In the history of Ethereum's development, nothing is more iconic than the "The DAO" incident in 2016. It was not only the most astonishing crowdfunding project in Ethereum's history but also the protagonist of the hacker attack that led to the split of the Ethereum community and the birth of "Ethereum Classic (ETC)".

After a decade, this name that once nearly destroyed Ethereum—The DAO—is making a comeback in another form. It will launch "TheDAO Security Fund," transforming the remaining over 75,109 ETH (worth more than $220 million) from the incident into a long-term fund focused on Ethereum's security development.

Historical Retrospective: A Crowdfunding Myth That Led to an Ecosystem Crisis

Rewind to 2016. At that time, TheDAO set a crowdfunding record with $150 million in financing, attracting a staggering 14% of Ethereum's total supply.

The vision of this decentralized autonomous organization excited the entire crypto ecosystem, but it soon encountered a catastrophic attack. Hackers exploited a recursive call vulnerability in the smart contract to steal a large amount of funds, prompting the Ethereum community to make a highly controversial decision—implement a hard fork to recover the stolen assets. This move directly led to a split in the community's philosophy, giving birth to Ethereum Classic (ETC).

But fund recovery was never simple. Although the hard fork resolved the redemption of standard DAO tokens, it could not handle all edge cases. Thus, a group of veteran Ethereum community members voluntarily formed the "TheDAO Curator Multisig Wallet" to take on the responsibility of resolving these complex legacy issues.

TheDAO Security Fund Emerges

Griff Green, who served as TheDAO's community manager and is now a co-founder of Giveth, was one of the core members of the "TheDAO Curator Multisig Wallet" back then. According to the official announcement, as early as August 2016, these core administrators clearly stated an important plan: if the leftover funds from these edge cases remained unclaimed after January 31, 2017, they would be used to support Ethereum smart contract security development.

Then, these funds lay "dormant" for nearly a decade. Griff Green said in an interview with Unchained: "As of 2026, we have never touched these funds, and the rise in Ethereum's price has led to substantial appreciation. This is an extremely dramatic turn of events—the 'leftover funds' from back then are now worth far more than TheDAO's original $150 million crowdfunding total."

