撰文:White55,火星财经

一场由政策误读引发的市场暴跌,一次机构逢低扫货的精准操作,加密货币市场在爆仓者的废墟上完成新一轮强弱换手。

北京时间 10 月 13 日凌晨,比特币在跌破 10 万美元关口后迅速拉升,重新站上 11.5 万美元高位,24 小时涨幅超过 5%。与此同时,以太坊也逼近 4200 美元,单日反弹幅度超过 11%。

这场逆转发生在前一交易日全球加密货币市场总市值蒸发 2.5 万亿美元的背景下。

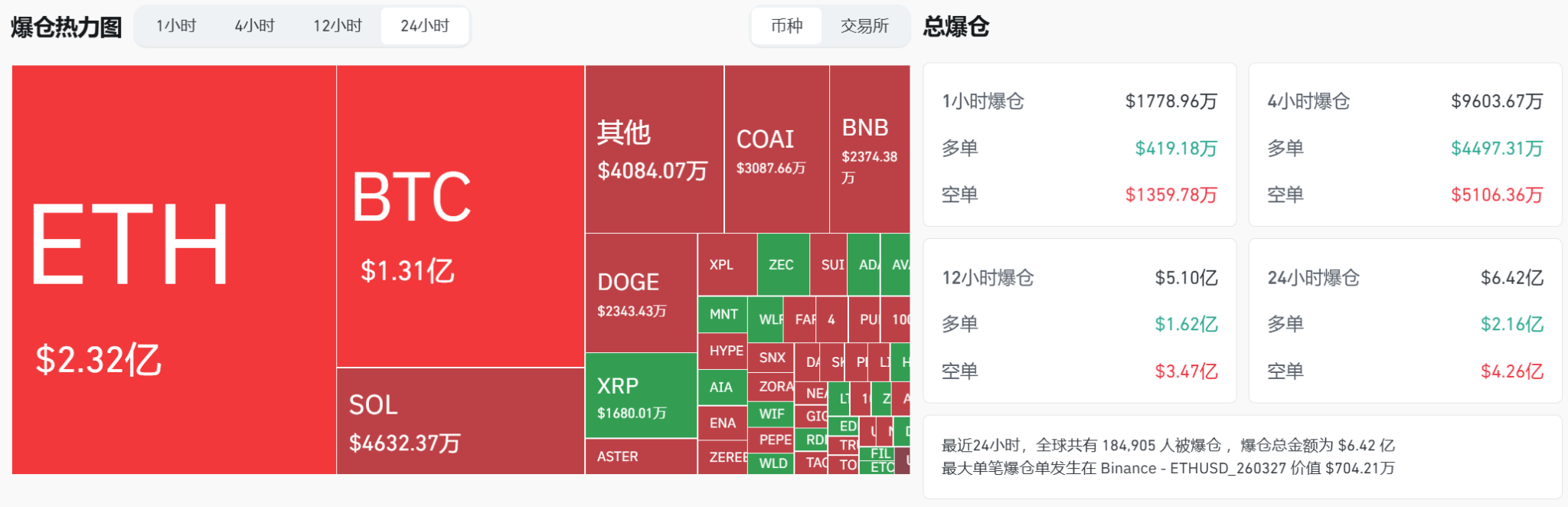

根据 CoinGlass 数据,最近 24 小时内,全球共有超过 18 万人被爆仓,爆仓总金额高达 6.42 亿美元。而在这场多空对决中,最大的单笔爆仓损失发生在 Binance 的 ETHUSD 交易对,价值 704.21 万美元。

