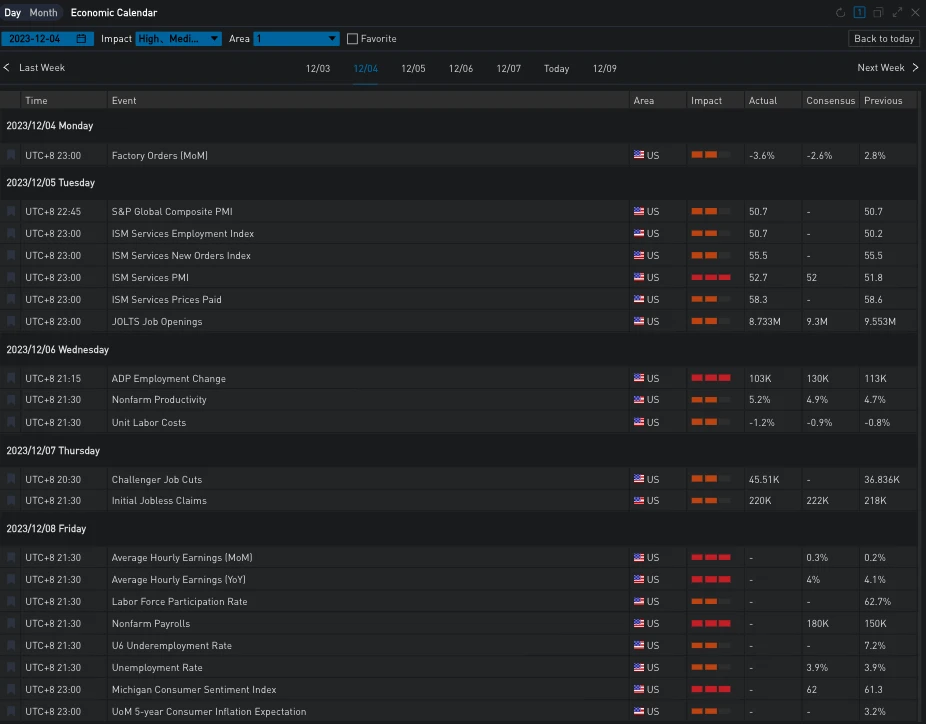

昨日(7 Dec)美国 12 月 2 日当周初请失业金人数录得 220 K,略低于预期 222 K,美债收益率先跌后涨,两年/十年期收益率分别报 4.622% 和 4.175% ,美国三大股指集体收涨,道指/标普/纳指分别收涨 0.18% /0.8% /1.37% 。今晚市场将迎来本周重磅数据非农就业指数,敬请留意相关风险。

Source: SignalPlus, Economic Calendar

Source: SignalPlus & TradingView

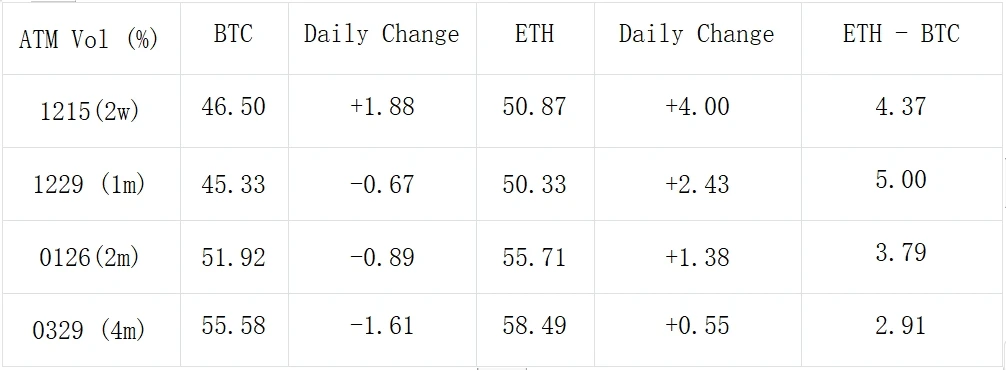

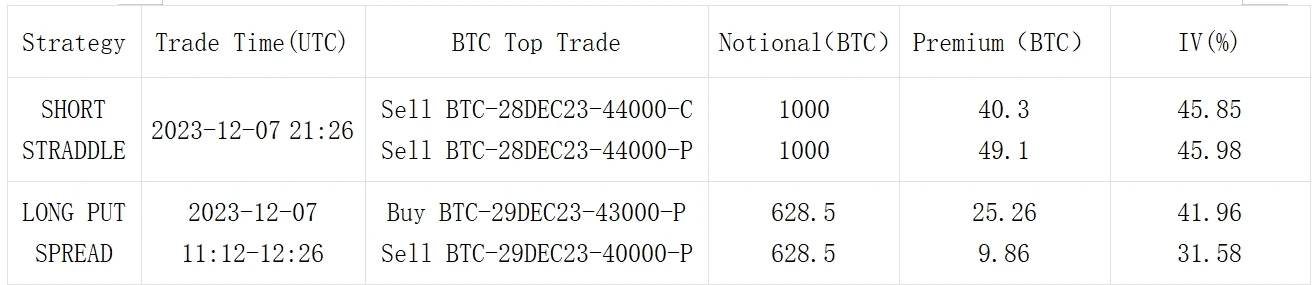

数字货币方面,BTC 还在 43000 支撑位上方坚守,ETH 则继续乘势向上触摸 2400 美元大关。两者价格上截然不同的走势也反应到了期权市场的变化上,具体来看,BTC IV 再度受 RV 拖累下滑,成交量也是大幅回落, 29 Dec 上一组 Short 44000 Straddle 以单腿高达 1000 BTC 的数量强势表达了看跌年底波动率的观点,同时该到期日上也有大量 43000 vs 40000 的保护性看跌价差成交;另一方面,受价格提振,ETH 呈现出截然不同的表现, 29 Dec 上 2400 的 Long Straddle 成交量达到 18000 组,同时 15 Dec 和 29 Dec 两个到期日上 2400 至 2800 行权价的看涨期权在大宗和 Deribit 散户平台上均有大量建仓购入,不仅抬高了这段的隐含波动率水平,也让 ETH 中前端的 Vol Skew 反弹回到高位。

Source: Deribit (截至 8 DEC 16: 00 UTC+ 8)

Source: SignalPlus

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

您可在 ChatGPT 4.0 的 Plugin Store 搜索 SignalPlus ,获取实时加密资讯。如果想即时收到我们的更新,欢迎关注我们的推特账号@SignalPlus_Web3 ,或者加入我们的微信群(添加小助手微信:xdengalin)、Telegram 群以及 Discord 社群,和更多朋友一起交流互动。

SignalPlus Official Website:https://www.signalplus.com