Author: Sanqing, Foresight News

Original Title: Trove Raises Tens of Millions Then 'Switcheroo', Suspected of Misusing Funds and Manipulating Prediction Markets

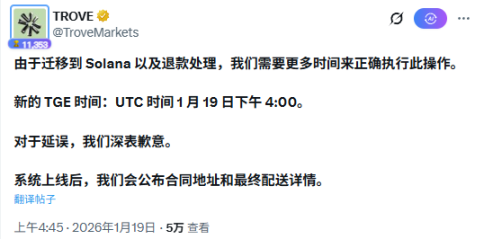

On January 19, unwise, a team member of the digital collectibles contract platform Trove, tweeted that Trove would migrate to Solana. The member stated that this was because the liquidity partner supporting its Hyperliquid path chose to liquidate its 500,000 HYPE position. Subsequently, the HYPE purchase address disclosed on its ICO page began selling.

unwise's tweet (top), Trove-associated address HYPE transaction record (bottom) | Source: X (top, translated), HypurrScan (bottom)

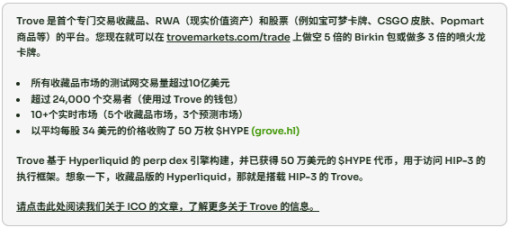

Previously, Trove repeatedly mentioned that it had raised $20 million, would launch a token on Hyperliquid, and would build its digital collectibles contract platform based on HIP-3. Based on this public information, it completed an ICO with a $20 million FDV, selling 12.5% of the total supply.

ICO Flip-Flopping, Transferring Raised Funds to Prediction Markets

The Trove ICO was originally scheduled to start on January 9 at 1:00 and end on January 12 at 1:00.

On January 12, the project team announced it had raised over $11.5 million and extended the ICO by 5 days until January 16 at 1:00. 42 minutes later, they posted again revoking this decision and stated the ICO would end as originally scheduled.

Affected by this, the probabilities on Polymarket for the Trove ICO total raising over 15M, 20M, 25M, and 30M all sharply increased from near zero to 40% – 80% within a short time.