政策误读与市场过激反应

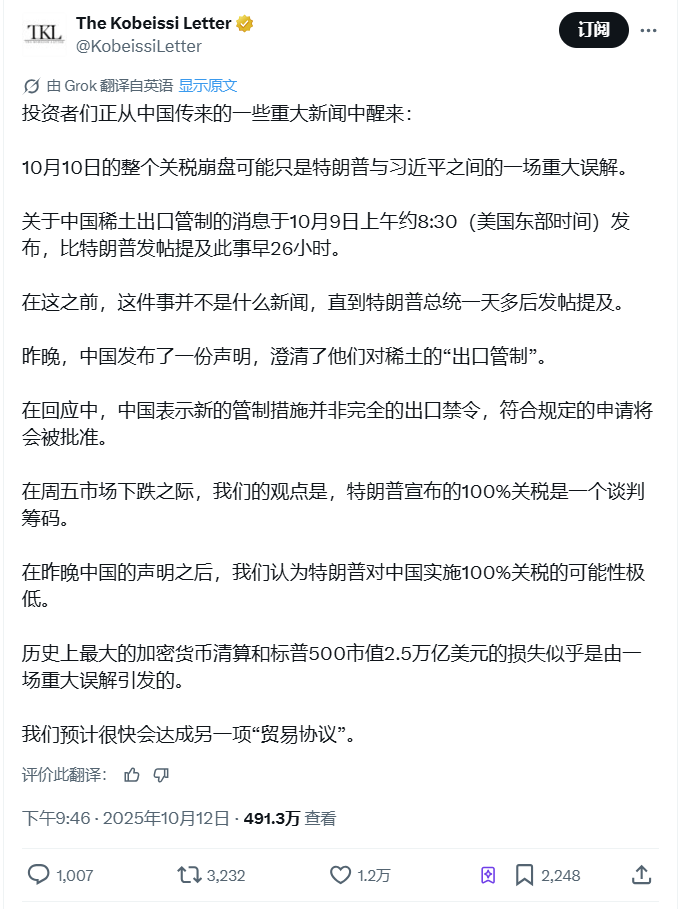

这场市场动荡的源头可追溯至 10 月 9 日。中国商务部关于稀土出口管制的声明在当时并未引起市场过度反应,然而 26 小时后,特朗普在社交媒体上的评论彻底改变了局势。

特朗普威胁「大幅增加」对华关税,这一言论瞬间引爆市场恐慌。标普 500 指数市值蒸发 2.5 万亿美元,加密货币市场随之崩盘,比特币从 12.6 万美元历史高点一度暴跌至 10 万美元附近。 市场分析机构 The Kobeissi Letter 指出,中国的稀土政策并非全面禁止出口,只要「符合规定」的申请仍会被批准。

该机构认为,特朗普的关税威胁更像是一种谈判策略,真正实施的可能性极低。 这种「特朗普关税戏剧」模式已被华尔街归纳为「TACO」交易策略,即「Trump Always Chickens Out」的缩写。

根据广发证券分析,今年 4 月以来,全球「TACO」交易已多次出现,包括美方威胁加关税后不断延期、威胁开除鲍威尔但又马上反复等。

杠杆清算与市场结构重置

在这场暴跌中,加密货币市场经历了史上最严重的去杠杆。

Glassnode 数据显示,整个加密货币市场的资金费率已跌至 2022 年熊市以来的最低水平,表明投机性过度行为已被系统性地清理出场。 过度杠杆化是放大此次市场波动的关键因素。

高杠杆合约在价格波动中的脆弱性暴露无遗。大量散户在 12 万美元附近高杠杆做多,当比特币跌至 10.2 万美元(跌幅 15%)时,其保证金已不足以覆盖亏损,账户直接归零。

这种市场结构重置虽然短期带来剧痛,但为市场健康反弹奠定了基础。

Matrix on Target 周度报告指出,自 2024 年 12 月以来,社交媒体上山寨币相关话题的讨论量已下降逾 40%,而比特币相关讨论仍然高涨,反映出市场对比特币作为宏观对冲资产的持续兴趣。

机构逢低布局与特朗普的比特币利益

在市场恐慌之际,机构投资者正在悄然布局。

加密分析平台 Lookonchain 指出,最大的企业以太币财务公司 BitMine Immersion Technologies 在崩盘后抢购了超过 128,700 个以太币,价值 4.8 亿美元。

BitMine 执行主席 Tom Lee 表示,「任何没有真正结构性变化的价格下跌都是一个很好的买入机会」。

同样,MicroStrategy 执行董事长迈克尔·塞勒也暗示其公司可能已逢低买入,他在社交媒体上发布了公司比特币持仓图表,标题为「不要停止相信」。

值得注意的是,特朗普本人已成为比特币市场的重要利益相关方。

据福布斯报道,通过持有特朗普媒体与技术集团(TMTG)的股份,特朗普间接持有价值约 8.7 亿美元的比特币,这使其跻身全球最大比特币投资者行列。

TMTG 今年 7 月购入了价值 20 亿美元的比特币,而自公司布局比特币以来,比特币价格上涨约 6%。这一利益关联或许能解释为何特朗普政府对加密货币行业采取友好立场,包括推进加密货币战略储备计划。

