Original | Odaily Planet Daily (@OdailyChina)

Author | Asher (@Asher_ 0210)

On December 1, Zama, a fully homomorphic encryption network that has raised a total of $130 million, announced on X that it will sell 10% of the total ZAMA token supply through a sealed-bid Dutch auction, using fully homomorphic encryption (FHE) to keep bids confidential. Additionally, the Zama mainnet is expected to launch before the end of the year.

Zama is arguably one of the most discussed projects in the community for its upcoming TGE. Below, Odaily Planet Daily will break down the Zama project, the sealed-bid Dutch auction, and the final interaction opportunities before the token generation event.

Project Overview

Zama is a company specializing in fully homomorphic encryption (FHE) technology, one of the most cutting-edge innovations in the field of privacy computing. Simply put, it allows computations to be performed directly on encrypted data without decryption. Zama's mission is to build efficient and user-friendly FHE tools to promote the widespread adoption of this technology in Web3 and beyond. Zama's core team was co-founded by Rand Hindi and Pascal Paillier:

- Rand Hindi learned to program at age 10, created a social website that went viral in France at 14, holds a PhD in Computer Science and Bioinformatics from University College London, and previously founded and sold the AI voice platform Snips;

- Pascal Paillier is a top expert in fully homomorphic encryption with 25 years of research experience, holding 25 patents and publishing dozens of papers. He has won the Asiacrypt Best Paper Award and is a core member of IACR.

To date, Zama has completed two funding rounds, raising a total of $130 million. In March 2024, Zama announced a $73 million Series A round co-led by Multicoin Capital and Protocol Labs; in June 2025, Zama announced a $57 million Series B round led by Blockchange Ventures and Pantera Capital. (For more details, read: The Next Blockchain Giant: Why ZAMA Raised $130 Million)

Sealed-Bid Dutch Auction Token Public Sale to Begin on January 12

Public Sale Details

Auction Method: Sealed-bid Dutch auction;

Auction Time: January 12 to 15, with claims starting January 20;

Public Sale Share: 10% of the total token supply, with 8% sold via auction and 2% sold at a fixed price post-auction (capped at $10,000 per person);

Lock-up: Zama tokens purchased in the auction will be fully unlocked;

Auction Pre-registration Link: https://www.zama.org/auction.

Zama Public Sale to start on January 12

What is a Sealed-Bid Dutch Auction?

Zama will sell 10% of the total ZAMA token supply through a sealed-bid Dutch auction on Ethereum, using fully homomorphic encryption (FHE) to maintain bid confidentiality. Key highlights include fair distribution, no front-running, no bots, and no gas wars. Specifically, the sealed-bid Dutch auction consists of 4 stages:

- Stage 1: Shield stablecoins. Prepare funds by converting personal USDC, USDT, DAI, and other stablecoins on the Ethereum network into ERC-7984 confidential assets (a conversion website will be provided by the official at the public sale launch). The balances and transfer amounts of these tokens will be encrypted.

- Stage 2: Place your bids. This is the bidding stage, running from January 12 to January 15. Users can submit any number of bids. Bid prices are public, but quantities are confidential. The starting price is $0.005 (corresponding to a $55 million FDV). Unlike a public Dutch auction where the price decreases over time, the sealed-bid Dutch auction allows users to bid at any price throughout the bidding period.

- Stage 3: Clearing price and allocation. This is the settlement stage, running from January 16 to January 19. The smart contract uses FHE calculations to accumulate demand from the highest to the lowest price to determine the clearing price. Therefore, users will fall into three scenarios: 1. If the bid is higher than the clearing price, they receive their full allocation, and any overpayment is refunded; 2. If the bid equals the clearing price: if the quantity exceeds the remaining supply at that price, they receive a proportional share of tokens, with the remainder refunded; 3. If the bid is lower than the clearing price: they receive no tokens and get a full refund.

- Stage 4: Claim your tokens. This is the token claim stage, starting January 20. Users can claim their ZAMA tokens (fully unlocked) and any refunds.

