Ethereum Network Fees Drop 62%: Is ETH Price at Risk?

Ethereum's base layer demand softened in November, but despite the decline in fees and TVL, the underlying price support and strong growth of Layer 2 indicate the network remains dynamic.

Key Points:

Ethereum's base layer activity has cooled, with fees and TVL declining. Although the recent price has rebounded, the slowdown in demand is evident.

Layer 2 networks are growing rapidly, providing support for Ethereum even as base layer usage weakens and traders remain cautious.

Ethereum rose on Tuesday after weak U.S. jobs market data, as the market strengthened expectations that U.S. monetary policy may turn less restrictive earlier than before, with the price rising to a three-week high near $3,400.

Despite the 11.2% weekly gain, traders are still concerned about the low activity on the Ethereum network and the demand for long positions, which may suppress short-term upside potential.

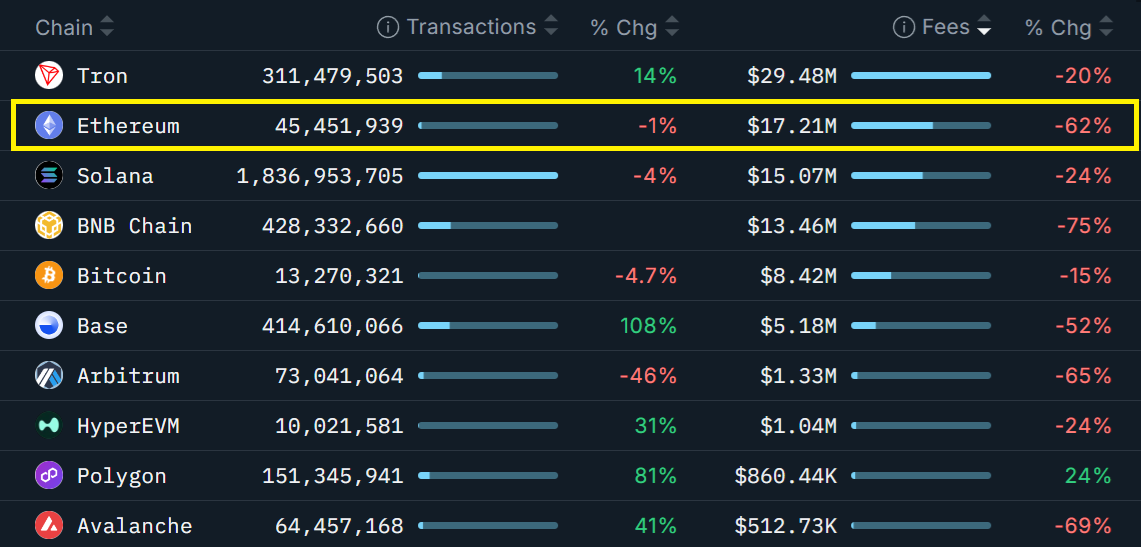

Nansen data shows that Ethereum network fees have fallen 62% over the past 30 days, far exceeding the approximately 22% decline of Solana and HyperEVM during the same period.

However, there are still bright spots: Base chain transaction volume increased by 108%, and Polygon increased by 81%, indicating that Ethereum's expanding Layer 2 ecosystem continues to have momentum.

Ethereum's Fusaka upgrade on December 3 introduced changes aimed at improving Rollup efficiency, which may have contributed to the lower network fees this month.

