Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

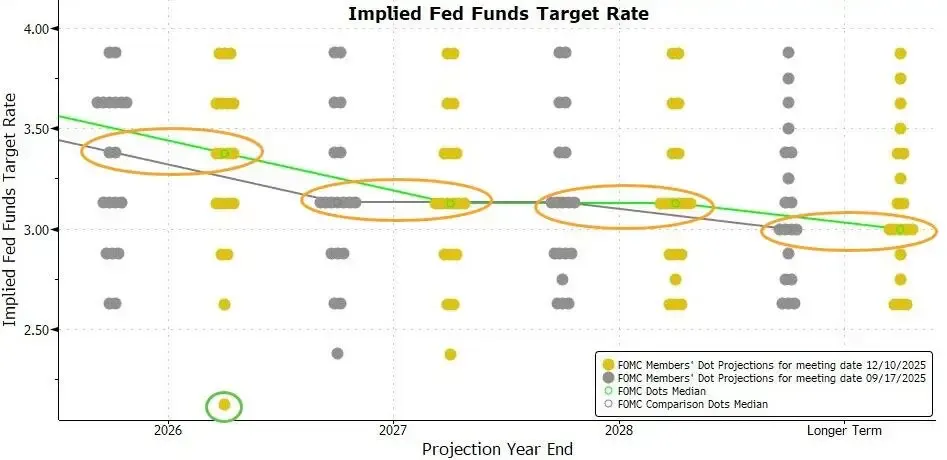

Early this morning, Powell announced as scheduled a 25 basis point cut in the benchmark interest rate to 3.50%-3.75%. This marks the third consecutive rate cut this year, concluding the year with a cumulative reduction of 75 basis points. However, the signals from the dot plot are not entirely optimistic, reflecting intense internal debate within the Fed. Although the overall expectations are slightly more dovish compared to the last meeting, the internal consensus is loosening: this time, as many as 7 officials dissented from the decision, with 6 even favoring no change (maintaining the current rate). Additionally, the median interest rate forecast remains exactly the same as in September, suggesting that after this year's aggressive cuts, the pace of easing in the next two years will slow significantly (likely only one cut each year). This complex, "hawkish-dovish" mixed signal and the extremely cautious expectations do not seem to have provided the market with sufficient confidence to go long. Consequently, the crypto market, dominated by risk speculation, is shrouded in fear, experiencing a continuous decline.

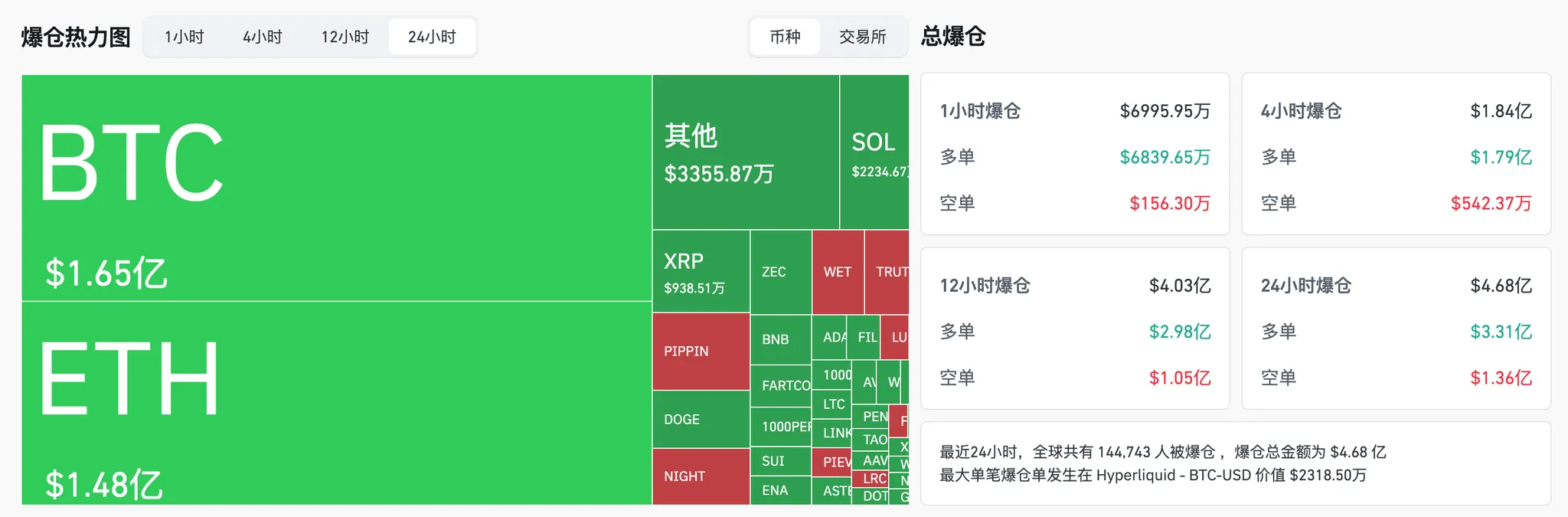

OKX real-time data shows that around 11:40 today (all subsequent times refer to this point), BTC fell to a low below $90,000, temporarily reported at $89,790.5, a 2.45% drop in 24 hours, breaking below the $90,000 mark; ETH fell below $3,200, currently at $3,181.24, down 4.47% in 24 hours; SOL dropped below $130, currently at $129.5, down 4.88% in 24 hours.

According to SoSoValue, various sectors of the crypto market generally pulled back, with the DePIN sector leading the decline, down 4.28% in 24 hours, where Filecoin (FIL) fell 7.50% and Render (RENDER) dropped 5.52%. In other sectors, the CeFi sector fell 1.00% in 24 hours, with Cronos (CRO) down 3.39%; the Layer2 sector declined 2.15%, but Mantle (MNT) held relatively firm, up 1.12%; the DeFi sector fell 2.35%, while Hyperliquid (HYPE) bucked the trend, rising 2.95%; the Layer1 sector dropped 2.54%, with previously strong performer Zcash (ZEC) falling 10.78%.

In the U.S. stock market, according to msx.com data, as of the close, the Dow rose 1.05%, the S&P 500 gained 0.67%, and the Nasdaq increased by 0.33%. Crypto-related stocks mostly fell, with ETHZ down over 8.1%, HODL down over 6.39%, and ABTC down over 5.37%.

In derivatives trading, Coinglass data shows that over the past 24 hours, there was $468 million in liquidations across the network, with long positions accounting for $331 million and short positions $136 million. By cryptocurrency, BTC saw $165 million in liquidations, and ETH $148 million.

Market sentiment is being released, and the downturn continues. Discussions about whether "expectations are exhausted and the market is weak" are heating up.

Below, Odaily Planet Daily will summarize the views and arguments of institutions and analysts regarding the future market trend.

What will be the subsequent trend of Bitcoin?

Greeks.live: Year-end liquidity drying up, limited momentum for restarting the bull market

Adam, a researcher at Greeks.Live, posted on social media, stating that the Fed's interest rate meeting cut rates by 25 basis points as expected and announced the restart of a $40 billion short-term U.S. Treasury bill (T-bills) purchase plan; its dovish stance will effectively supplement the financial system's liquidity, constituting a clear positive for the market.

However, it is still too early to talk about "restarting quantitative easing (QE) to drive a bull market restart": with Christmas and year-end settlements approaching, this period has historically been the worst for crypto market liquidity, with low market activity and very limited momentum for a bull market restart.

Looking at cryptocurrency options data, over 50% of option positions are accumulated by the end of December, with BTC's max pain point at the $100,000 integer mark and ETH's at $3,200; the implied volatility (IV) for major tenors has declined across the board this month, indicating a continued decrease in market expectations for volatility this month.

In summary, the current crypto market performance is weak, pressured by year-end liquidity and low market sentiment; "slow decline" is the mainstream expectation in the options market. However, one must also be wary of potential sudden positive news that could trigger a market reversal.

ING: Improved inflation environment, maintaining forecast for two rate cuts in 2026

ING Bank stated that the market currently expects the Fed to cut rates by another 50 basis points in 2026.

However, considering the current situation—the economy continues to grow, unemployment is low, the stock market is near historical highs, and inflation is closer to 3% than the Fed's 2% target—there is insufficient justification for the Fed to further ease policy. Nevertheless, the bank suspects that the inflation environment in the coming months will be more conducive to rate cuts, providing support for further dovish action: although tariff threats remain, their impact is slower and weaker than expected, buying more time for factors easing inflation such as falling energy prices, slowing rental growth, and weakening wage increases; the bank believes this will push inflation closer to 2% faster than the Fed expects.

Coupled with rising uncertainty in the "employment" dimension of the Fed's dual mandate—Powell mentioned that the Fed believes recent employment growth data has been overestimated by about 60,000 people—ING Bank maintains its original forecast that the Fed will cut rates twice in 2026, by 25 basis points each in March and June.

Goldman Sachs: Pacifying the hawkish camp, the threshold for future easing is significantly raised

Goldman Sachs analyst Kay Haigh stated that the Fed has completed this round of "preemptive rate cuts." She noted: "To justify additional near-term easing, the core prerequisite is that labor market data must weaken further."

The "hard dissent" among voting members and the "soft dissent" in the "dot plot" both highlight the hawkish camp within the Fed; the reintroduction of wording about the "extent and timing" of future policy decisions in the statement was likely to pacify this camp. This adjustment, while preserving the possibility of future rate cuts, means that a relatively high degree of labor market weakness would be required to trigger a new round of easing.

Analyst: Policy statement "dovish on the surface, hawkish underneath," expects 100 basis points of cuts next year

Analyst Anna Wong stated: "My assessment is that this policy statement and the updated forecasts are overall dovish in tone, though with some hawkish signals隐含. On the dovish side, the Committee significantly upgraded the economic growth path, lowered the inflation outlook, and kept the 'dot plot' forecast unchanged; the FOMC also announced the start of reserve management purchase operations."

"On the other hand, one signal in the policy statement indicates the Committee's inclination towards a prolonged pause in the rate-cutting cycle." She added: "Although the 'dot plot' shows only one rate cut in 2026—differing from the market's expectation of two—we believe the Fed will ultimately cut rates by a cumulative 100 basis points next year. The core basis is that we expect wage growth to remain weak and currently see no clear signs of inflation reigniting in the first half of 2026."

Summary

Although the Fed cut rates as expected this morning, the internal divisions and slowed easing expectations revealed by the "dot plot" have subjected the market to a complex "hawkish-dovish" mixed signal. BTC breaking below the $90,000 mark and over $300 million in long liquidations indicate that, in the absence of incremental funds, the "realization of the rate cut" alone can no longer掩盖 the reality of year-end liquidity drying up.

Institutions generally believe that in the short term, constrained by the Christmas holiday and year-end settlements, market activity will decline significantly. "Slow decline" and "defense" are likely to be the main themes year-end, with very limited momentum to restart the bull market. However, looking further ahead, the focus of contention has shifted from单纯 inflation data to the performance of the labor market. Although institutions like Goldman Sachs提示 that the threshold for future easing has been raised, if wage growth weakens or employment data deteriorates further next year, the market could still迎来 a more aggressive rate-cutting path than expected. For investors,盲目 bottom-fishing is not the optimal strategy before liquidity returns and macro signals become clearer.