Digital asset investment company CoinShares predicts that the surge in tokenized real-world assets (RWAs) in 2025 will continue into 2026, driven by increasing global demand for dollar yield.

In its 2026 Digital Asset Outlook report, CoinShares said tokenized RWAs saw strong growth in 2025, led by tokenized US Treasurys. According to the report, onchain Treasurys more than doubled this year, climbing from $3.91 billion to $8.68 billion. Private credit nearly doubled as well, rising from $9.85 billion to $18.58 billion over the same period.

“Tokenisation has materially moved beyond the longtime narrative of crypto enthusiasts,” CoinShares digital asset analyst Matthew Kimmell said. “Real assets, issued by reputable firms, receiving material investment. Even real regulators engage with crypto rails as credible infrastructure.”

Ethereum remains the most dominant network for tokenized US Treasurys. Data from RWA.xyz showed that as of Monday, Ethereum has over $4.9 billion in US Treasurys tokenized in the blockchain.

US Treasurys are the most “immediate” growth vector

CoinShares expects US government debt-backed products to lead the next leg of expansion in 2026, citing global demand for dollar yield and the efficiency of crypto-based settlement rails.

CoinShares said investors tend to prefer holding Treasurys over stablecoins when yield is available with minimal incremental risk.

“We’ve observed stablecoins demonstrating significant global demand for tokenised dollars as both a reserve and transactional asset,” CoinShares wrote. “Yet, when investors, as opposed to transactors, have the option, they generally prefer to hold Treasurys over holding dollars directly.”

CoinShares also argued that RWA tokenization has already moved beyond a niche experiment by crypto enthusiasts.

The company said that as established financial firms issue these assets, it attracts material capital and draws engagement from regulators who increasingly view blockchain as credible infrastructure.

The company also added that efficiency improvements are no longer theoretical. CoinShares said that settlement, issuance and distribution are starting to happen directly onchain, rather than through legacy custodial processes.

CoinShares expects the shift to continue, though not without competitive tension. According to the company, multiple networks and settlement systems are vying for market share. As a result, it remains uncertain which platforms will emerge victorious and how liquidity will consolidate.

Related: Hua Xia state-linked Chinese bank tokenizes $600M in yuan bonds

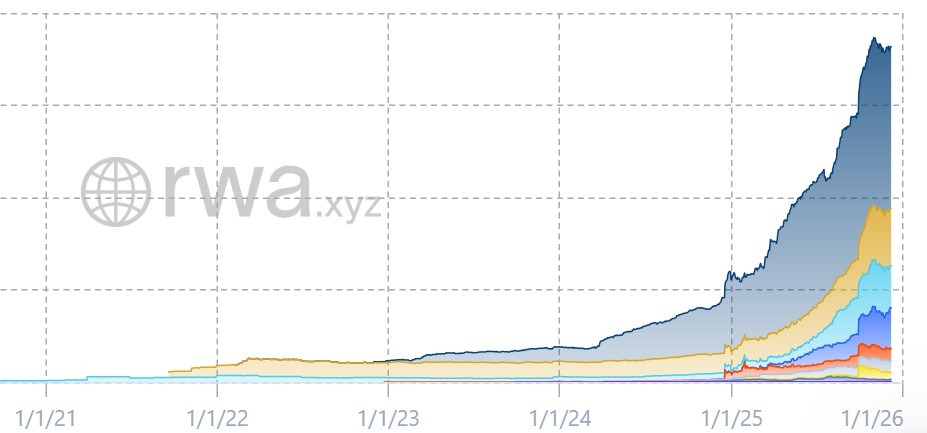

Tokenized RWAs grew 229% in 2025

RWA.xyz data showed that excluding stablecoins, which have a market capitalization of over $300 billion, RWAs grew from $5.5 billion on Dec. 31, 2024, to $18.1 billion at the time of writing. This represents a 229% growth in nearly a year.

CoinShares CEO Jean-Marie Mognetti said digital assets are no longer operating outside the traditional economy. He said they are embedded within it.

“If 2025 was the year of the graceful return, 2026 looks positioned to be a year of consolidation into the real economy,” he said.

Magazine: Koreans ‘pump’ alts after Upbit hack, China BTC mining surge: Asia Express