Key Takeaways

Bitcoin hit $118.8K on the 11th of July, but on-chain data showed low retail activity, moderate MVRV Ratio, reduced Short-Term Holder profits, and declining Miner Position Index. All of these signal the rally isn’t over yet.

Bitcoin [BTC] was trading at $117,783, after clocking a fresh all-time high of $118,856 earlier that day, as bullish sentiment started to drive the market upward.

Google Trends showed that the Bitcoin topic was still not popular in the United States, and was far away from the peaks of 2020, or even November 2024.

No retail frenzy in sight

The trend of a lack of retail euphoria was visible in the Spot Retail Activity.

Using the trading frequency and position size to understand whether retail participation was increasing, this metric is a useful tool in understanding whether smaller market participants were flooding in.

According to CryptoQuant, this metric hasn’t seen a retail surge since March 2024. That mirrors earlier cycles too: in February 2021, retail jumped in, and BTC soon met rejection near $60k.

Further evidence that the Bitcoin market has not overheated

In a post on CryptoQuant Insights, analyst Avocado_onchain demonstrated how the market sentiment and dynamics were strikingly different from the previous market peaks.

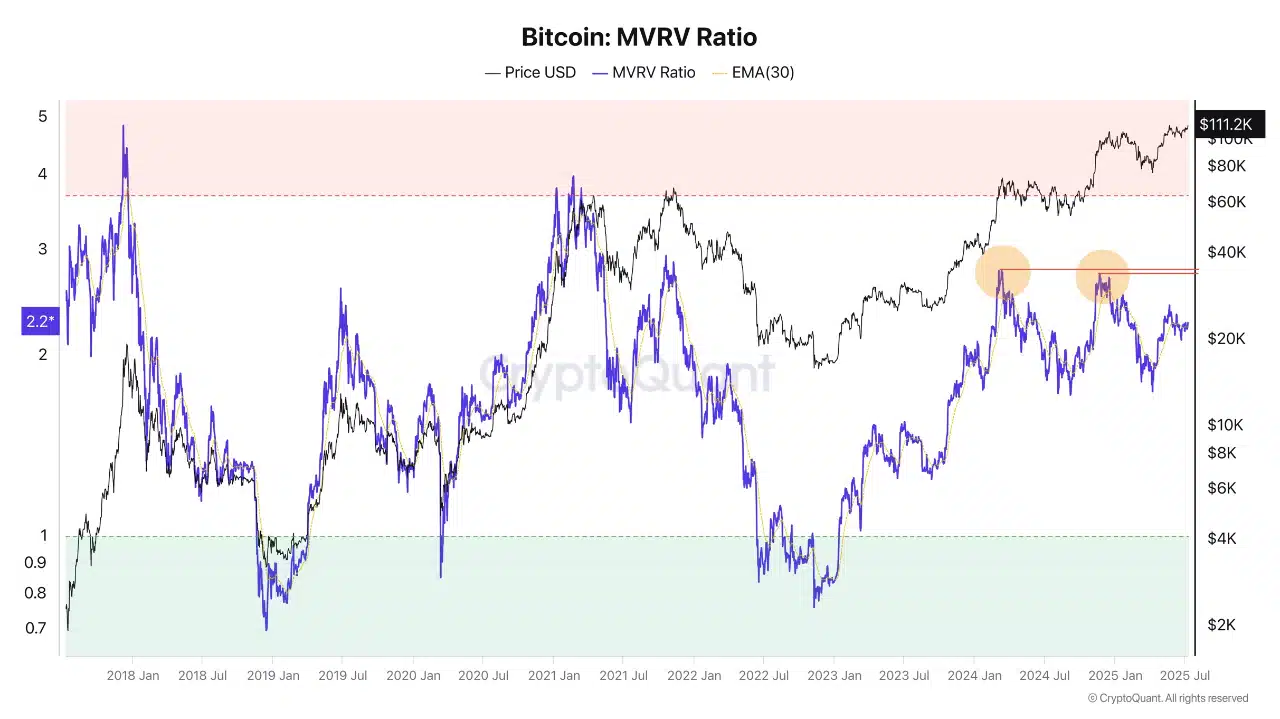

The MVRV Ratio exceeded 2.7 in March and December 2024. On the 11th of July, though, the reading hovered around 2.2—a signal of healthier market conditions.

