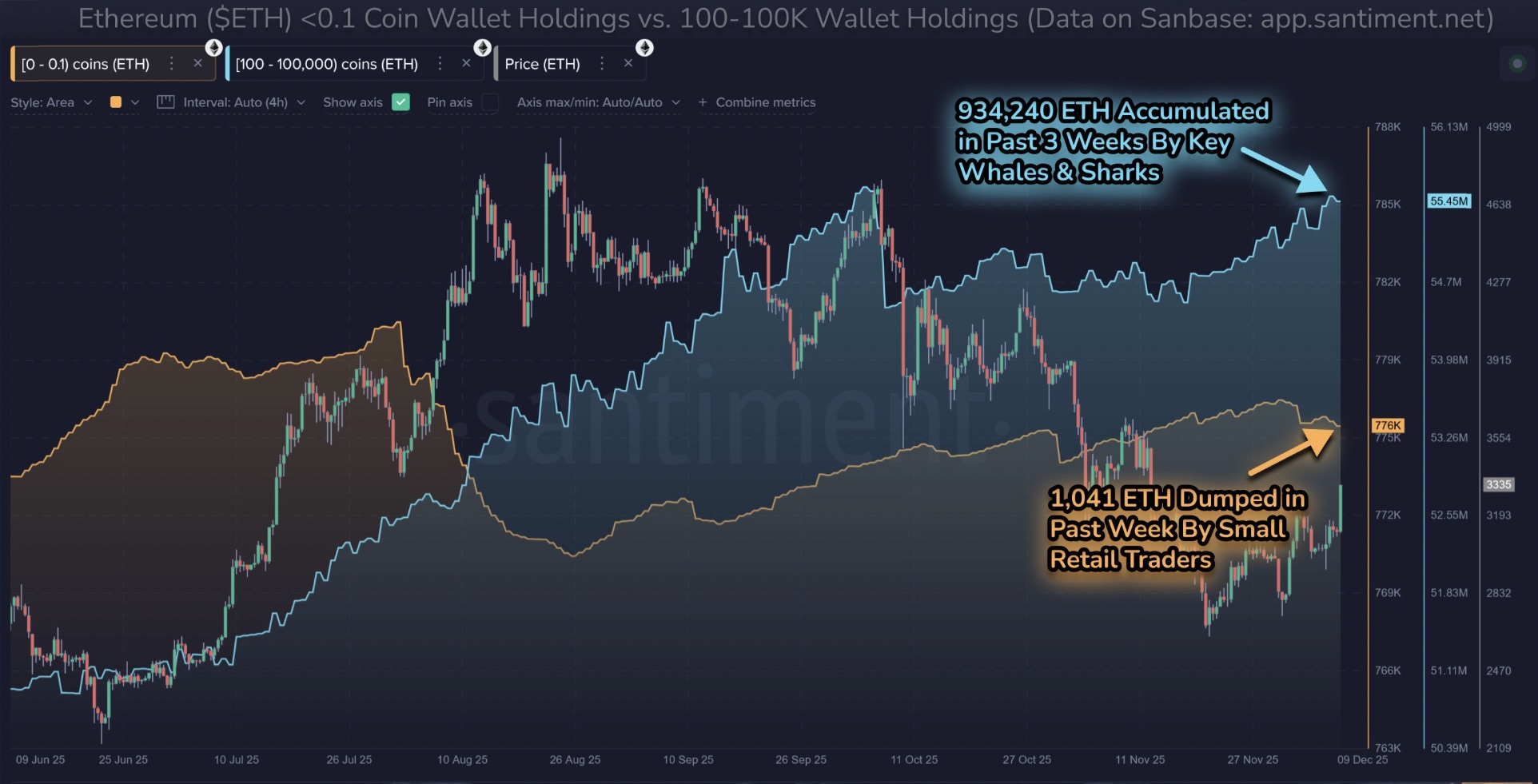

“Ethereum is a standout gainer today, climbing +8.5% and seeing an encouraging accumulation pattern from whales and sharks,” said market intelligence company Santiment on Tuesday.

The accompanying chart shows that these investors have accumulated approximately 934,240 ETH, worth $3.15 billion at current rates, over the past three weeks, while small holders have sold approximately 1,041 ETH in the past seven days.

“Ethereum soars back to $3,400 with an ideal setup of whale and shark accumulation, but retailers are dumping.”

