Author: Deng Tong, Golden Finance

On December 11, 2025, the Depository Trust Company (DTC) received a no-action letter from the U.S. Securities and Exchange Commission (SEC), permitting it to tokenize some of its custodial assets. DTC aims to leverage blockchain technology to connect traditional finance (TradFi) and decentralized finance (DeFi), thereby building a more resilient, inclusive, and efficient global financial system. Previously, the U.S. Office of the Comptroller of the Currency (OCC) issued Interpretive Letter 1188, confirming that national banks can engage in permissible banking activities related to risk-free principal crypto asset transactions.

This article focuses on the recent regulatory actions by the U.S. SEC and OCC.

I. SEC: DTCC Can Tokenize Stocks, Bonds, and Treasury Securities

Yesterday, the Depository Trust & Clearing Corporation (DTCC) announced that its subsidiary, the Depository Trust Company (DTC), has received a no-action letter (NAL) from the U.S. Securities and Exchange Commission (SEC), authorizing it to provide a new service under the federal securities laws and regulations, within a controlled production environment, for tokenizing real-world assets held by DTC. DTC expects to begin rolling out this service in the second half of 2026.

The no-action letter authorizes DTC to provide tokenization services for DTC participants and their clients on pre-approved blockchains for a period of three years. According to the no-action letter, DTC will be able to tokenize real-world assets, with the digital versions enjoying the same rights, investor protections, and ownership as traditional assets. Additionally, DTC will provide the same high level of resilience, security, and robustness as traditional markets.

The authorization applies to a range of specific high-liquidity assets, including the Russell 1000 Index (representing the 1,000 largest U.S. publicly traded companies by market capitalization), ETFs tracking major indices, and U.S. Treasury bills, bonds, and notes. This no-action letter is significant because it allows DTC, subject to specific limitations and declarations, to launch the service more quickly than otherwise possible once the service is finalized.

The SEC's no-action letter is a key enabler for the company's broader strategy to advance a secure, transparent, and interoperable digital asset ecosystem, fully leveraging the potential of blockchain technology.

Frank LaSala, President and CEO of DTCC, stated: "I would like to thank the U.S. Securities and Exchange Commission (SEC) for their trust. The tokenization of U.S. securities markets promises numerous transformative benefits, such as collateral liquidity, new trading models, 24/7 access, and programmable assets, but this can only be achieved if market infrastructure lays a solid foundation for this new digital era. We are very excited to have this opportunity to further empower the industry, our participants, and their clients, and to drive innovation. We look forward to collaborating with all parties in the industry to safely and reliably achieve the tokenization of real-world assets, thereby advancing the future of finance for generations to come."

To support this strategy, DTCC's tokenization solution will enable DTC participants and their clients to utilize comprehensive tokenization services supported by the DTCC ComposerX platform suite. This will allow DTC to create a unified liquidity pool within both traditional finance (TradFi) and decentralized finance (DeFi) ecosystems and build a more resilient, inclusive, cost-effective, and efficient financial system.

According to the no-action letter, DTC is permitted to provide limited production environment tokenization services on L1 and L2 providers. DTCC will provide more details in the coming months regarding onboarding requirements (including wallet registration) and the L1 and L2 network approval process.

SEC Chairman Atkins noted: On-chain markets will bring greater predictability, transparency, and efficiency to investors. DTC participants can now transfer tokenized securities directly to the registered wallets of other participants, and these transactions will be tracked by DTC's official records. This initiative by DTC marks a significant step towards on-chain capital markets. I am pleased to see the benefits this program brings to our financial markets and will continue to encourage market participants to innovate to advance our move towards on-chain settlement. But this is just the beginning. I look forward to the SEC considering granting innovation exemptions, allowing innovators to leverage new technologies and business models to begin transitioning our markets on-chain without being burdened by cumbersome regulatory requirements.

II. OCC: Crypto Companies Obtaining Bank Charters to Be Treated Equally with Other Financial Institutions

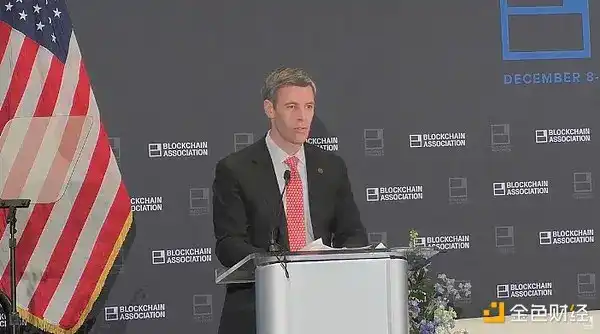

On December 8, U.S. Comptroller of the Currency Jonathan Gould stated that cryptocurrency companies seeking to obtain a U.S. bank charter should be treated the same as other financial institutions.

So far this year, the OCC has received 14 applications to establish new banks, "including some from entities engaged in novel or digital asset activities," which is almost on par with the number of similar applications the OCC received in the past four years. "The chartering system helps ensure the banking system keeps pace with financial developments and supports the modern economy. Therefore, institutions engaged in digital assets and other emerging technologies should have the opportunity to become federally regulated banks."

The regulator "receives letters from existing national banks almost daily, informing us of exciting innovative products and service initiatives they are launching themselves. All of this strengthens my confidence in the OCC's ability to effectively regulate new entrants as well as new business lines of existing banks in a fair and impartial manner."