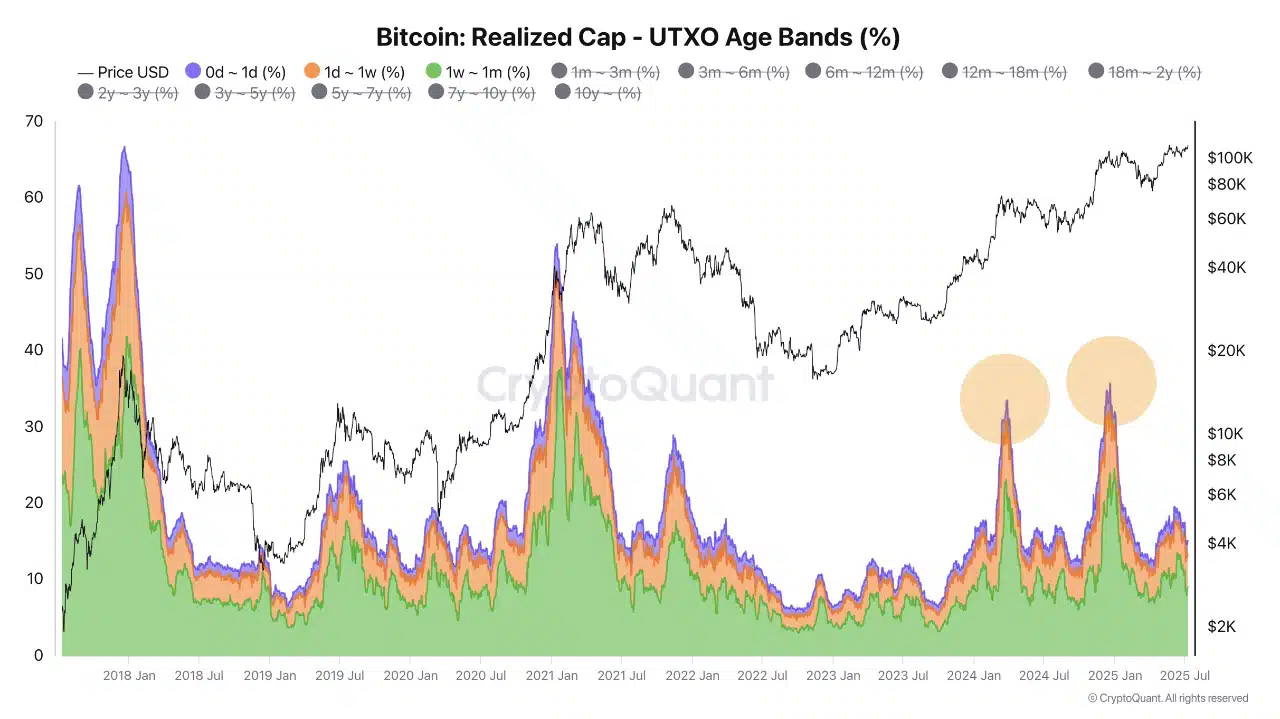

Another important cue came from the UTXO Age Bands, which analyze how long each Bitcoin remains unspent.

Data showed that 15% of the BTC supply belonged to Short-Term Holders (STH)—wallets holding coins for under a month. For context, this figure sat near 30% at prior cycle peaks.