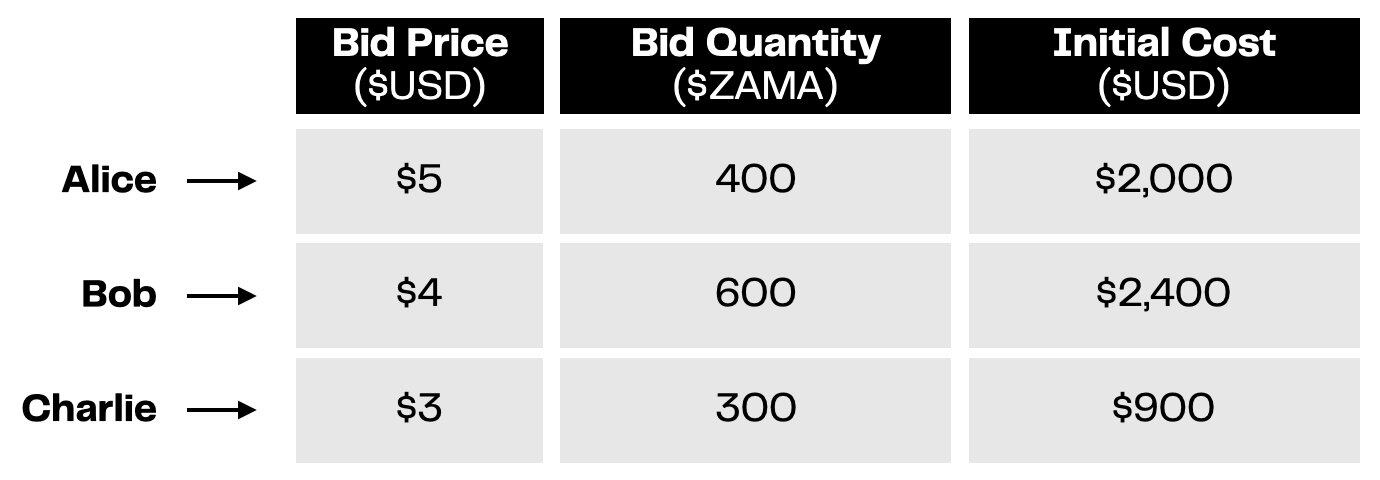

To make it easier to understand, Odaily Planet Daily provides an example. Assume 1000 ZAMA tokens are sold via a sealed-bid Dutch auction, with three participants: Alice, Bob, and Charlie.

First, during the bidding stage, their bids are as follows:

- Alice bids for 400 tokens at $5 each, paying a total of $2000;

- Bob bids for 600 tokens at $4 each, paying a total of $2400;

- Charlie bids for 300 tokens at $3 each, paying a total of $900.

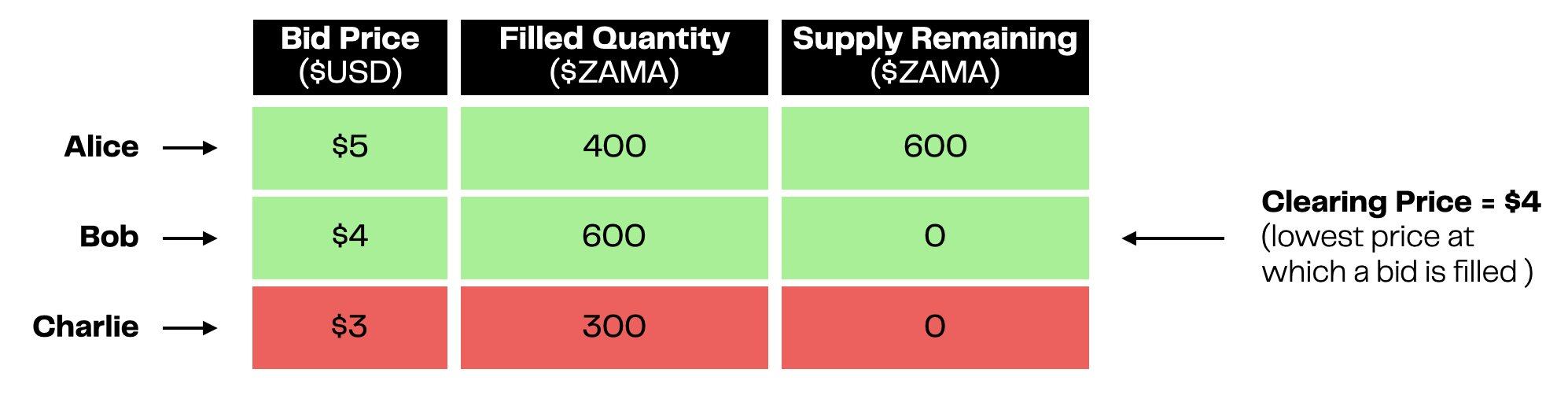

Next, after the bidding period ends, the auction smart contract allocates tokens to each participant in order from the highest to the lowest bid:

- Alice has the highest bid and receives her 400 tokens. 600 tokens remain to be allocated.

- Bob is the second highest bidder and receives the remaining 600 tokens. The remaining supply is now 0. Thus, the final clearing price is Bob's bid price of $4 per token.

- Charlie's bid is below the final clearing price, so he receives no allocation.

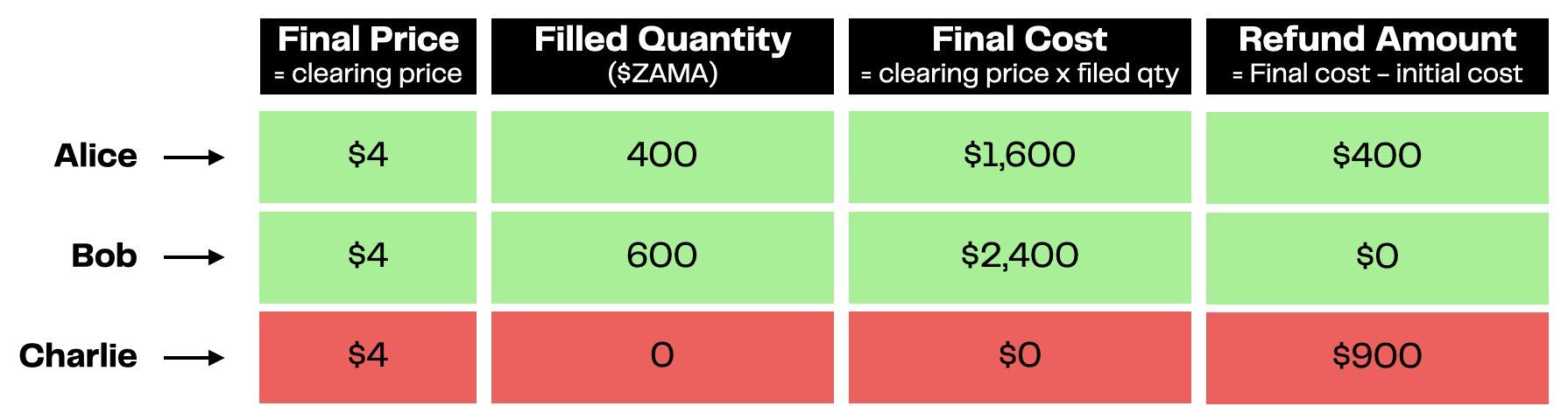

Finally, during the claim and refund stage:

- Alice receives 400 ZAMA tokens and a $400 refund;

- Bob receives 600 ZAMA tokens, with no refund;

- Charlie receives no ZAMA tokens but gets a full refund of his $900.

Final Interaction Opportunities Before TGE

Currently, you can still participate in Zama's guild tasks (Link: https://guild.xyz/zama/home), which include:

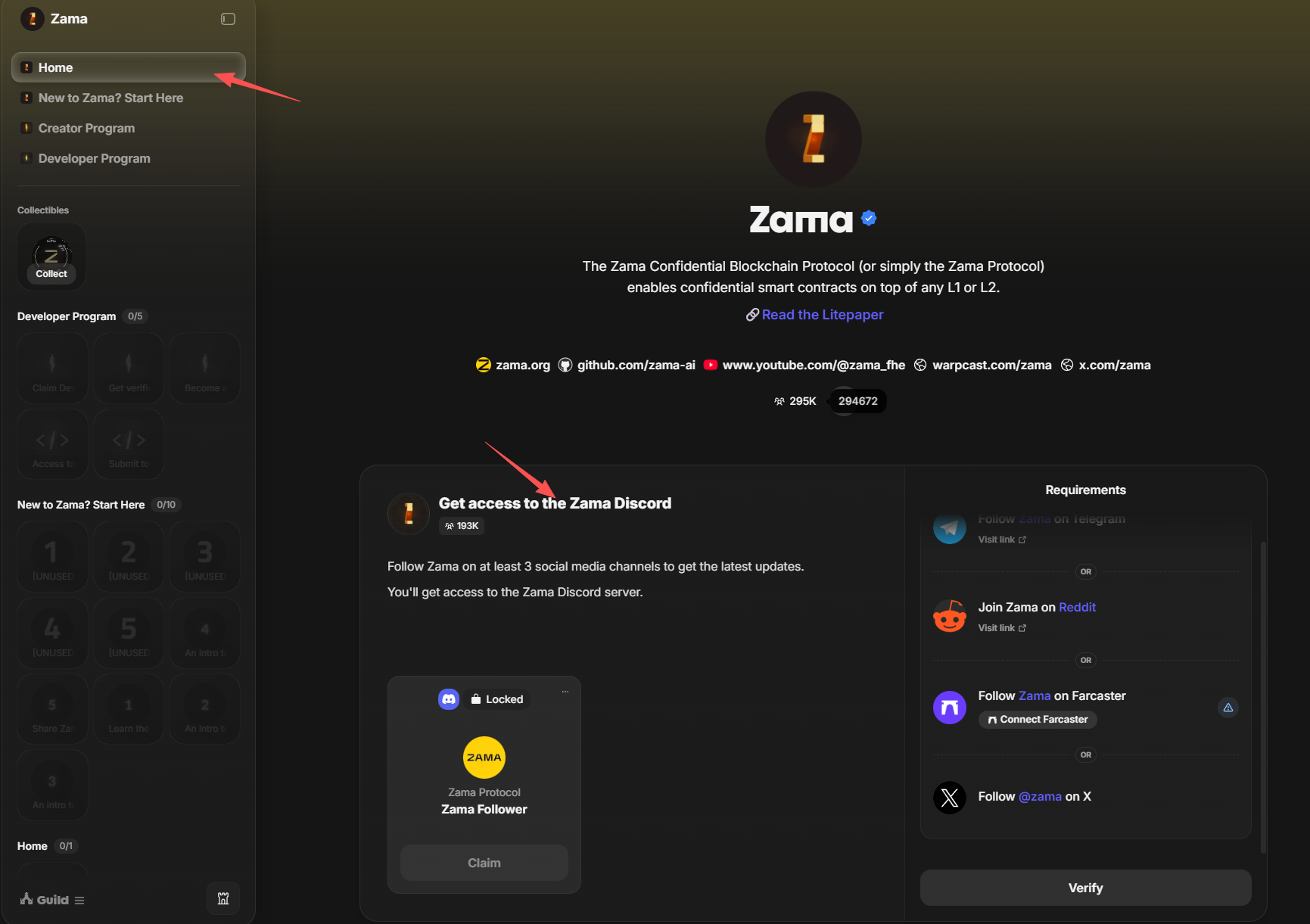

Basic Task: Get access to the Zama Discord. Join three of the four official communities to complete this task, and also join the official Discord channel to get a role.

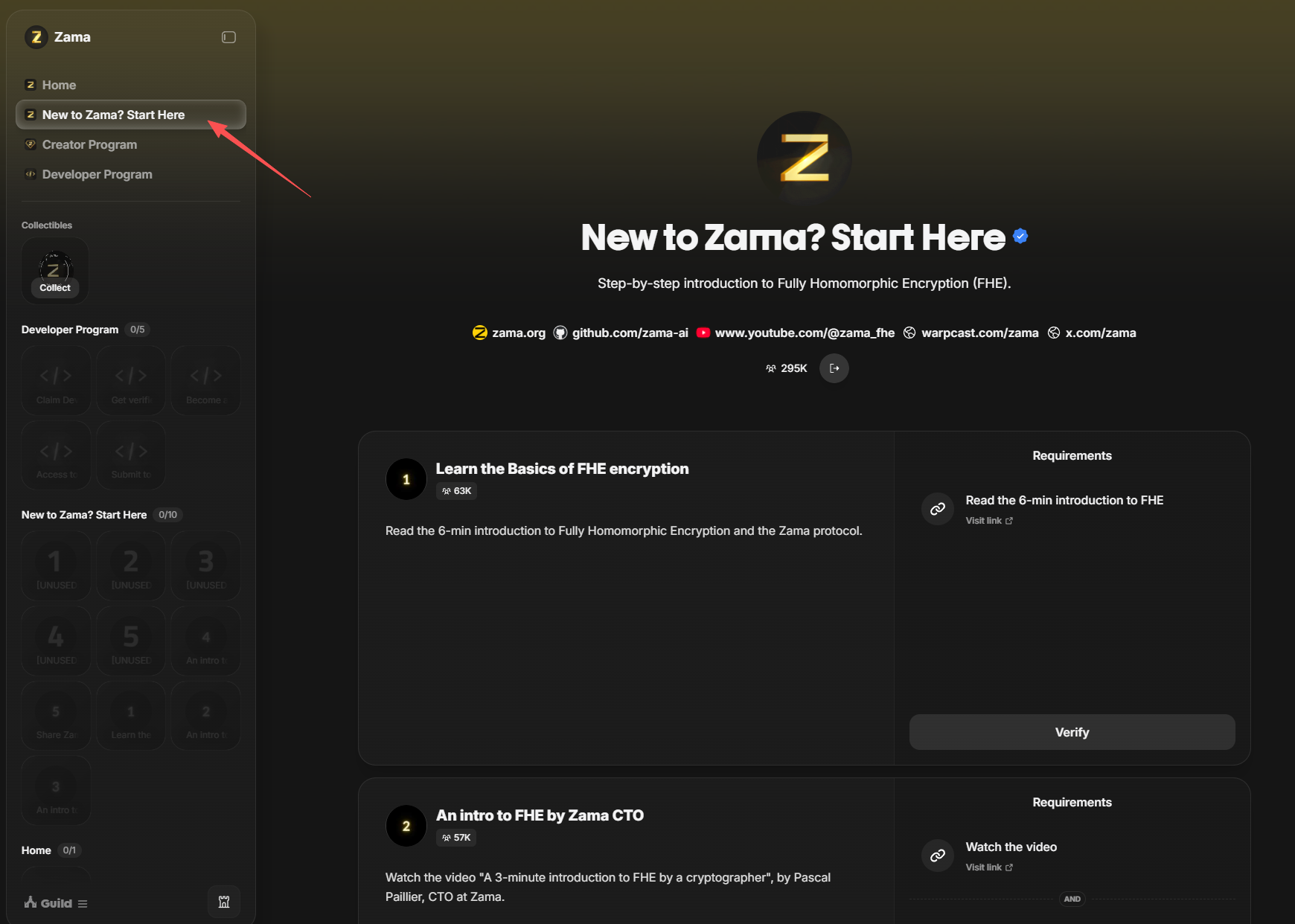

New to Zama? Task: Includes five subtasks, easy to complete by following the prompts.

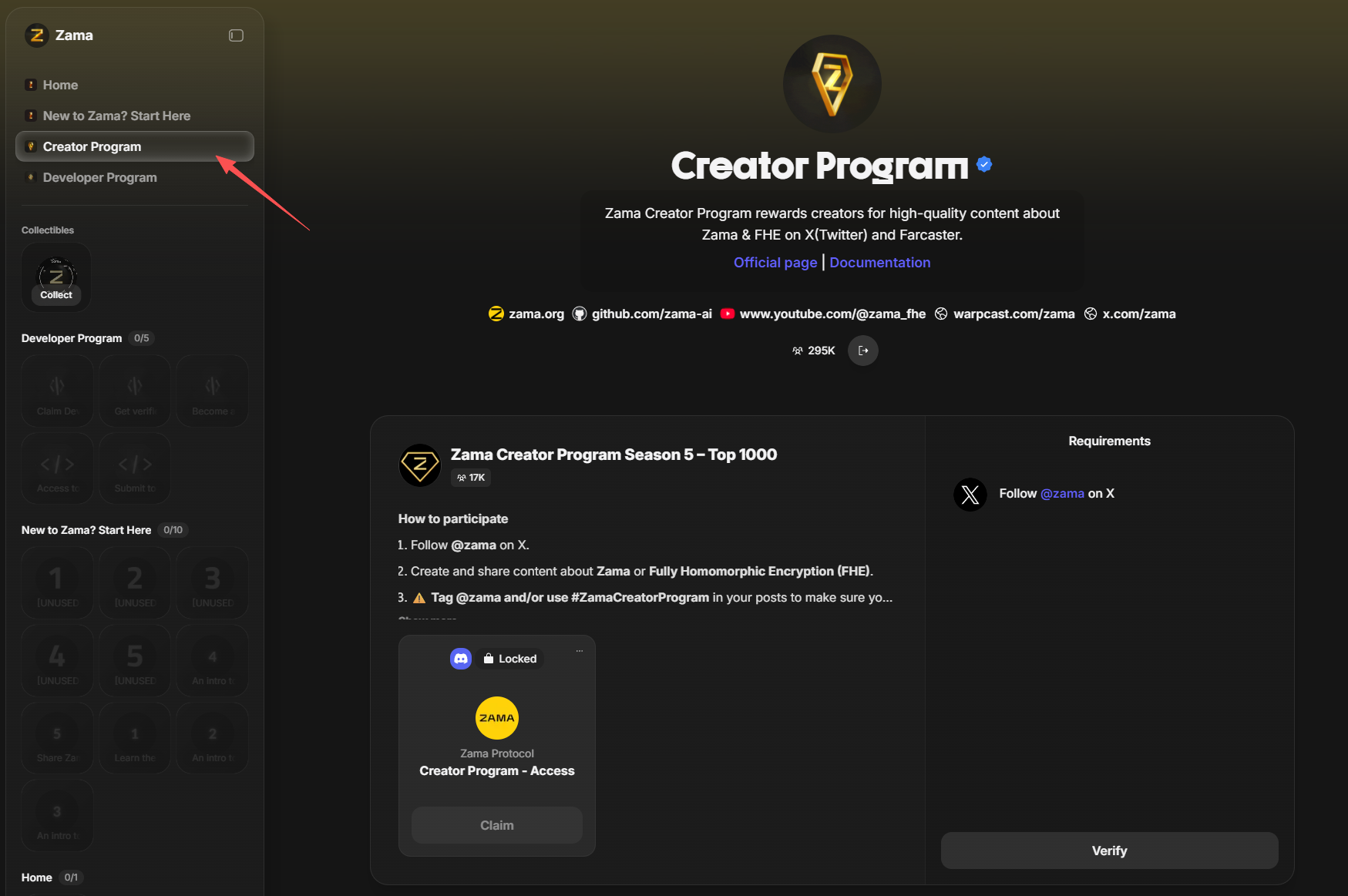

Creator Program Task: Includes two subtasks. The first subtask has funding requirements, and the second is the creator program.