The DAO Fund's Goal: Safeguarding Ethereum Security

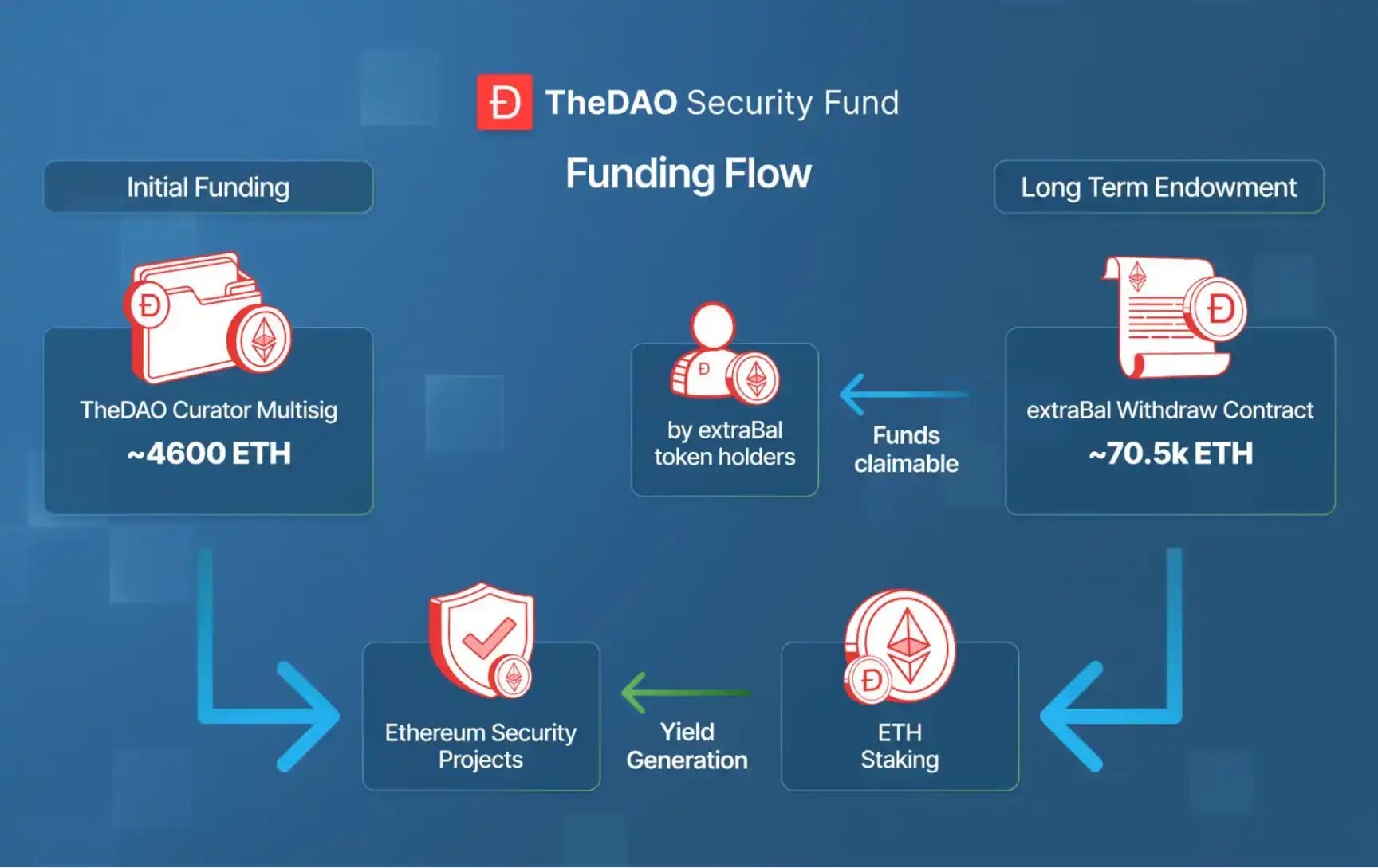

According to the official announcement, the funding sources for TheDAO Security Fund are mainly divided into two parts, totaling over 75,109 ETH (worth $220 million):

· Approximately 70,500 ETH in the ExtraBalance contract, which can still be claimed by eligible individuals.

· Approximately 4,600 ETH and some DAO tokens in TheDAO Curator Multisig, worth about $13.5 million, for which there are no clear claimants.

The operation and usage plan for TheDAO Security Fund's funds are clear and specific: 69,420 ETH allocated from the ExtraBalance contract will be staked, generating staking rewards to form a perpetual endowment fund, providing long-term financial support for Ethereum security development. The staking rewards will be combined with the 4,600 ETH from TheDAO Curator Multisig to jointly fund various Ethereum security-related projects. Simultaneously, the ExtraBalance withdrawal contract will retain a portion of ETH to ensure the rights of legitimate claimants are unaffected.

Regarding the scope of funding, TheDAO Security Fund's core objective is very specific—prioritizing the security of the entire Ethereum ecosystem, covering all dimensions of security development: from wallet user experience optimization and smart contract security audits, to emergency response for security incidents and security upgrades for the Ethereum core protocol, to security protection for Layer 2 networks and cross-chain bridge ecosystems. All work contributing to enhancing Ethereum's security level falls within the fund's funding scope.

Additionally, the fund will rely on the optimization directions and opportunities in the current security landscape outlined by the Ethereum Foundation's Trillion Dollar Security initiative, combined with ongoing communication with ecosystem partners, to determine the specific scope and focus of each funding round.

In terms of the fund allocation mechanism, TheDAO Security Fund adheres to open, bottom-up governance principles. It will employ diverse methods such as quadratic funding, retroactive funding, and request for proposal (RFP)-based ranking votes to carry out funding work in rounds, allowing ecosystem participants to jointly participate in fund allocation decisions.

Currently, the fund has assembled a professional curator team to provide expert guidance and supervision for the fund's operation and funding decisions. Team members are all veteran practitioners and security experts in the crypto ecosystem: including Ethereum founder Vitalik Buterin, MetaMask security engineer Taylor Monahan, Zisk, Giveth co-founder Jordi Baylina, security expert pcaversaccio, ENS co-founder Alex Van de Sande, and Dappnode CEO Pol Lanski.

Summary

TheDAO Security Fund is not without controversy. Its core disputes still revolve around two main issues: first, the "legitimacy of the purpose" of using these leftover funds for a security fund, and second, the "degree of decentralization" of the fund's governance mechanism.

Should this huge asset be considered the "private property" of all original token holders, or has it already been deemed ownerless property to be used for the "public good"?

These controversies not only continue the philosophical divide within the Ethereum community sparked by the 2016 The DAO incident but also reflect the deep-seated contradictions in the current crypto ecosystem at the governance level—the balance between the ideal of decentralization and the efficiency of actual operations, as well as the compliance of asset disposal, remains a subject that the entire industry needs to continuously explore.

But setting aside the controversies, from the 2016 crowdfunding myth and ecosystem crisis to the 2026 security fund and ecosystem safeguarding, the decade-long cycle of The DAO is itself a microcosm of Ethereum's ecosystem development. It witnesses Ethereum's growth from immaturity to maturity and confirms the resilience and community strength of the crypto ecosystem.