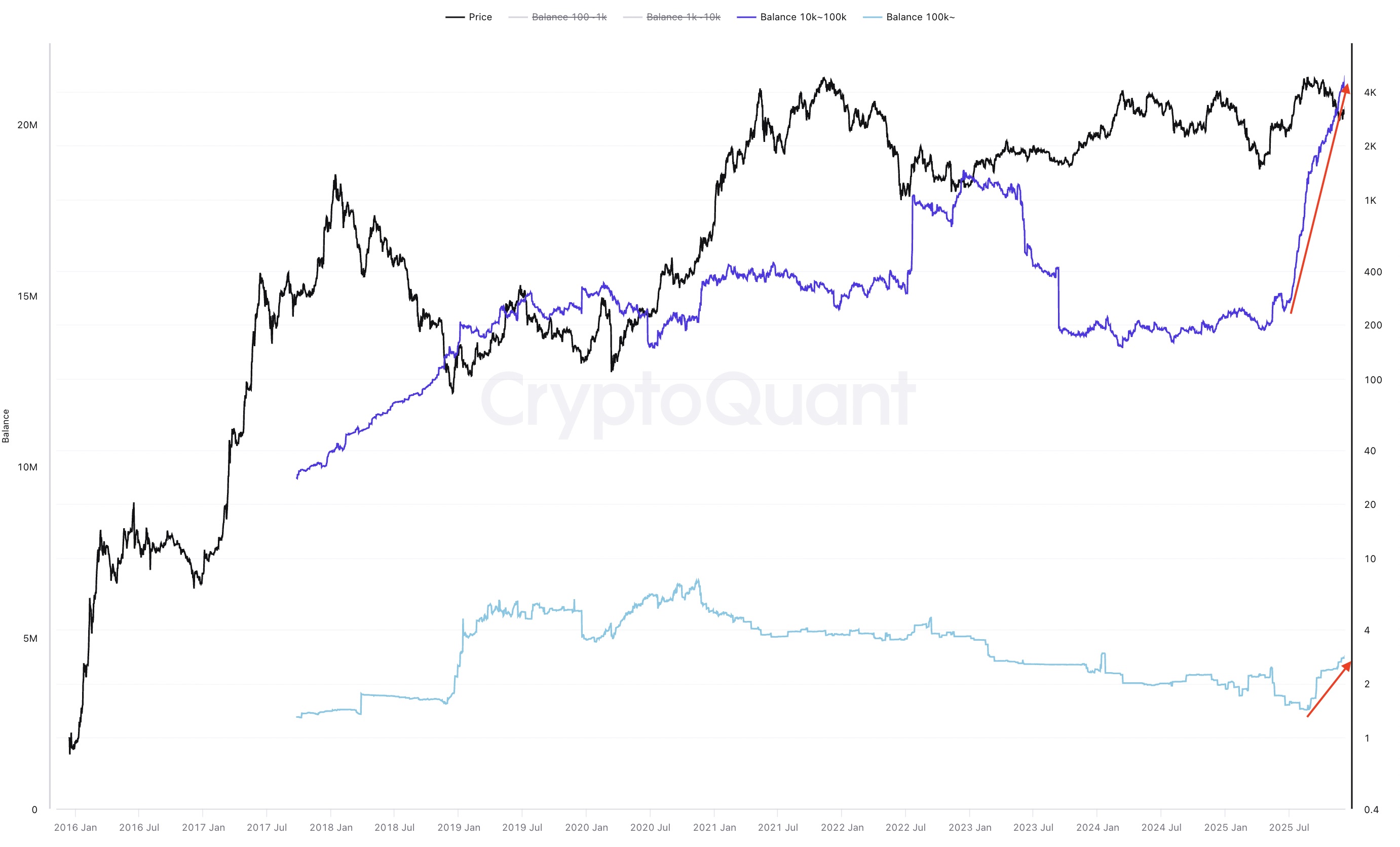

Additional data from CryptoQuant shows that whale wallets holding between 10,000 ETH and 100,000 ETH have reached record balances, with the wallets holding over 100,000 ETH also increasing their holdings, indicating bullishness among the bigger cohorts and institutions.

The resumption in whale interest coincides with an uptick in demand for spot Ethereum ETF flows, which recorded $177 million in inflows on Tuesday, the largest since Oct. 28, per data from SoSoValue.

The ETH Coinbase Premium Index, a measure of US investors’ interest, remained positive over the past week after being negative for about a month. This pointed to a return in demand from US investors, which could propel ETH price higher.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.