Institutional investors are quietly reshaping the narrative around XRP, with the latest analysis report from the billion-dollar asset manager WisdomTree confirming what insiders have long suspected. According to the report, XRP is garnering institutional interest and demand on a global scale. While retail traders debate short-term price movements, smart money capital inflows into XRP are surpassing those of almost every other altcoin.

XRP Dominates Institutional Inflows Across Europe And The Globe

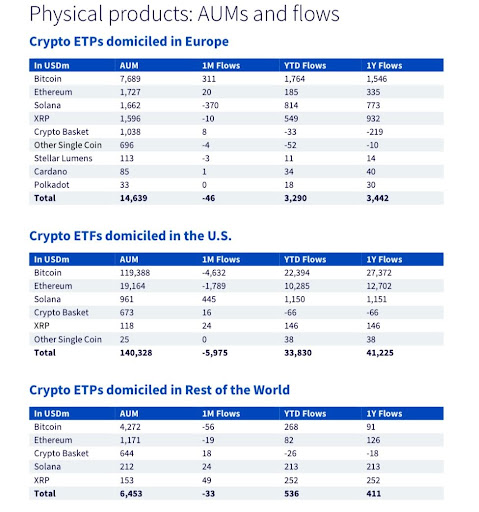

According to an X post by crypto expert Stern Drew, the latest WisdomTree report shows that XRP is the only digital asset attracting consistent institutional demand worldwide. In Europe, XRP has attracted over $549 million in new institutional capital this year, more than three times the inflows into Ethereum. This figure surpasses the total for every altcoin in the market and multi-asset products except Bitcoin.

In a continent traditionally known for conservative investment strategies, these flows into XRP represent a decisive vote of confidence from European institutional investors. Drew has revealed that the demand for XRP has also extended beyond Europe. Outside the United States, XRP has captured roughly $252 million in fresh institutional capital just this year.

By comparison, Bitcoin products absorbed only $268 million in smart money capital. Given that BTC products are more than 25 times the size of XRP products, this suggests that institutions have directed nearly 25 times more new capital into XRP than into Bitcoin. Drew has suggested that this increase in flows indicates careful, deliberate positioning rather than short-term speculative activity, which highlights the market’s growing preference for XRP.

US Adoption Signals Broader Shift

In his post, Drew also revealed the growing institutional interest in XRP within the US. This year, a new synthetic XRP product attracted $241 million, surpassing flows into Solana and all other altcoin products in the same category. This surge came at a time when the two largest cryptocurrencies, Bitcoin and Ethereum, collectively saw $6.4 billion exit their ETF structures.

Drew revealed that the dramatic outflows from BTC and ETH signaled that institutional investors were diversifying from established assets while selectively accumulating XRP. The WisdomTree report also showed that, excluding Europe and the US, regions such as Asia and other global markets are increasing their exposure to XRP.

Surprisingly, this surge in global institutional demand is occurring during periods of market stress rather than euphoric rallies. The XRP price is currently down by more than 15% this year and trading at just $2.1. The cryptocurrency has also been experiencing significant choppy action over the past few months, failing to reclaim former highs above $3.

Despite this structural weakness, institutions continue to accumulate XRP in large quantities, indicating a clear bias toward the cryptocurrency. Drew has also revealed that smart money views XRP as a settlement-grade asset, well-suited for integration into the future architecture of regulated digital finance. He highlights that, as global institutional preference increasingly concentrates on XRP, price movements might follow later.