宏观环境与资金流向转变

美联储货币政策转向成为市场的重要支撑。

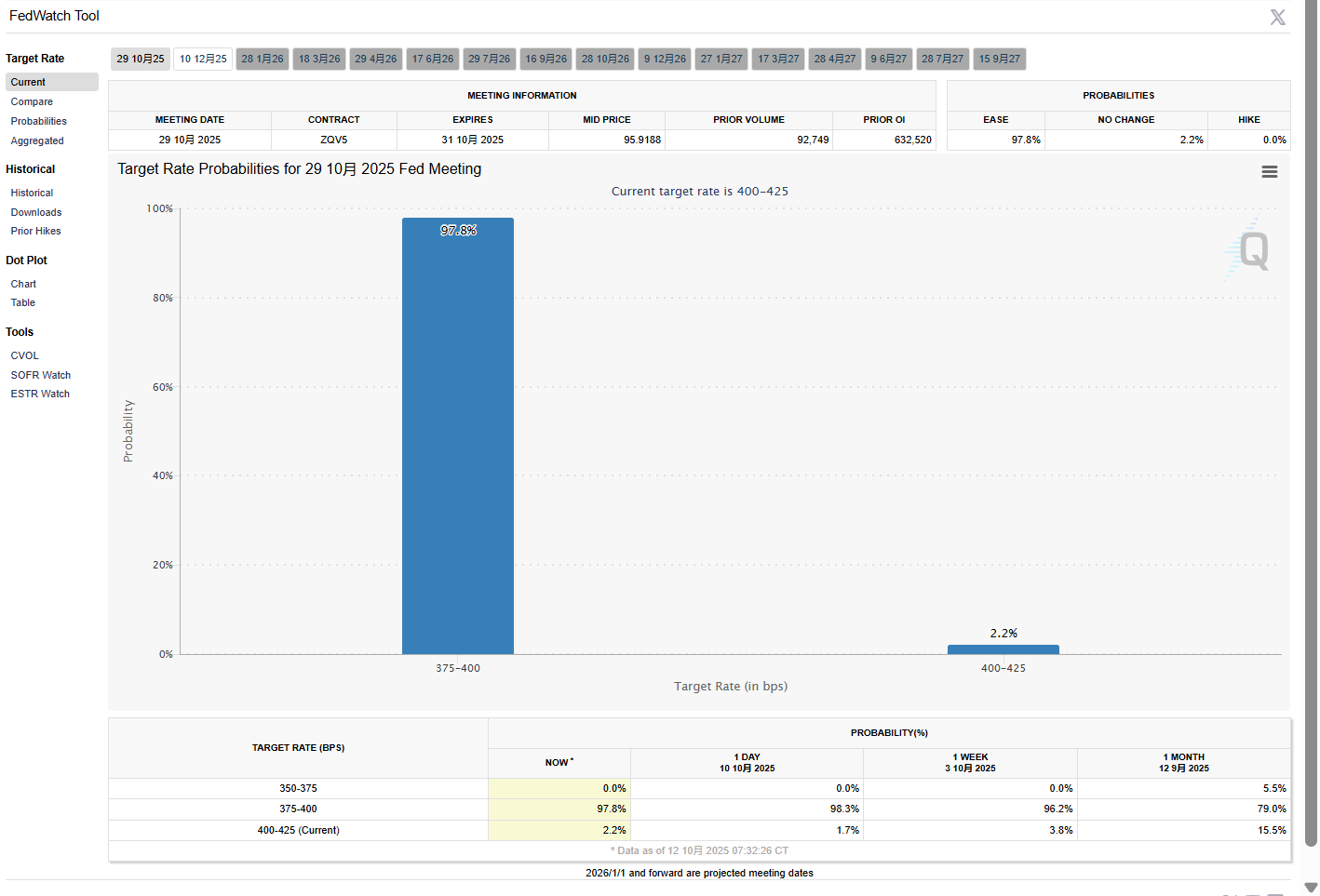

根据 CME「美联储观察」数据,美联储 10 月降息 25 个基点的概率高达 97.8%,12 月累计降息 50 个基点的概率达到 96.7%。这种流动性宽松预期为风险资产提供了有利环境。

