Zoye

07/23 22:30

S&P 500 inclusions lead to more BTC exposure The

S&P 500 inclusions lead to more BTC exposure

The S&P 500 index accounted for $50 trillion in market capitalization as of the end of first quarter of 2025. By buying into an exchange-traded fund or other instrument that tracks the S&P 500, investors gain exposure to a wide variety of industries, including, now, crypto.

In a Wednesday X post, OnlyCalls wrote, “Institutional entrance solidifies BTC's financial visibility. Expect more conservative entities to consider BTC as a viable treasury asset.”

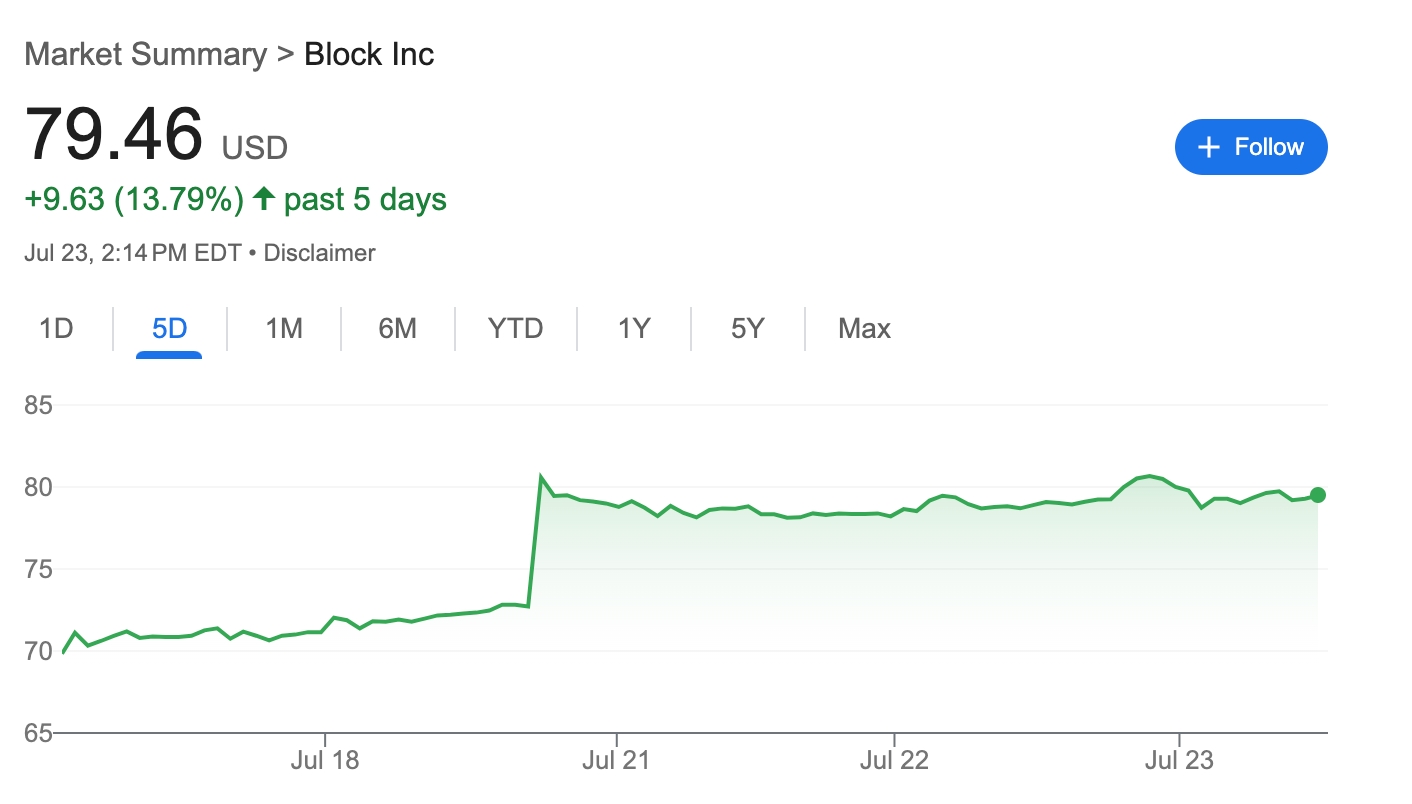

Block is replacing Hess Corp, a US energy company that is dropping out after its $55 billion merger with energy conglomerate Chevron.

Coinbase, Tesla stock performances

The other two companies with significant Bitcoin holdings that have landed in the S&P 500 are Coinbase and Tesla. Coinbase holds 9,267 BTC worth about $1.1 billion at time of publication. Tesla holds 11,509 BTC worth $1.4 billion.

Coinbase’s share price has risen 28.4% over the past month, according to Google Finance. That’s a steeper rise than the overall crypto market, which has jumped 23% in the past 30 days, according to CoinGecko.

Tesla’s share price has fallen 4.6% in the past month, though it may be linked less to the crypto market and more to its fundamentals and operations.

全部评论0最新最热

暂无记录