Bitcoin Returns Above $94,000: Is the BTC Bull Market Restarting?

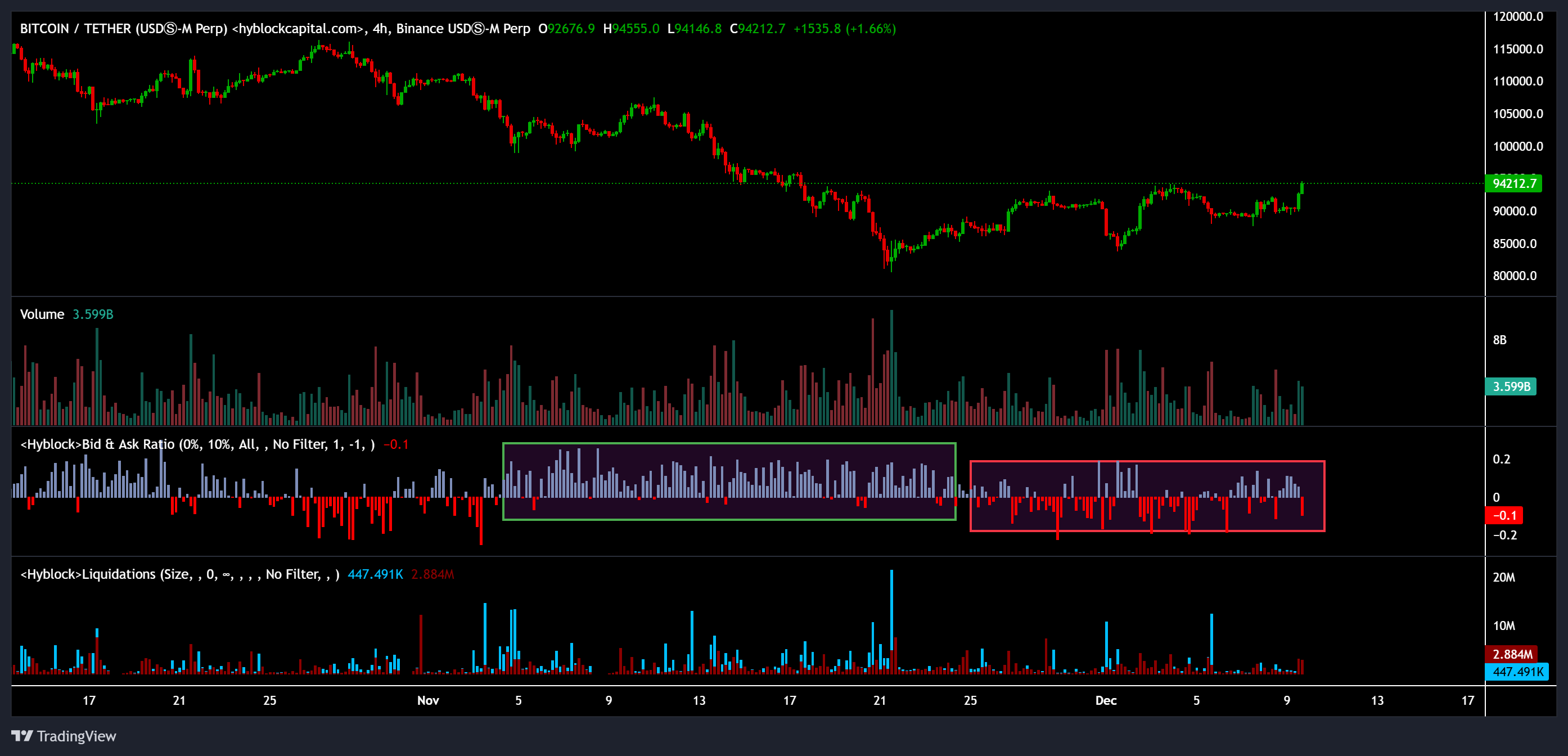

Bitcoin bulls have recaptured the key $94,000 level, but BTC trading volume data casts doubt on the sustainability of this rally. Market focus shifts to whether the bulls can provide the necessary sustained momentum.

Bitcoin bulls appear to have regained control of the short-term market trend, pushing the BTC price above $94,000, although underlying liquidity indicators are still sending warning signals.

Key Points:

BTC successfully recaptured $94,000, significantly strengthening the short-term bullish structure after days of uncertainty.

Despite the price breakout, buy-sell order book liquidity remains in a low and confused state, indicating buyers are gradually entering the market but the scale has not yet reached a sufficient level.

BTC Maintains Upward Momentum Ahead of FOMC Meeting

After its initial structural breakout on December 3rd, BTC struggled to achieve a decisive daily close above $93,000. As the broader market prepared for the upcoming FOMC meeting, traders widely adopted a wait-and-see attitude, leading to several days of sideways consolidation.

This situation changed on Tuesday, with the BTC price clearly breaking through the $93,500关口, forming the higher highs needed to restore short-term bullish momentum.

On the 4-hour chart, BTC had previously absorbed the entire Fair Value Gap (FVG) between $87,500 and $90,000 but failed to trigger a subsequent uptrend. This breakout broke the previous hesitation and showed that despite macroeconomic event volatility, Bitcoin is regaining strength.

Even if an upward reversal occurs, BTC is still hovering near the monthly Volume Weighted Average Price (VWAP) on the 4-hour and daily time frames. If it can remain steadily above the monthly VWAP after the FOMC meeting, it will further confirm this momentum-supported trend reversal.

Trader Jelle pointed out when commenting on the recent sideways trend:

"The market is currently quite tasteless, $BTC is still oscillating near the monthly open... Need to watch if lower lows appear below 87.6k, or if a clear breakout occurs in the $93k gray area."

With the $93,000关口 successfully broken before the FOMC meeting, the market is biased towards an upward trend, although traders may still remain highly alert to any post-meeting volatility.

BTC Price Rises But Liquidity Issues Remain Unresolved

Although the BTC price shows a bullish trend, liquidity indicators do not yet show full market confidence. BTC's bid-ask spread ratio remains at a relatively low level with unstable fluctuations. During the sharp drop from $100,000 to $80,000 in November, this ratio turned positive as large buy orders absorbed selling pressure. However, professional analysts point out that the current rebound does not show the same active buying momentum, indicating that the breakout above $93,500 is mainly price-driven, while new demand is still gradually following up.

This phenomenon highlights the current market state: although buyers are acting, they are not showing the large-scale, determined concentrated buying pattern typical of a strong upward trend. Currently, price strength明显exceeds market depth strength.

BTC exchange premium data同样reveals a more complex market situation.

As an important indicator of retail investor sentiment, the Korean premium index has significantly cooled. Earlier this year, the Korean market often traded at a premium during the uptrend; however, market research shows that this enthusiasm has receded to near par or slightly negative levels, indicating that retail speculators have not actively chased this round of gains.

At the same time, the Coinbase premium index, which serves as a gauge for US investor sentiment, has turned positive. Historically, small increases usually预示the initial现货absorption during a trend reversal.

Related recommendation: Bitcoin Hash Ribbon indicator flashes "buy" signal at the $90,000 level: Will the BTC price rebound?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages arising from your reliance on this information.