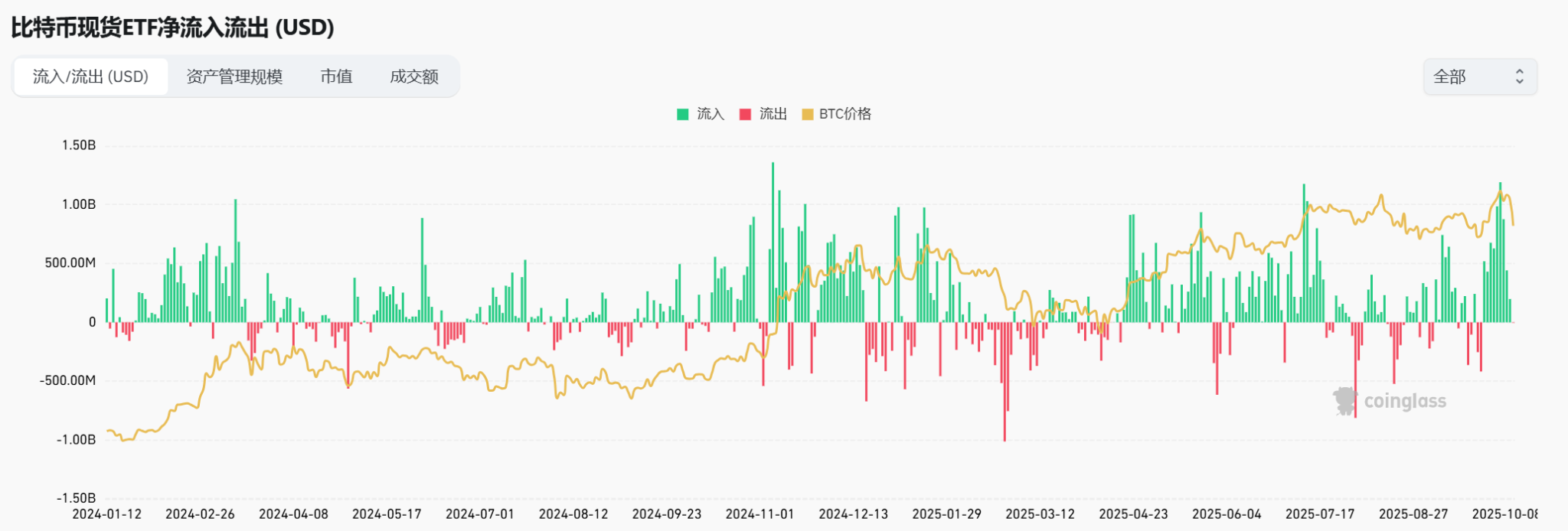

传统金融市场的资金流动也呈现出新的趋势。

9 月以来近 2000 亿元资金涌入 ETF 市场,其中权益类 ETF 净申购额合计达 1216.13 亿元。这种「资产荒」背景下的资金配置需求,也为加密货币市场带来了潜在买盘。

黄金与比特币的同步上涨也值得关注。

现货黄金在 10 月 13 日一度冲上 4060 美元 / 盎司,创下历史新高。这种传统避险资产与新兴数字资产的同向波动,表明当前市场流动性环境正在推动各类资产价值重估。

渣打银行数字资产研究全球主管 Geoff Kendrick 指出:「与 2018 年—2019 年上一次政府关门不同,当时比特币与传统风险资产的联动性较弱,如今其所处的位置已截然不同」。这种与传统金融市场关联性的增强,使得比特币更易受宏观因素影响。

市场展望与策略调整

对于后市走势,分析师们普遍呈现乐观态度。

Fundstrat 联合创始人 Tom Lee 预计比特币年底将升至 20-25 万美元,而渣打银行的 Geoff Kendrick 则重申了其对比特币年底价格 20 万美元的目标。

技术分析也支持反弹判断。比特币 10.9 万美元附近被视为关键支撑位,与矿工关机价重合,历史上类似位置常引发强势反弹。

期权市场 Delta 倾斜度(看跌 - 看涨)升至 12%,超过 10% 的极度恐慌阈值,而历史上此水平后 1 个月平均反弹 40%。 不过,市场仍面临诸多不确定性。

美联储政策可能超预期转向,若通胀反弹导致降息暂停,加密货币或面临二次下探风险。

同时,各国对稳定币的强监管可能引发流动性危机,这也是潜在的风险点。 对于投资者而言,控制杠杆成为当前市场的首要原则。分析建议拒绝 20 倍以上杠杆,以现货交易为主,避免在单日 10% 波动中爆仓的风险。同时,合理配置资产,将高风险资产(BTC/ETH)占比控制在 10% 以内,保留 15%-20% 的现金抄底机会。

随着比特币重新站稳 11.5 万美元,加密货币总市值也回升至 4 万亿美元上方。市场参与者结构正在悄然改变:散户杠杆被清洗出局,而机构投资者和巨鲸账户则趁机增持。 特朗普政府与加密货币市场日益复杂的利益关联,以及美联储即将到来的降息决策,将继续塑造市场的新格局。而这一次,市场从「散户投机」向「机构配置」的演进,可能将给数字货币市场带来更深刻的变革。