进入9月,整个币圈都在屏住呼吸。? 去年9月降息之后,比特币和A股一路大涨,点燃了市场激情。今年,投资者同样期待“历史重演”。不过,这一次的市场背景已经不同:比特币和以太坊在ETF和机构资金的加持下,价格不再便宜,而大多数山寨币仍然处于低位徘徊。问题来了——模因币们能否继续带节奏?哪些山寨有机会成为黑马?

让我们从大家最关心的狗狗币(DOGE)和柴犬币(SHIB)说起。

狗狗币 & 柴犬:9月不确定,10月最值得期待

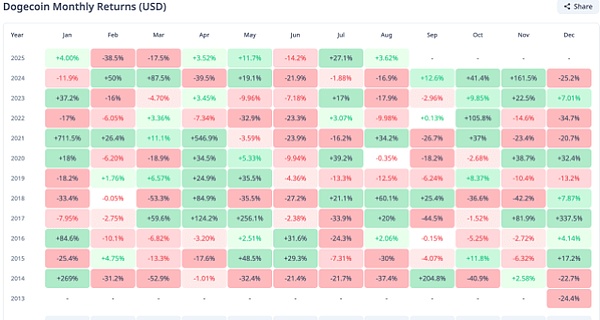

DOGE 已经有12年历史,SHIB也在5年时间里成为全球第二大模因币。两者的走势常常呼应,但9月的数据却不算乐观。?

2021年9月:狗狗币大跌26.7%,柴犬币小涨4.65%。之后两年两者表现都疲软。

2024年9月:情况逆转,双双录得两位数涨幅。

这说明,9月行情往往充满不确定性,很大程度上要看比特币的走势和市场整体风险情绪。

但好消息是:10月才是模因币的黄金月份。

SHIB自上线以来,10月从未收跌。

DOGE过去六年,10月也都是上涨收盘。

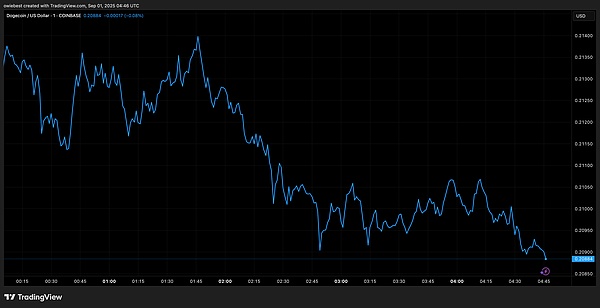

DOGE 周末暴跌,创下局部新低

所以,如果9月依然显得有点闷,或许10月会是模因党真正的“收割季”。

Pepe:社区狂热不减,但上涨空间受限

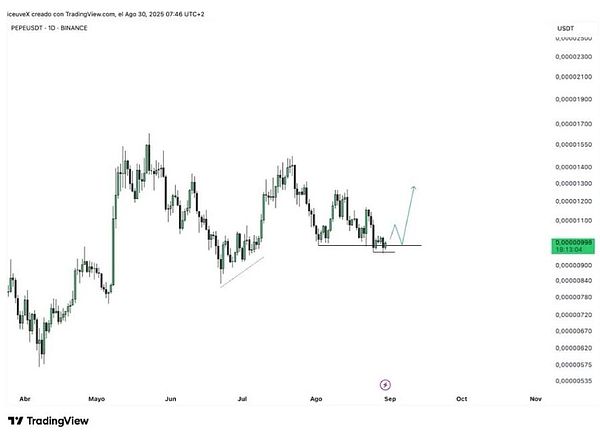

除了狗狗和柴犬,Pepe(PEPE)依然是今年模因赛道的热门角色。它拥有忠诚的社区,每天交易量还在 10亿美元 级别。鲸鱼甚至会一次性买入200万美元的代币,足以证明它的热度。

然而,技术面却给市场泼了点冷水:

0.000011美元成了顽固阻力位,短期难以突破。

悲观预测认为可能回落到0.00000708美元,跌幅高达30%。

乐观的情况下,到年底也难以冲破0.000028美元。

这意味着,Pepe虽然热闹,但上涨空间有限。聪明资金也在寻找下一个可能实现“千倍回报”的新项目,而不是单纯在情绪币上豪赌。

9月的主旋律:降息与机构资金

宏观层面,今年9月最大的期待就是降息。 去年降息带来的大行情还历历在目,而这一次,比特币和以太坊有了ETF、机构入场等新利好,理论上行情爆发的空间更大。

不过现实情况是:BTC和ETH的价格已经不算低,真正的低位机会反而还在山寨币。资金虽然目前主要集中在以太坊,但市场普遍认为——山寨季迟早会来。

策略上,逢低布局以太坊仍是相对稳健的选择;而对于山寨币来说,可以耐心等待市场全面启动。别在黎明前割肉,春天总会到来。

哪些山寨可能迎来100倍机会?

虽然大盘还没完全放量,但部分山寨已经开始试盘拉升,给市场释放出信号。以下几个板块值得重点留意:

明星与老牌项目

POL(前身为21年明星项目Matic)改名后依旧具备潜力。

AXS、LRC、KSM 这类老牌项目位置极低,有望在行情回暖时迎来补涨。

基本面扎实的龙头

LDO、ENS、ARB:估值合理,基本盘稳固,适合长期持有。

超跌反弹潜力股

YGG、ROSE、FLOW:一旦突破趋势线,有可能直接起飞。

国产优势项目

CFX(Conflux):最新V3升级将支持每秒1.5万笔交易、AI功能和RWA代币化,还能发行稳定币。图形上看,价格有望冲击0.273美元。

近期热点项目

CRO:一周从0.25美元飙升到0.38美元,涨幅150%,创2022年以来新高。受益于与特朗普媒体的64亿美元合作,CRO被整合进Truth Social平台,并有望进入ETF分配。

XRP:虽然跌破3美元后短暂回调,但目前已回升至3.01美元,社区信心仍在。

小结:9月蓄势,10月或迎狂欢,100倍机会属于耐心的人

综上,9月对于模因币来说可能依旧充满波动,狗狗币和柴犬大概率继续跟随比特币节奏,而Pepe的上涨空间有限。但从10月开始,模因赛道或许会迎来真正的爆发点。与此同时,机构资金与降息预期正在为市场积蓄能量,山寨币的春天值得期待。

操作策略:

短期:以太坊仍是资金主线,逢低布局更稳健。

中期:关注基本面强、位置低的山寨项目,等待资金轮动。

长期:模因币虽具情绪溢价,但更适合作为“行情催化剂”,真正的财富效应可能来自价值型山寨。

币圈从来都不缺惊喜,9月或许只是前奏,真正的狂欢,可能要等到10月才开始。

点赞、转发、关注我,带你捕捉更多市场风口,陪你笑看牛熊起伏!一起加油!

在当前的市场环境下,短线操作确实是很必要的。如果一直等待现货回升,可能会感到时间的煎熬。我最近也在全力进行二级短线和一级土狗的操作,收获不错,想要跟上的小伙伴私可以关注我!