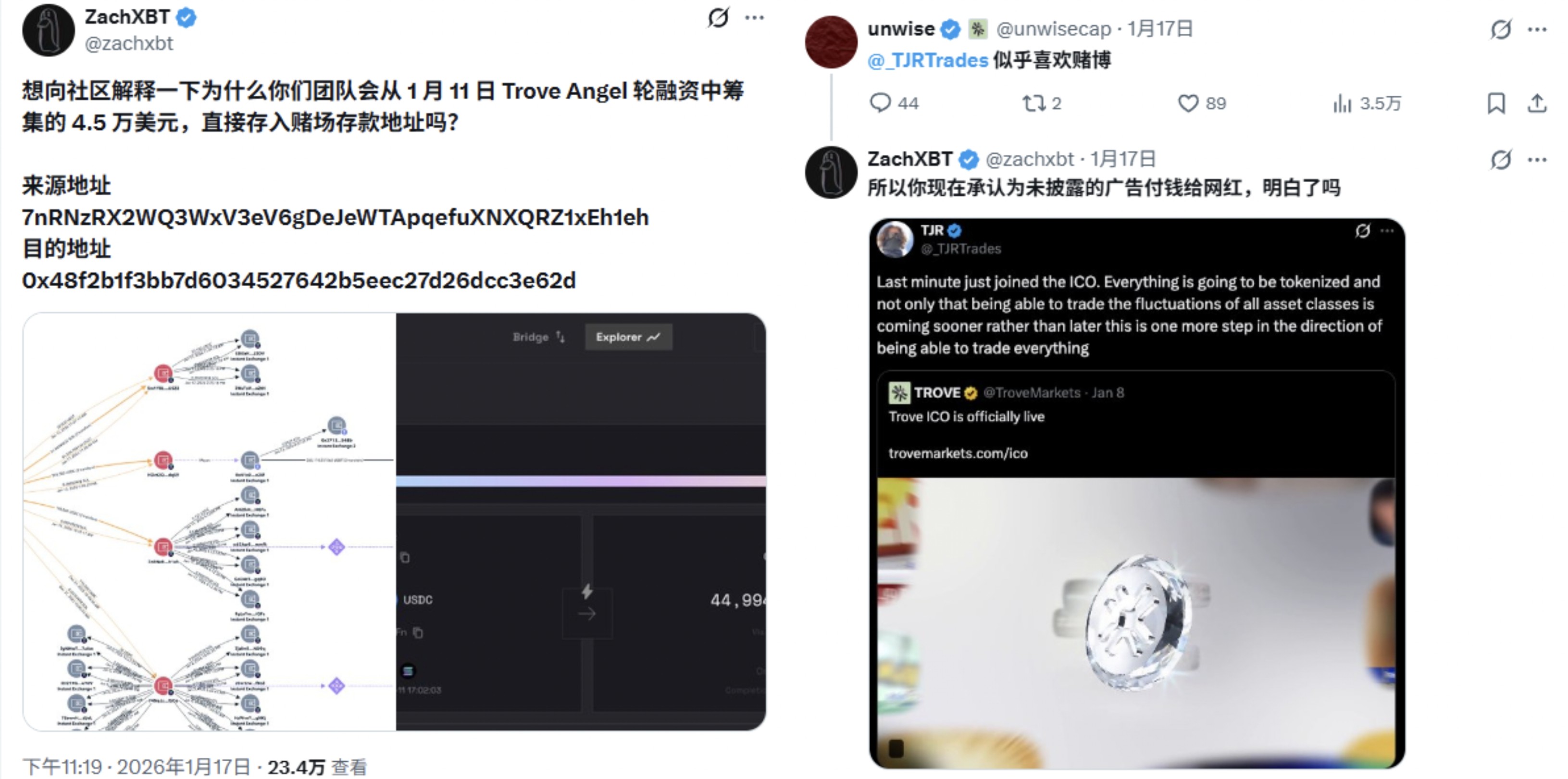

On January 17, on-chain detective ZachXBT tweeted that Trove had directly moved $45,000 from its Trove angel round financing into prediction markets on January 11. Trove team member unwise replied, attributing the operation to TJR (an English crypto KOL).

Source: ZachXBT and uniwise tweets (translated)

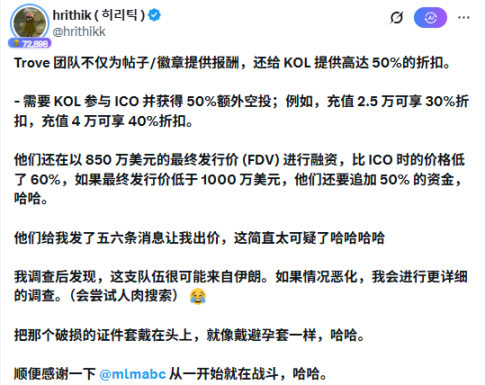

Furthermore, according to crypto KOL hrithik, they received multiple messages from the Trove team promising additional compensation for promoting their ICO bids and posts.

Source: hrithik tweet (translated)

Community feedback on the ICO changes and Polymarket activities included criticism that the extension decision increased uncertainty and damaged trust.

Source: xero tweet (translated)

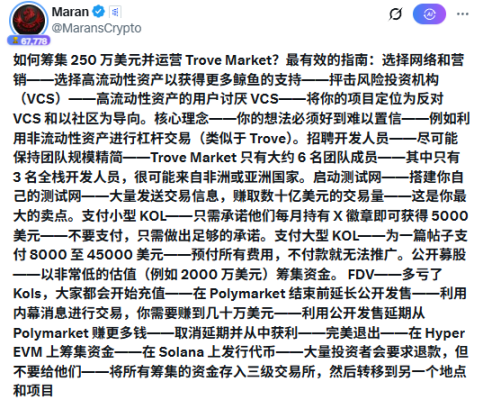

Regarding Polymarket, users accused the team of manipulation and non-disclosure, turning a previously promising ICO into demands for refunds, with some calling it insider trading, leading to a shift in sentiment from excitement to caution.

Source: Maran tweet (translated)

Violating ICO Public Information, Temporarily Migrating to Solana

Previously, Trove repeatedly stated on its official Twitter that it had purchased HYPE tokens, would build its digital collectibles contract platform based on HIP-3, and had launched a test website.

Source: TROVE tweet (translated)

During its ICO, it did not make any changes to this related information.

Trove related information | Source: Trove ICO page (translated)

The community strongly opposed the migration to Solana, viewing the shift as a deviation from the initial Hyperliquid promise. Some participants demanded full refunds, stating it no longer aligned with the investment logic.

Source: unwise (left) and Trove official Twitter reply (right), translated

Source: Wazz tweet (translated)

As of now, Trove has not responded to related refund requests. It stated that TGE will occur on January 20 at 00:00, followed by ICO token distribution and oversubscription refunds.

Source: Trove official Twitter (translated)

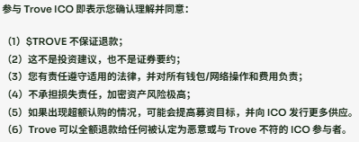

The Boundary Between ICO Promises and Investor Protection

The changes in Trove's actual execution have deviated from the core path, technical dependencies, and liquidity promises publicly during the ICO. These are major substantive changes, not mere technical optimizations or iterations.

Source: Trove ICO page (translated)

This behavior of诱导 (inducing) first and switching later changes the essence of the investment target; the initial investment logic should be invalidated. Investors'诉求 (demands) for refunds to protect their rights should receive broad support.

The crypto investment environment is highly speculative and uncertain. Participants must carefully review project whitepapers, on-chain fund flows, team track records, etc., before deciding, and specifically evaluate the project team's communication transparency, timeliness, and compensation mechanisms for any major changes.

Investors need to be especially vigilant towards project parties with non-public team information, high anonymity, or those with delayed communication after changes.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush