Australia’s securities regulator has finalized exemptions that will make it easier for businesses to distribute stablecoins and wrapped tokens.

The Australian Securities and Investments Commission (ASIC) announced the new measures on Tuesday, aimed at fostering innovation and growth in the digital assets and payment sectors.

It stated that it was “granting class relief” for intermediaries engaging in the secondary distribution of certain stablecoins and wrapped tokens.

This means that companies no longer need separate, and often expensive, licenses to act as intermediaries in these markets, and they can now use “omnibus accounts” with proper record-keeping.

The new exemptions extend the earlier stablecoin relief by removing the requirement for intermediaries to hold separate Australian Financial Services (AFS) licenses when providing services related to stablecoins or wrapped tokens.

Leveling the playing field for stablecoin issuers

The regulator stated that these omnibus structures were widely used in the industry, offering efficiencies in speed and transaction costs, and helping some entities manage risk and cybersecurity.

“ASIC’s announcement helps level the playing field for stablecoin innovation in Australia,” said Drew Bradford, CEO of Australian stablecoin issuer Macropod.

“By giving both new and established players a clearer, more flexible framework, particularly around reserve and asset-management requirements, it removes friction and gives the sector confidence to build,” he continued.

Related: Australia risks ‘missed opportunity’ by shirking tokenization: top regulator

The old licensing requirements were costly and created compliance headaches, particularly for an industry awaiting broader digital asset reforms.

“This kind of measured clarity is essential for scaling real-world use cases, payments, treasury management, cross-border flows, and onchain settlement,” added Bradford.

“It signals that Australia intends to be competitive globally, while still maintaining the regulatory guardrails that institutions and consumers expect.”

Angela Ang, head of policy and strategic partnerships at TRM Labs, also welcomed the development, stating, “Things are looking up for Australia, and we look forward to digital assets regulation crystallizing further in the coming year – bringing greater clarity to the sector and driving growth and innovation.”

Global stablecoin growth surges

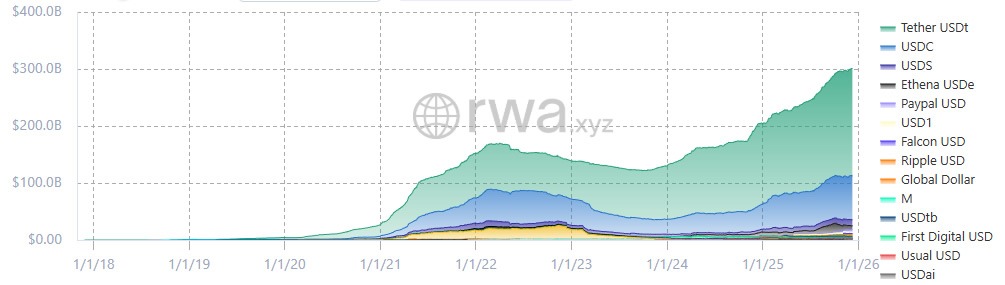

Total stablecoin market capitalization is at a record high of just over $300 billion, according to RWA.xyz.

It has grown by 48% since the beginning of this year, and Tether remains the dominant issuer with a 63% market share.

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest