San Fransisco, California, December 10th, 2025, Chainwire

As CARV advances its vision of sovereign AI Beings, it’s become clear that true value creation lies not just in compute or data, but in people. At the heart of CARV’s AI Being roadmap is a new class of agents, AI-powered digital extensions of individuals, anchored in verifiable identity and private context. To bridge the Social and Economic Ledgers that have long operated in silos, CARV introduces Cashie: a programmable on-chain layer turning real social engagement into verifiable economic activity. No longer just a social payment tool, Cashie is evolving into a core protocol for trustless coordination between influence and value.

As part of CARV’s broader modular agentic infrastructure, alongside CARV ID (ERC-7231), Model Context Protocol (MCP), and the Shielded Mind update, Cashie’s integration with x402 protocol transforms social engagement into verifiable, automated, and privacy-preserving on-chain rewards, pushing the boundaries and limits of the creator economy, turning social capital into on-chain value.

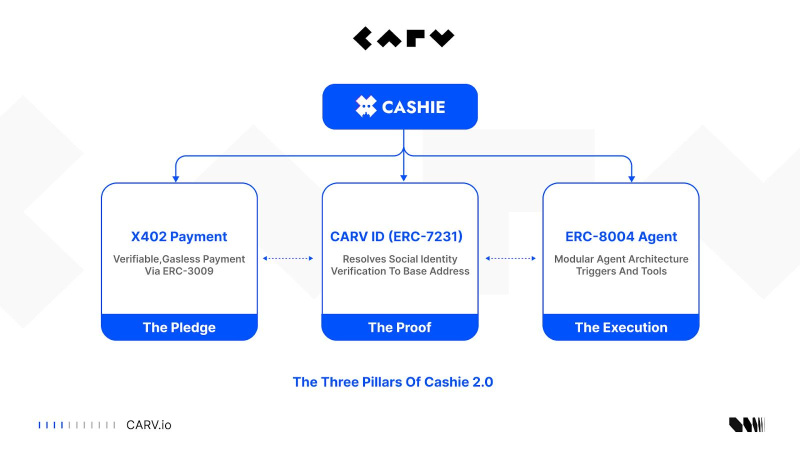

How Cashie 2.0 Works: The Three-Pillar Bridge

Cashie 2.0 is architected around three foundational pillars:

1. x402 Payment: ‘The Pledge’

Cashie campaigns begin with a single ERC-3009 signature, where a project or KOL pledges funds to a campaign. This is the “X-Payment” proof, and it’s verified on-chain. No gas. No manual transfer. It ensures that funds are committed and can be distributed autonomously.

2. CARV ID: ‘The Proof’

How to reward a retweet or any other engagements? Traditional wallets don’t recognize @handles on social media. Cashie solves this with CARV ID, which maps social actions (like a retweet from @user) to on-chain identities (0xABC). This is the identity oracle that connects the Social Ledger to the Economic Ledger.

3. ERC-8004 Agent: ‘The Executor’

Cashie isn’t a monolithic bot. It’s an AI-powered agent built with modular tools:

- A Payment Tool to verify and move funds

- A Twitter Tool to monitor and analyze social activity

- A Raffle/Quest Tool to select winners or check completions

- A Distribution Tool to deliver on-chain rewards

All of this happens trustlessly and autonomously, removing manual ops and Sybil vectors.

The Developer Breakthrough: Powering the Agents-to-Agents Economy

To unlock the full potential of sovereign AI Beings and decentralized coordination, infrastructure must evolve, quietly but radically. While the spotlight shines on AI agents and social campaigns, it’s the innovation under the hood that makes everything work. With Cashie 2.0, CARV introduces a new kind of developer stack: one that’s not just programmable, but agent-native.

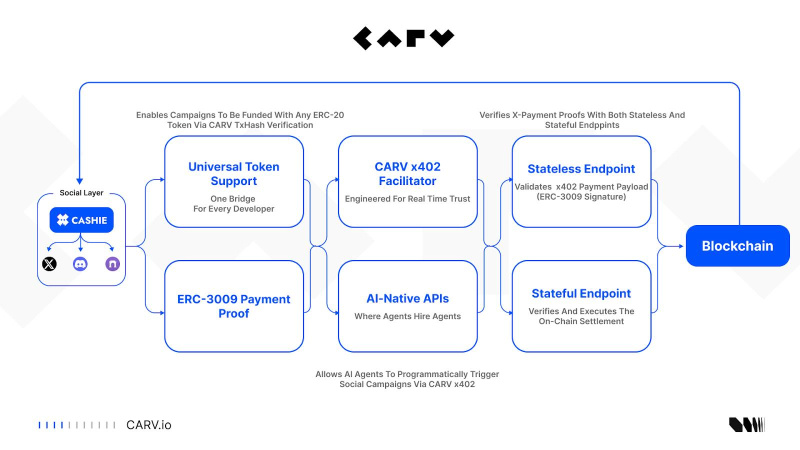

The CARV x402 Facilitator: Enhancing the Protocol

Every action in Cashie starts with a cryptographic promise, but verification is what makes it trustworthy. To enable secure, gasless campaigns at scale, the company built the CARV x402 Facilitator: a high-performance verifier that adds state and nonce tracking to reject replayed signatures instantly, preventing duplicate settlements before gas is spent.

