Author: Zhang Yaqi

Source: Wall Street News

As the Federal Reserve's December 10th policy meeting approaches, the market is not only focused on the widely anticipated interest rate cut but also on a potential major balance sheet expansion plan, according to senior Wall Street strategists.

Recently, Mark Cabana, a former New York Fed repo expert and now a rates strategist at Bank of America, predicted that, in addition to the widely expected 25 basis point rate cut, Fed Chair Jerome Powell will announce a plan next Wednesday to purchase $45 billion per month in Treasury bills (T-bills). This bond-buying operation is set to be implemented in January 2026, aiming to inject liquidity into the system and prevent a further surge in repo market rates.

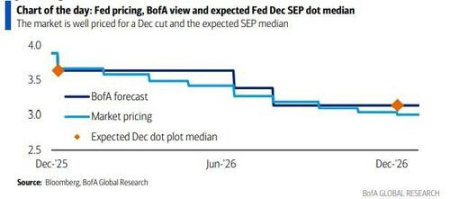

Cabana warned in a report that while the interest rate market has reacted tepidly to the rate cut, investors are generally "underestimating" the scale of the Fed's actions regarding its balance sheet. He pointed out that current money market rates indicate that reserves in the banking system are no longer "abundant," and the Fed must restart purchases of securities to fill the liquidity gap. Meanwhile, UBS's trading desk has made a similar prediction, expecting the Fed to begin purchasing about $40 billion in Treasury bills per month starting in early 2026 to maintain stability in the short-term interest rate market.

This potential policy adjustment comes at a critical time of impending leadership transition at the Fed. With Powell's term nearing its end and market expectations rising that Kevin Hassett might succeed him as Fed Chair, next week's meeting is not only about short-term liquidity but will also set the tone for the monetary policy path in the coming year.

Former New York Fed Expert Predicts: $45 Billion Monthly Purchases

Although market consensus is locked in on a 25 basis point rate cut next week, Mark Cabana believes the real variable lies in balance sheet policy. In his weekly report titled "Hasset-Backed Securities," he noted that the size of the RMP (Reserve Management Purchases) the Fed is likely to announce could be as high as $45 billion per month, a prediction that significantly exceeds current general market expectations.

Cabana detailed the composition of this figure: the Fed needs to purchase at least $20 billion monthly to cope with the natural growth of its liabilities, plus an additional $25 billion to reverse the reserve drain caused by previous "excessive quantitative tightening." He expects purchases of this magnitude to continue for at least 6 months. This announcement is expected to be included in the Fed's implementation note, with detailed operation sizes and frequency published on the New York Fed's website, focusing purchases on the Treasury bill market.

As previously reported by Wall Street News, since the balance sheet peaked at nearly $9 trillion in 2022, the Fed's quantitative tightening (QT) policy has reduced its size by approximately $2.4 trillion, effectively draining liquidity from the financial system. However, even with QT halted, signs of funding stress remain evident.

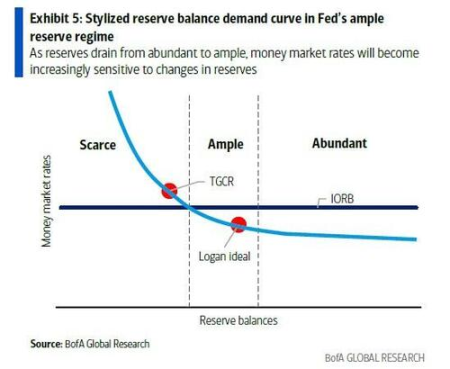

The clearest signals come from the repo market. As the short-term financing hub of the financial system, overnight reference rates in the repo market, such as the Secured Overnight Financing Rate (SOFR) and the Tri-Party General Collateral Rate (TGCR), have frequently and sharply breached the upper limit of the Fed's policy rate corridor in recent months. This indicates that reserve levels in the banking system are sliding from once "abundant" to "ample," with a risk of further moving towards "scarce." Given the systemic importance of the repo market, this situation is considered intolerable for the Fed in the long term, as it could weaken the transmission efficiency of monetary policy.

Against this backdrop, recent comments from Fed officials have also hinted at the urgency for action. New York Fed President John Williams stated that "we expect to reach ample reserve levels before long," while Dallas Fed President Lorie Logan noted that "I expect it will be appropriate to resume balance sheet growth before long." Cabana interprets "before long" as referring to the December FOMC meeting.

Auxiliary Tool Aimed at Smoothing Year-End Volatility

In addition to the long-term purchase plan, to address the impending year-end funding volatility, Bank of America also expects the Fed to announce term repo operations lasting 1-2 weeks. Cabana believes the pricing for these operations could be set at par with or 5 basis points above the Standing Repo Facility (SRF) rate, aiming to trim tail risks in the year-end funding market.

Regarding administered rates, although clients have inquired about the possibility of lowering the Interest on Reserve Balances (IORB), Cabana believes that simply cutting IORB "solves nothing," as banks generally prefer to hold higher cash buffers following the Silicon Valley Bank (SVB) collapse. He thinks it's more likely that the IORB and SRF rates could be cut synchronously by 5 basis points, but this is not the base case scenario.

Another important context for this meeting is the upcoming personnel changes at the Fed. The market currently views Kevin Hassett as a strong contender for the next Fed Chair. Cabana pointed out that once the new chair is confirmed, the market will price the medium-term policy path more based on guidance from the new appointee.

UBS also agrees with the view that balance sheet expansion is returning. UBS's sales and trading desk noted that by purchasing Treasury bills, the Fed can shorten the duration of its assets, thereby better matching the average duration of the Treasury market. Whether this operation is called RMP or quantitative easing (QE), its ultimate goal is clear: through direct liquidity injection, to ensure the financial market can maintain smooth operation during this critical period of political and economic transition.