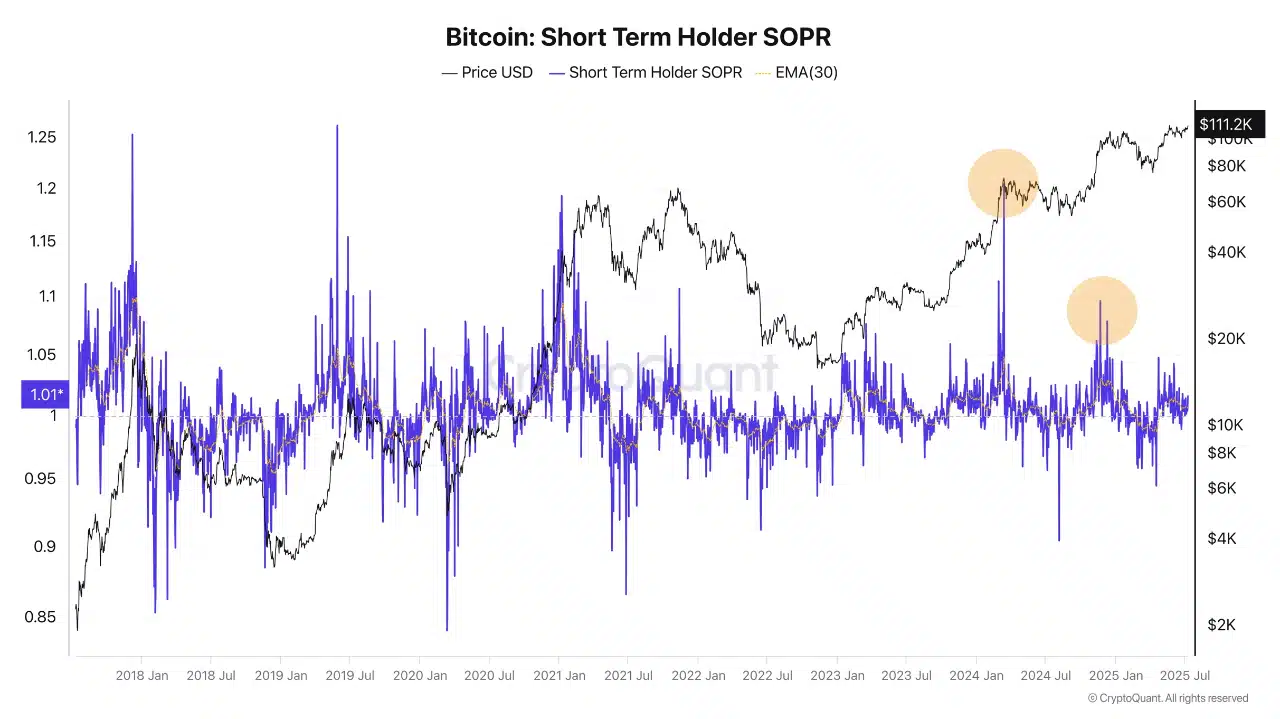

Moreover, the STH SOPR showed that holders were not sitting on large profits. This was another clue of minimal sell pressure from profit-taking activity from STH Bitcoin wallets.

Miners keep stacking – another reason bulls aren’t done

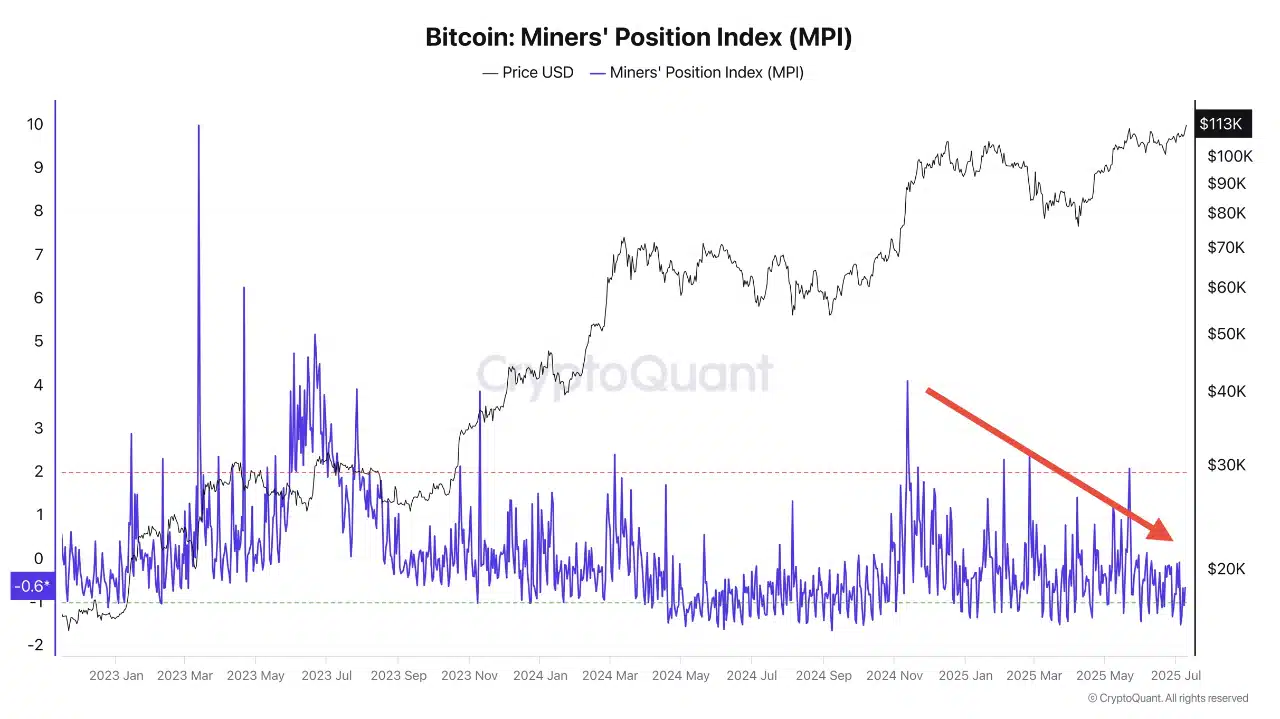

Finally, the Miner Position Index was also trending downward since November 2024. This showed reduced selling pressure from miners.

Mining companies have tended to accumulate Bitcoin instead of selling it, showing that they expected prices to continue to grow.

Overall, the signs of market exhaustion and widespread profit-taking were not here. There was hope that Bitcoin’s price would trend higher in the coming months, and the bull run was not yet over.