U.S. Comptroller of the Currency Jonathan Gould speaking at the 2025 Blockchain Association Policy Summit. Source: YouTube

III. What Impact Will the Policy Trends of the SEC and OCC Have?

With DTC approved to tokenize core assets like stocks, bonds, and ETFs on-chain, real-world assets are being formally integrated into the U.S. federal securities system. This means that core asset classes in traditional financial markets will have "native versions" on the blockchain in the future, enjoying the full legal rights of traditional assets; The OCC's clear statement that institutions engaged in digital asset businesses can apply for federal bank charters on an equal basis with traditional institutions means the crypto industry has, for the first time, a formal path to enter the "compliant core layer" of the U.S. banking system; The regulatory trends of the SEC and OCC are, in fact, part of the U.S. competition to set global standards for digital finance. As blockchain technology becomes financial infrastructure, the U.S. is adopting a model similar to the internet era: dominating global rule-setting through institutional and regulatory frameworks.

Appendix 1: Main Content of Gould's Speech:

Among the applications currently submitted to the OCC, several are for new national trust banks or banks wishing to convert to national trust banks. This growth indicates healthy market competition, reflects a commitment to innovation, and should be encouraging to all of us. The number of applications has returned to the OCC's normal level, consistent with past experience and practice.

Since the 1970s, the OCC has been responsible for chartering national trust banks, a power explicitly granted to the Administrator of National Banks (ANB) by Congress in 1978. Currently, the OCC regulates approximately 60 national trust banks. Some banks and their industry associations have expressed concerns about some pending applications. They argue that approving these applications would violate OCC precedent, as it would allow national trust banks to engage in non-fiduciary custodial activities.

What they fail to acknowledge is that for decades, the OCC has allowed national trust banks to engage in non-fiduciary custodial activities. In fact, prohibiting national trust banks from engaging in non-fiduciary activities would not only threaten the dynamic development of the federal banking system but also disrupt over a trillion in traditional business of existing national trust banks.

According to relevant regulations, national trust banks must limit their business activities to the operation of trust companies and their related activities. Despite recent claims to the contrary, non-trust activities, particularly custody and safekeeping, have been fully within their authorized business scope since the OCC began issuing national trust bank charters.

In fact, most national trust banks are already engaged in this business, including uninsured national trust banks that are subsidiaries or affiliates of full-service insured national banks or insured state banks. In the third quarter of this year, national trust banks reported that the scale of non-fiduciary custody or safekeeping assets under their management was close to $2 trillion, accounting for about 25% of their total managed assets.

Therefore, if non-fiduciary custody and safekeeping services were deemed unacceptable for pending charter applications, the legality of existing and mature national trust bank operations would also need to be re-evaluated, thereby disrupting the flow of funds in existing economic activities. Although the proposed business of some new charter applicants (particularly those in the digital or fintech space) may be considered new for national trust banks, custody and safekeeping services have been conducted electronically for decades.

For example, various banks, including existing national trust banks, typically hold corporate tickets and client custodianship electronically. Therefore, there is no reason to treat digital assets differently. Furthermore, we should not confine banks (including existing national trust banks) to past technologies or business models.

This is tantamount to decline. The business activities of national trust banks have changed, as have those of other banks across the country. State trust companies are currently also involved in activities related to digital assets. For example, several states, including New York and South Dakota, have authorized their trust companies to provide digital asset-related services to clients, including custody services.

Some existing banks/credit associations have also expressed concerns about potential unfairness or believe the OCC lacks the supervisory capacity to oversee the new activities proposed by current applicants. These concerns could hinder innovative initiatives that could better serve bank customers and support local economies.

As I mentioned earlier, the OCC has been regulating the activities of national trust banks for decades and ensures that both fiduciary and non-fiduciary activities (involving asset management worth millions of dollars) are conducted in a safe and sound manner and in accordance with applicable laws.

The OCC has years of experience supervising a crypto-native bank—a national trust bank—and receives feedback from existing national banks on their innovative products and services almost daily. All of this enhances my confidence in the agency's ability to effectively regulate new entrants as well as new business lines of existing banks in a fair and impartial manner.

We welcome initiatives from existing banking institutions and will ensure that both new and old banking institutions are treated fairly and held to the same high standards when their business activities and risks are similar. One of the greatest strengths of the federal banking system is its ability to evolve from the telegraph era to the blockchain era, actively embracing new technologies to provide banking products and services to customers from rural areas to urban centers. Although Congress reformed national banks over 160 years ago, they remain a vital part of the U.S. financial system to this day. This is no accident. Rather, it is a direct result of Congress and the courts long recognizing that banks can and must adapt and develop new ways to conduct age-old businesses. Preventing national banks, including national trust banks, from engaging in reasonably permissible activities simply because those activities are considered new or different from large tech market advantages would shake this fundamental premise. This could lead to economic stagnation and potentially have profound effects on the banking system.

Appendix 2: What Other No-Action Letters Has the SEC Issued Recently?

A no-action letter is a document originating from the U.S. legal system (in English, No-action Letter). It refers to a formal written document issued by a regulatory agency in response to an application from an institution or individual under its supervision, regarding a specific action the latter plans to undertake. It indicates that if the action is carried out as described in the application, the regulatory agency will not take legal or enforcement action against them. Its core function is to eliminate regulatory uncertainty; it is not a legally binding document.

On September 29, 2025, a no-action letter released by the SEC showed that for a certain token issued by DoubleZero, based on the described factual circumstances, the SEC would not recommend enforcement action regarding the token arrangement. This move is seen as a significant signal of change in crypto market regulation, representing the authorities' increased willingness to make case-by-case rulings on issues such as the classification of certain tokens and securities.

On September 30, 2025, the SEC's Division of Investment Management issued a "no-action letter" to Simpson Thacher, confirming that under certain conditions, state-chartered trust companies can be considered qualified custodians under Rule 206(4)-2 (Advisers Act Qualified Custodian) and permissible custodians under the 1940 Act, and that the SEC would not take enforcement action against enterprises and registered funds regarding this arrangement. This move helps traditional asset management institutions obtain a clearer regulatory positioning around crypto asset custody and compliance services.