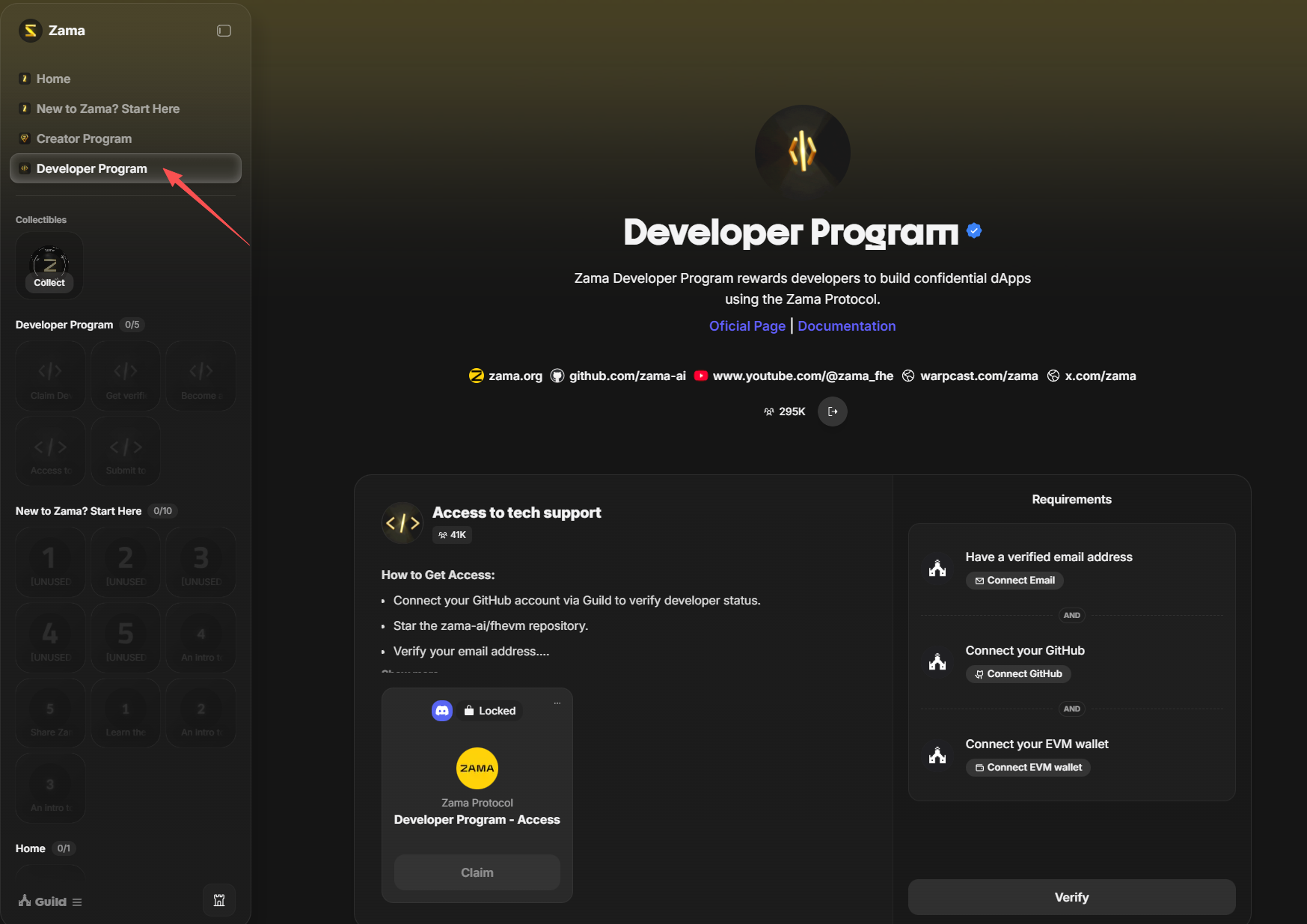

Developer Program Task: High task requirements, proceed based on your situation.

Additionally, the OG NFT minting page will open soon. Early participants should check if they are eligible when it opens (Link: https://www.zama.org/nft/og).