Ripple CEO Brad Garlinghouse used a Davos stage at the World Economic Forum’s 2026 annual meeting to make a pragmatic case for tokenization: stablecoins are already the lead use case, momentum has shifted sharply in the US, and the industry’s job now is to deliver measurable benefits rather than tokenize assets for novelty.

Why Ripple Is Building Bridges Between TradFi and DeFi

Garlinghouse’s remarks came on a panel titled “Is Tokenization the Future?” after the moderator cited Ripple-linked traction: tokenized assets on the XRP Ledger surged more than 2,200% last year. From there, Garlinghouse largely aligned with the panel’s theme that tokenization is moving from pilots toward mainstream financial plumbing, while drawing a clear boundary around monetary sovereignty.

“I do think the first poster child of tokenization is really stablecoins,” Garlinghouse said, arguing that usage growth has been decisive. He cited stablecoin transaction volumes rising from “$19 trillion of transactions on stablecoins in 2024” to “33 trillion in 2025,” describing that as “about 75% growth” and adding that “many in our industry would say that’s going to continue.”

Where the discussion turned to a “Bitcoin standard” framing, Garlinghouse emphasized the political reality of state money. “Sovereignty of fiat currencies, I believe, is for many countries sacrosanct,” he said, before invoking a line he attributed to Ben Bernanke from a prior Ripple event: “Governments will roll tanks into the street before giving up monetary supply, giving up the control of monetary supply, which stuck with me as yeah, that makes sense.”

That worldview shaped how Garlinghouse positioned Ripple’s strategy. “At Ripple, we very much focused on building the bridges between traditional finance and decentralized finance,” he said, describing work “with a lot of the banks around the world” as the practical path to scale rather than attempting to displace existing monetary regimes.

Garlinghouse also framed 2026 as a momentum year, not just a technology year. He argued that the political climate in the US has turned materially more constructive after a period he described as open hostility. “The US, the largest economy in the world, has been pretty openly hostile towards facets of crypto and blockchain technologies,” he said. “And that has shifted dramatically, you know, starting with the White House... [and] helped elect a much more pro-crypto pro-innovation Congress, and you’re seeing that play out.”

But the Ripple CEO repeatedly cautioned that narrative tailwinds are not enough. “Part of the tokenization topic [...] is like we shouldn’t tokenize everything just to tokenize something,” Garlinghouse said. “There has to be a positive outcome of efficiency or transparency [...] otherwise it’s just like okay it’s a nice science experiment.”

On regulation, Garlinghouse reiterated his pragmatic tone, arguing that the push for US crypto legislation should prioritize workable clarity over theoretical perfection. “What’s going on in the US right now is a classic dynamic of when you create new law, it’s never going to be perfect,” he said. “I subscribe to the idea that perfection is the enemy of good.”

He pointed to Ripple’s own history: “a five-year battle with the US government being sued because of the lack of clarity” to underline the stakes, adding: “We are very much an advocate of clarity is better than chaos.”

When pressed on whether stablecoins should pay rewards, one of the live fault lines in US policy debate, Garlinghouse positioned Ripple as less directly exposed than some peers, while still endorsing competitive symmetry. “Ripple doesn’t have as much of a dog in that fight as others in the industry,” he said, but added that a “level playing field goes two ways,” arguing that crypto firms and banks should face comparable standards when competing for the same activity.

Garlinghouse also addressed energy concerns around blockchain-based infrastructure, pushing back on a one-size-fits-all critique. “Not all layer 1 blockchains are created equal,” he said, contrasting proof-of-work systems with proof of stake and other consensus models, and arguing that stablecoin activity is already skewing toward “more power efficient blockchains.”

Spirited dialogue during today’s WEF session (to say the least), but one important point of agreement across the panelists was that innovation and regulation aren’t on opposite sides.

I firmly believe this is THE moment to use crypto and blockchain technology to enable economic... https://t.co/4d3jNeNC4h

— Brad Garlinghouse (@bgarlinghouse) January 21, 2026

On tokenization’s social and market impact, Garlinghouse reframed a question about speculation as a question about access. He said he sees the opportunity in “the democratization of access to investment less so on the speculation side,” pointing to the idea that smaller investors could gain exposure to assets that are effectively inaccessible at modest ticket sizes today.

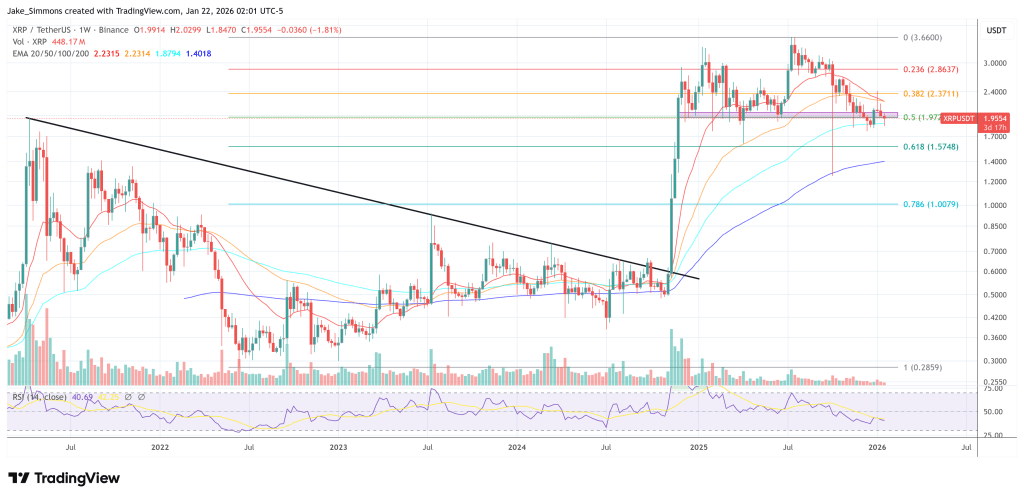

At press time, XRP traded at $1.9554.