CARV is opening its facilitator endpoints for any developer on Base to build their own x402-powered applications. Developers can start building against their live endpoints today:

- A stateless endpoint to validate an x402 paymentPayload (ERC-3009 signature): https://interface.carv.io/cashie/protocol/verify

- A stateful endpoint that verifies and executes the on-chain settlement: https://interface.carv.io/cashie/protocol/settle

The AI-Native API: Agents Hiring Agents via x402

True to the ERC-8004 (Trustless Agents) vision, Cashie 2.0 is not just a platform; it’s a programmable tool for other AI agents. CARV are exposing an AI-native HTTP API that fully implements the x402 protocol. This means another AI agent (from Virtual, Base, or anywhere else) can now programmatically hire Cashie to run a campaign. An agent can call the API, receive a 402 Payment Required challenge, and then resubmit its request with its own X-Payment proof to autonomously fund and launch the entire operation. This is agent-to-agent social commerce in action.

Universal ERC-20 Support via TxHash Verification

Web3 is fragmented by token standards. Not every ERC-20 supports gasless approvals or signature-based authorizations. But Cashie was designed for inclusivity. CARV built Cashie for the entire Base ecosystem, not just for tokens with ERC-3009 support. The platform includes a separate, robust txhash-based verification API.

This internal capability will allow any project to sponsor a campaign with their own (and any) native ERC-20 token, even if it doesn’t support permit or authorization. The sponsor simply sends a standard on-chain transfer and provides the txHash as proof. CARV’s system handles secure, on-chain verification and replay protection, making Cashie the most flexible and inclusive social-growth engine on Base, with a clear roadmap to open this universal token support to all builders.

What This Means for Users and Developers

Cashie introduces a new way to engage and earn. Users can receive crypto rewards directly through social actions like retweets or quests, without wallet submission required, with CARV ID ensuring verified ownership and privacy preserved. For developers, Cashie becomes a programmable growth layer where automated campaigns, bounties, and agent-driven incentives can be built without manual wallet collection, enabling new composable experiences across social and onchain environments.

To encourage adoption, CARV launches Cashie 2.0 Creator Campaign with a $45,000 prize pool to incentivize creators and participants. Through this campaign, the Creators (e.g., KOLs and projects) can configure a reward pool, duration, eligibility logic, and then publish a campaign link via a single social post. Read more about this campaign in this link.

What’s Next

Cashie is already driving early campaigns across the Base ecosystem, but this is only the beginning. With upcoming support for self-hosted x402 facilitators, AI-powered campaign agents, and enterprise-grade SDKs for social growth, Cashie will evolve into the coordination engine between agents, humans, and verifiable engagement. As CARV’s AI Being roadmap advances, Cashie plays a key role in building trustless bridges between influence and value.

About CARV

CARV is where Sovereign AI Beings live, learn, and evolve.

What are AI Beings? They are sovereign intelligences born natively on-chain. AI Beings are designed with purpose, autonomy, and the capacity for growth. They possess memory, identity, and the ability to perceive and interact with their environment, not just to execute tasks, but to make independent decisions, adapt over time, and pursue self-defined goals.

Anchored by its proprietary CARV SVM Chain, D.A.T.A. Framework, and CARV ID/Agent ID system (ERC-7231), CARV enables verifiable, consent-based AI Beings that learn, adapt, and co-create with users. Driven by CARV’s AI-first stack, consumer AI apps incubated through CARV Labs launched on Google Play, App Store and beyond, reaching billions of people, bringing agent-powered experiences and real-world incentives into mainstream digital life.

With 8M+ CARV IDs issued, 60K+ verifier nodes, and 1,000+ integrated projects, CARV bridges AI agents, Web3 infrastructure, and real-world utility, fueling the rise of agent-driven economies. At its core, $CARV token powers staking, governance, and coordination across this stack, making CARV the operating system for AI Beings on Web3.

X (Twitter): https://x.com/carv_official

Discord: https://discord.com/invite/carv

Telegram: https://t.me/carv_official_global

Whitepaper: https://docs.carv.io/

Contact

COO

Victor Yu

CARV

[email protected]