Ripple’s UK & Europe policy director Matthew Osborne is urging central banks to stop treating stablecoins as an external threat and instead fold well-regulated issuers into core safeguards, arguing that oversight plus access to official infrastructure can make stablecoins a net stabiliser for payments and settlement.

Writing for the Official Monetary and Financial Institutions Forum on 19 January 2026, Osborne said stablecoins have moved well beyond a niche experiment, citing a market value “in excess of $300bn” and annual transaction volumes that he wrote now surpass Visa and Mastercard combined. He argued momentum could accelerate in the US after the Genius Act, which he said would introduce federal rules and allow banks to issue stablecoins.

The Ripple exec framed the shift as already visible among central banks themselves. He pointed to the European Central Bank’s recent recognition of stablecoins’ benefits for cross-border payments and its view that tomorrow’s financial system will host multiple forms of money. He also cited the Bank of England’s stance that stablecoins could support “faster, cheaper retail and wholesale payments” as part of a “multi-money” system underpinned by central bank money.

Ripple Exec: Bring Stablecoins Into The Safety Net

At the centre of his case is the claim that stablecoins should be treated as an incremental evolution rather than an adversarial replacement. “Regulated stablecoins could play a key role in financial markets alongside other forms of money,” Osborne wrote. “First, stablecoins are more likely to complement the existing financial system than replace it. This is evolution, not revolution.” He then added: “The solution lies in central banks channelling stablecoin momentum, not fighting it.”

Osborne argues central bank money will remain essential as a risk-free settlement asset and safe store of value, but its relative role could shift in digital markets. He pointed to atomic settlement, where legs of a transaction settle simultaneously and conditionally, as reducing the traditional need to use central bank money purely to mitigate settlement risk.

Where stablecoins could be structurally preferred, he wrote, is in cross-border flows and multi-chain markets. “Cross-border payments are one example, given that stablecoins can move value anywhere in the world in seconds,” the Ripple exec said.

“In contrast, central bank money is likely to be less suitable for cross-border payments given access may be geographically limited and adoption of on-chain central bank money is far from universal around the world.” He also argued stablecoins are likely to exist across more blockchain networks than central bank money, making same-chain settlement between tokenized assets and cash more achievable while interoperability remains uneven.

Central banks have repeatedly warned that stablecoins could pull funds from bank deposits, weakening bank credit creation and potentially amplifying stress events. Osborne pushed back, arguing the risk is overstated because markets already accommodate instruments backed by highly liquid assets, money market funds, e-money, and “narrow banks”, without causing sustained deposit runs.

His bigger point is that regulation, while necessary, is insufficient without a backstop. “But regulation alone is not enough,” Osborne wrote. “Stablecoin issuers lack access to the safety net that gives bank deposits their resilience. Without it, even well-managed stablecoins are more vulnerable to shocks – as seen when USDC temporarily lost its peg following exposure to Silicon Valley Bank in 2023.”

He argued central banks should consider extending elements of that safety net, including allowing well-regulated stablecoin issuers to hold part of their backing assets in central bank accounts, offering liquidity insurance against market-wide shocks, and granting more direct payment-system access to reduce tiering risk.

The Ripple exec closed by positioning the choice for central banks as strategic: resist stablecoins and risk the market scaling beyond official influence, or “bring them inside the tent,” shaping development through prudential oversight and infrastructure access as tokenized settlement rails mature.

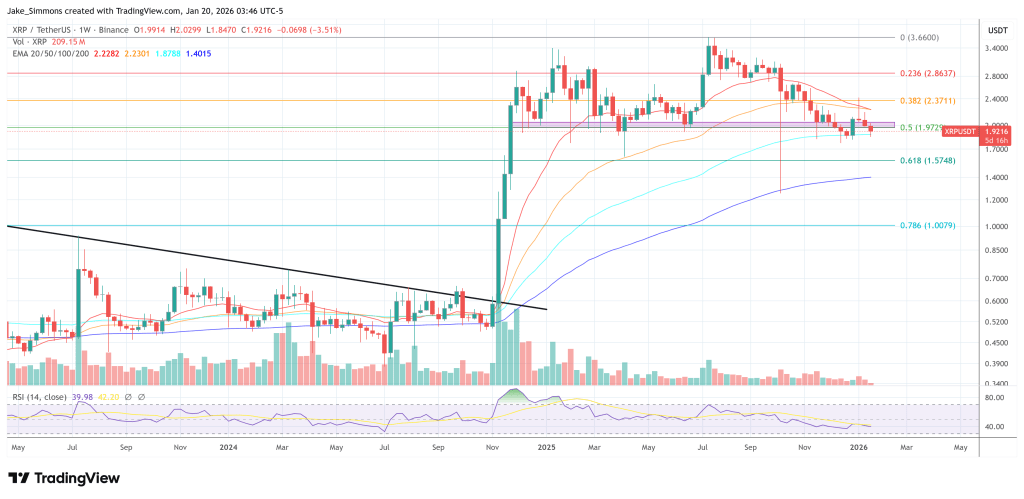

At press time, XRP traded at $1.9216.