crypto analysis

07/25 00:54

Ethereum’s yield engine stalls as Aave gets draine

Ethereum’s yield engine stalls as Aave gets drained

Aave [AAVE] is a key liquidity hub in Ethereum’s DeFi scene. Naturally, the whole system relies on a healthy liquidity buffer to keep borrow/lend rates balanced. But recently, that buffer got tested hard.

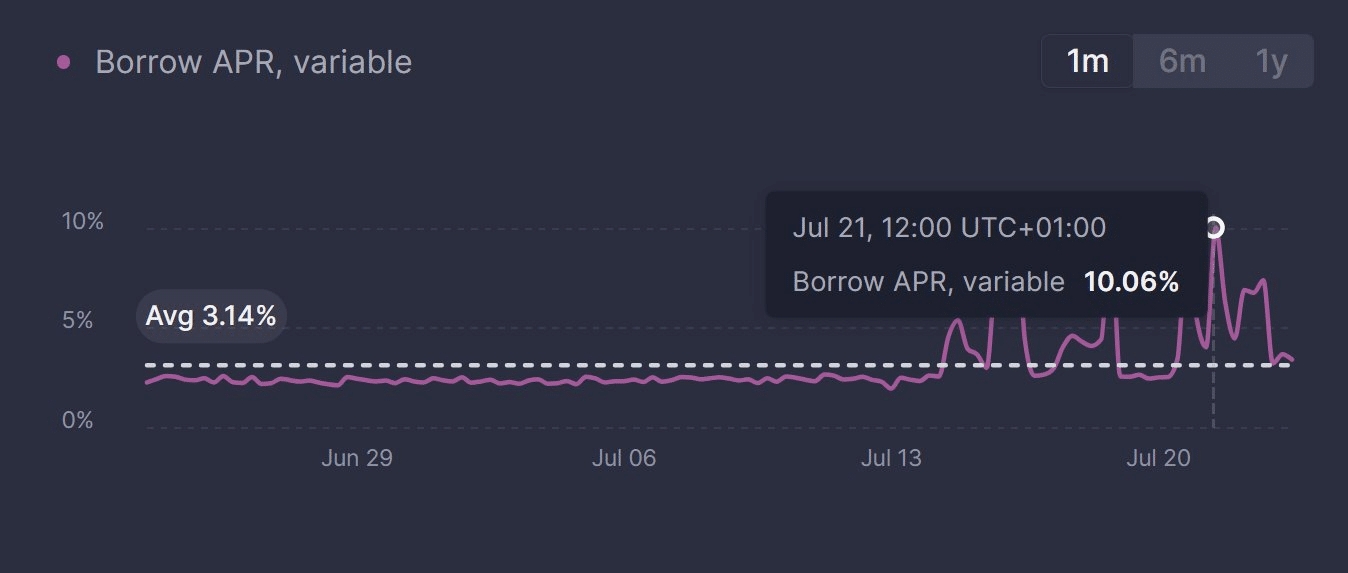

Justin Sun’s recent $600 million ETH withdrawal created a significant liquidity shock, draining Aave’s ETH reserves.

The fallout? ETH’s variable borrow rates surged to over 10.06%, making leverage far more expensive across the board. But the loopers took the biggest hit (traders who stack yield by looping stETH and ETH).

Here’s how it works: You stake ETH via Lido and get stETH in return, then drop that stETH into Aave as collateral, borrow ETH, and repeat the loop to boost your staking APY. It’s a classic DeFi yield play.

Take for example, someone stakes 100 ETH, gets 100 stETH, deposits it into Aave, borrows 80 ETH, stakes that too, and keeps looping. When ETH borrow rates are low, this can multiply staking yields.

But once borrowing costs jumped past 10%, the loop broke down. That forced loopers to unwind, flood the market with stETH, and push its price slightly below Ethereum.

全部评论0最新最热

暂无记录