BTC31011

07/26 05:00

Bitcoin Bearish Pressure Is Sharply Increasing Th

Bitcoin Bearish Pressure Is Sharply Increasing

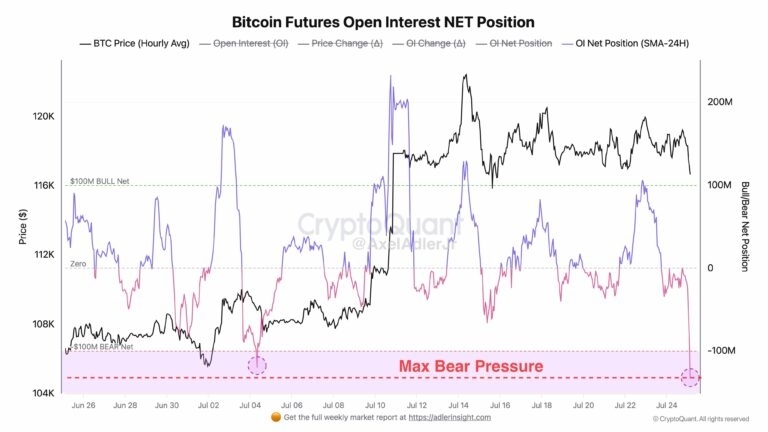

The net position of Bitcoin futures has fallen sharply into negative territory, according to CryptoQuant analyst Axel Adler.

The net open interest position has since surged past $100 million, reaching its highest level of bearish pressure in three weeks.

Usually, when this metric reaches an extremely bearish level, it indicates that traders are actively short the market. Therefore, most market participants expect prices to decline in the near future.

At the same time, Bitcoin open interest (OI) has soared to a new all-time high of $44.68 billion at press time.

This sharp jump reflects an increase in capital inflows into the futures market.

The fact that the net position change has reached its maximum negative value and OI is rising suggests that most of these traders are short the market.

However, such an extreme negative divergence in OI could trigger a short squeeze if the price bounces back. However, the risk of further downside remains as long as OI remains in the zone of maximum bearish pressure.

#HTX 12th-Anniversary Carnival#ETH price breaks through $4,600, buy or sell?#Check In Daily, Win Prizes Daily — Join the Fun!#Do you think MemeCore is promising?

1分享

全部评论0最新最热

暂无记录