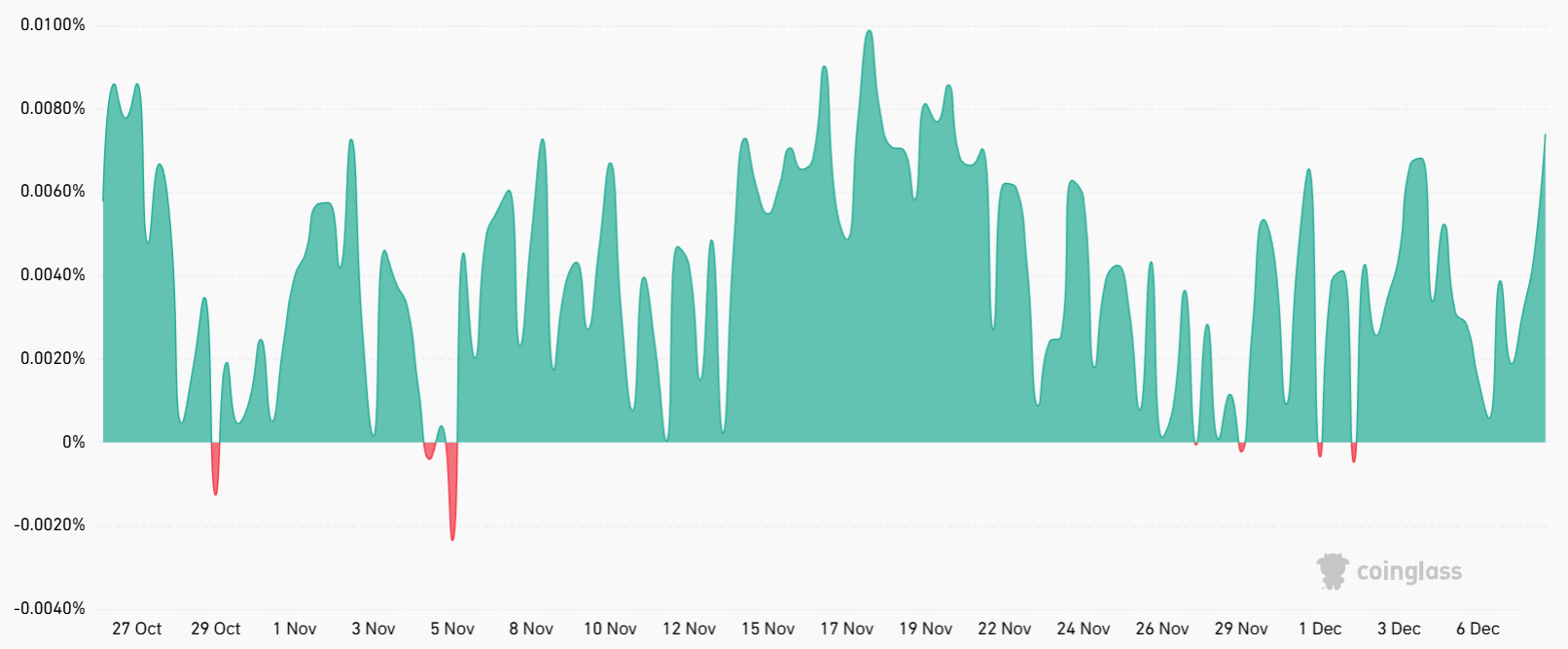

On Tuesday, the annualized funding rate for Ethereum perpetual contracts remained near 9%, reflecting a relatively balanced distribution of long and short leverage positions. Under normal circumstances, this indicator typically fluctuates between 6% and 12% to reflect funding costs; levels above this range often indicate stronger long positions.

The U.S. Bureau of Labor Statistics reported 185,000 job cuts in October, the highest since 2023. The market is currently pricing in a 0.25% rate cut by the Fed on Wednesday, while also paying attention to Chairman Powell's speech after the committee meeting.

Ethereum's Layer-2 Growth Offsets Base Layer Fee Decline

Despite recent bullish momentum, Ether is still 32% below its August historical high of $4,597. To determine whether the network's demand is truly declining, observing the impact on decentralized applications (DApps) is useful.

