PNC Bank has begun offering direct spot Bitcoin trading to eligible private bank clients, becoming the first major US bank to enable buy, hold and sell functions inside its own digital platform.

According to a Tuesday release, the launch marks the first phase of PNC’s partnership with Coinbase. Announced in July, the collaboration is supported by Coinbase’s Crypto-as-a-Service trading and custody stack.

PNC Private Bank serves high- and ultra-high-net-worth individuals, families, family offices and business owners. The bank plans to expand access to additional client groups and add more capabilities over time.

According to Federal Reserve data, PNC ranks as the eighth-largest commercial bank in the US, with about $564 billion in assets and more than 2,300 branches across the country.

While several major US banks have expanded their crypto offerings this year, most are targeting custody services or investment products, such as exchange-traded funds (ETFs).

On Dec. 2, Bank of America said that beginning next year, it will allow its wealth management clients to access four Bitcoin ETFs issued by Bitwise, Fidelity, Grayscale and BlackRock.

The ETFs provide investors with exposure to the Bitcoin (BTC) price through a regulated fund that trades on stock exchanges, without the need to buy and hold the digital asset directly.

Related: 21Shares taps Standard Chartered for custody as TradFi tightens grip on crypto

Wealthy clients are increasingly attracted to crypto

As crypto adoption becomes more mainstream, asset managers and crypto exchanges are expanding services to wealthy clients.

In June, JPMorgan announced that it would allow its trading and wealth-management clients to use crypto ETFs as collateral for loans. The bank also said it would begin factoring clients’ crypto holdings into assessments of their overall net worth.

Binance recently introduced a concierge-style service for family offices, asset managers and private funds entering the crypto market.

Crypto allocations are also rising in Hong Kong, mainland China and Singapore, with some planning to put about 5% of their portfolios into digital assets. Wealth managers in the region reported that client inquiries are increasing and new cryptocurrency funds are generating strong interest.

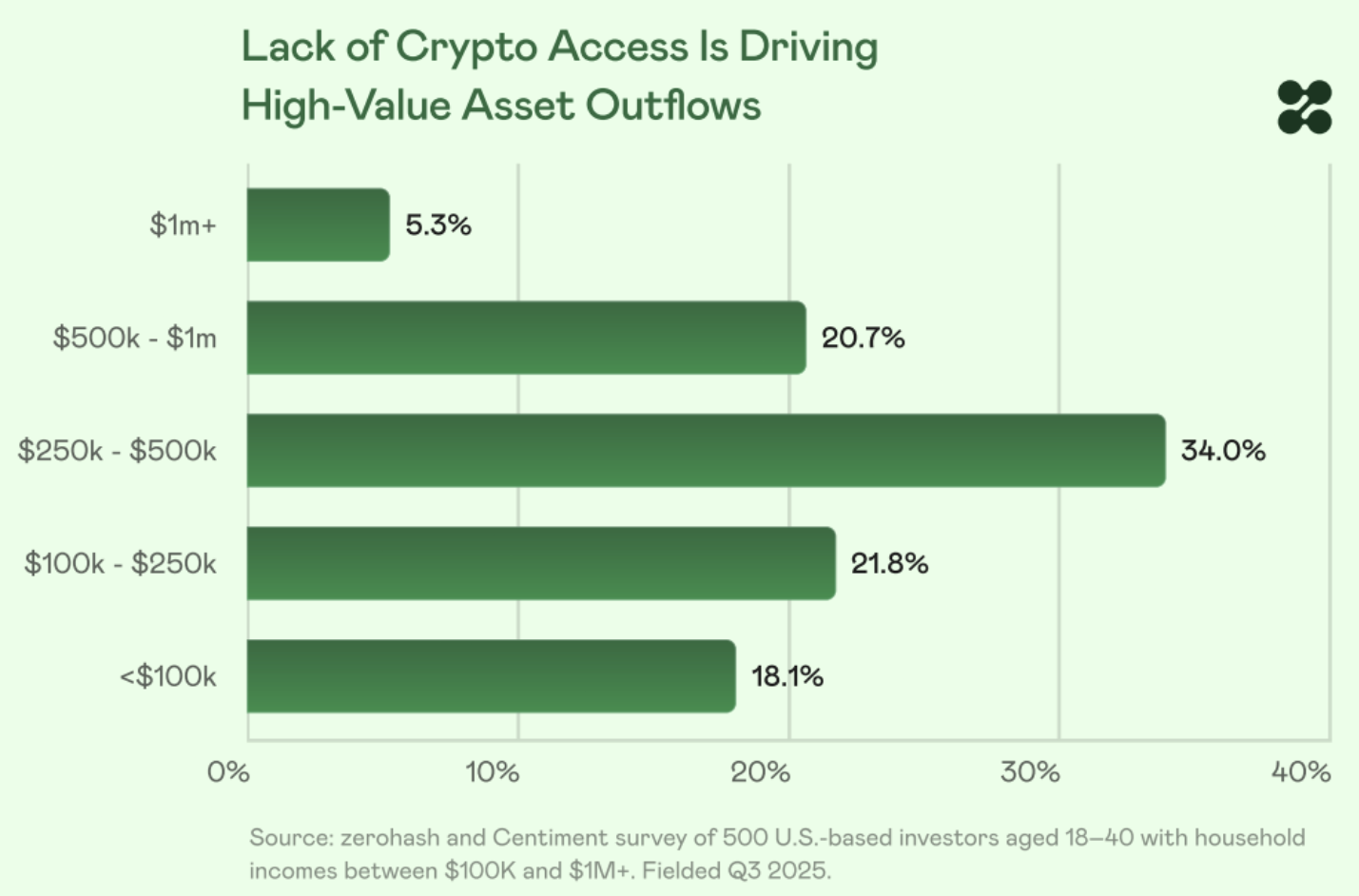

The growing demand for cryptocurrency among wealthy investors is reshaping the financial-adviser market. A Zerohash survey of 500 US investors aged 18 to 40 conducted in November found that 35% moved money away from advisers who didn’t offer crypto access.

Magazine: Quantum attacking Bitcoin would be a waste of time: Kevin O’Leary