Ethereum is holding above the $3,000 level for the fourth consecutive day as the market enters a decisive week dominated by the upcoming FOMC meeting. Traders are cautiously positioning ahead of the Federal Reserve’s announcement, aware that liquidity signals and rate expectations could determine whether this recovery continues—or breaks down.

Despite the recent stabilization, fear remains firmly in control. Many analysts warn that if ETH loses the $3K floor, the market could face a deeper retracement, especially with volatility expected to spike around the macro event.

Amid this uncertainty, on-chain data from Lookonchain has revealed a striking development: BitcoinOG, the same whale who famously shorted the market during the violent October 10 crash, has now dramatically increased his bullish exposure to Ethereum. According to the data, he has ramped up his long position to 67,103.68 ETH, valued at approximately $209.8 million.

Whale Positioning Adds a New Layer of Volatility

According to Lookonchain, the BitcoinOG whale is now sitting on more than $4 million in unrealized profit from his massive Ethereum long. His position of 67,103.68 ETH, currently valued at over $209 million, comes with a liquidation price of $2,069.49, a level far below current market conditions but still within the realm of possibility if macro pressure intensifies.

This liquidation threshold is especially important because it reveals the whale’s risk appetite and how aggressively he’s leveraging this bet. A liquidation level near $2,070 implies confidence that Ethereum won’t revisit its deeper range lows, even as the market remains fragile ahead of the FOMC meeting. It also shows he has a significant margin buffer behind the trade, suggesting strategic positioning rather than impulsive speculation.

However, large leveraged positions can act as double-edged swords for the broader market. If price begins trending toward his liquidation zone, cascading liquidations across other longs could accelerate downside momentum. Conversely, whales with deep pockets often defend key levels to protect their positions.

ETH Higher-Timeframe Trend Remains Fragile

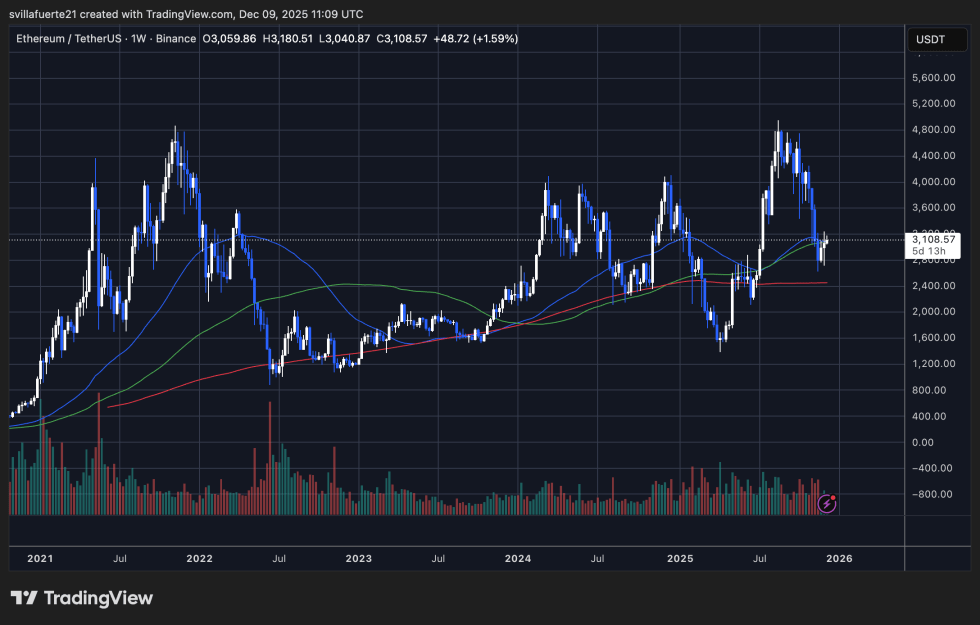

Ethereum’s weekly chart shows the market fighting to stabilize above the $3,000–$3,150 zone, a level that now acts as the primary support band after weeks of heavy selling. The recent bounce from the mid-$2,700s has created a short-term relief structure, but ETH still trades well below its 50-week moving average, which is beginning to curl downward—a signal that the broader trend is losing momentum.

The chart highlights a clear pattern: each rebound over the past six months has produced lower highs, reflecting persistent seller dominance whenever ETH approaches the $3,500–$3,800 region. This repeated rejection zone marks a key resistance cluster that bulls must reclaim to shift the medium-term outlook back toward bullish continuation.

Volume also remains relatively muted compared to earlier stages of the cycle, suggesting that current buying interest is hesitant. Without a surge in spot demand, rallies may continue to fade quickly.

On the positive side, ETH has reclaimed the 200-week moving average, an important long-term support that historically acts as a pivot between macro bull and bear phases. As long as this level holds, Ethereum retains structural strength.

ETH is in a neutral-to-bearish consolidation, and a decisive weekly close above $3,300 is needed to confirm regained momentum.

Featured image from ChatGPT, chart from TradingView.com