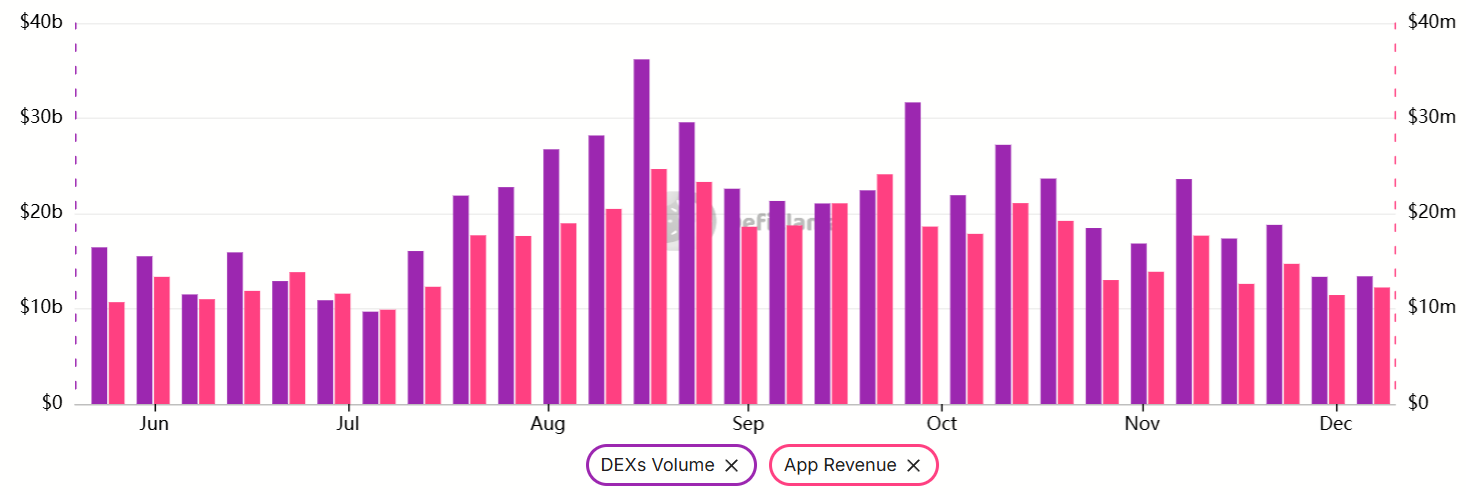

Trading volume on Ethereum-based decentralized exchanges fell to $13.4 billion in seven days, down from $23.6 billion four weeks ago. Similarly, decentralized application revenue reached a five-month low of $12.3 million during the same period. Overall, the demand processed by the Ethereum base layer has been declining since peaking in late August.

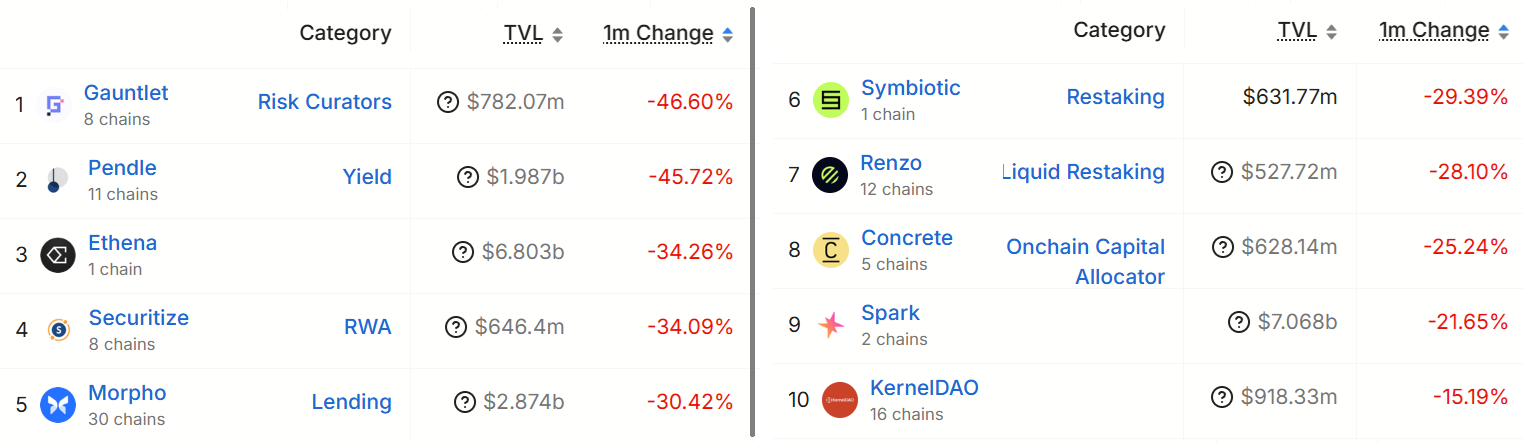

The locked value (TVL) of some top Ethereum DApps has declined significantly, including Pendle, Athena, Morpho, and Spark. The total TVL of the Ethereum base layer has dropped from $100 billion two months ago to $76 billion. Even so, Ethereum's leading position remains solid, with a market share of 68%, while Solana has less than 10%.

Bulls believe that compared to competitive blockchains with heavier loads and more centralized coordination methods, Ethereum's strong incentives around Layer 2 expansion provide a more sustainable model. Ethereum is expected to occupy an important share in the future growth of decentralized finance (DeFi).

According to a FOX Business report, the SEC's Paul Atkins stated in an interview that the digitization of the U.S. market could happen "within a few years" and said blockchain brings "great benefits," such as predictability and transparency. Atkins said the U.S. should "embrace this new technology, bring it onshore, and let it operate under U.S. rules."

Although Ethereum's base layer fees and TVL have seen a significant decline, the activity of the Layer 2 ecosystem is still expanding. Currently, neither on-chain data nor derivative data shows substantial weakness in Ethereum's price dynamics.

Related recommendation: Blockchain's pilot test on the Canton Network tested the mechanism for reusing collateralized products using digitized U.S. Treasury bonds

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages arising from your reliance on this information.