Source: Fintech Blueprint

Author: Laurence Smith

Original Title: DeFi: Polygon’s $250MM play for the Stablecoin Rails, competing with Stripe

Compiled and Arranged by: BitpushNews

Polygon Labs has acquired Coinme and Sequence for over $250 million.

Founded in 2014, Coinme is a compliance and physical bridge in the payments space. It operates one of the largest licensed cash-to-cryptocurrency networks in the United States, covering over 50,000 retail locations (including Coinstar kiosks), where users can exchange cash for digital assets.

More importantly, Coinme holds Money Transmitter Licenses (MTL) in 48 states, which can be embedded into diverse user experiences. For comparison, Alpaca Markets recently raised $150 million at a valuation exceeding $1 billion, with its business focused on embedded crypto asset and stock trading services.

Under the current U.S. regulatory environment, particularly the "Genius Act," licenses are a key prerequisite for generating revenue. MTLs are necessary to access the Federal Reserve payment system and avoid legal risks associated with unauthorized banking activities. By acquiring Coinme, Polygon directly gains market access, enabling it to handle fiat and stablecoin conversions without relying on third-party banking partners (which may terminate relationships with crypto businesses at any time).

Sequence addresses the second obstacle: user experience.

Polygon provides the underlying ledger, while Sequence offers smart wallet infrastructure. Its technology uses account abstraction to hide the complexities of blockchain (gas fees, private keys, cross-chain bridging), so end-users don't even need to be aware of the blockchain's existence. Its "Trails" coordination engine supports one-click payments, requiring no technical knowledge from the user.

Strategic Positioning: Becoming the "Stablecoin Public Chain"

Polygon's ultimate goal is to transform into a stablecoin public chain. The most direct comparison is the Stripe ecosystem: Polygon is analogous to Tempo (which raised $500 million), Sequence is analogous to Privvy (acquired by Stripe), and Coinme is analogous to Bridge (also acquired by Stripe).

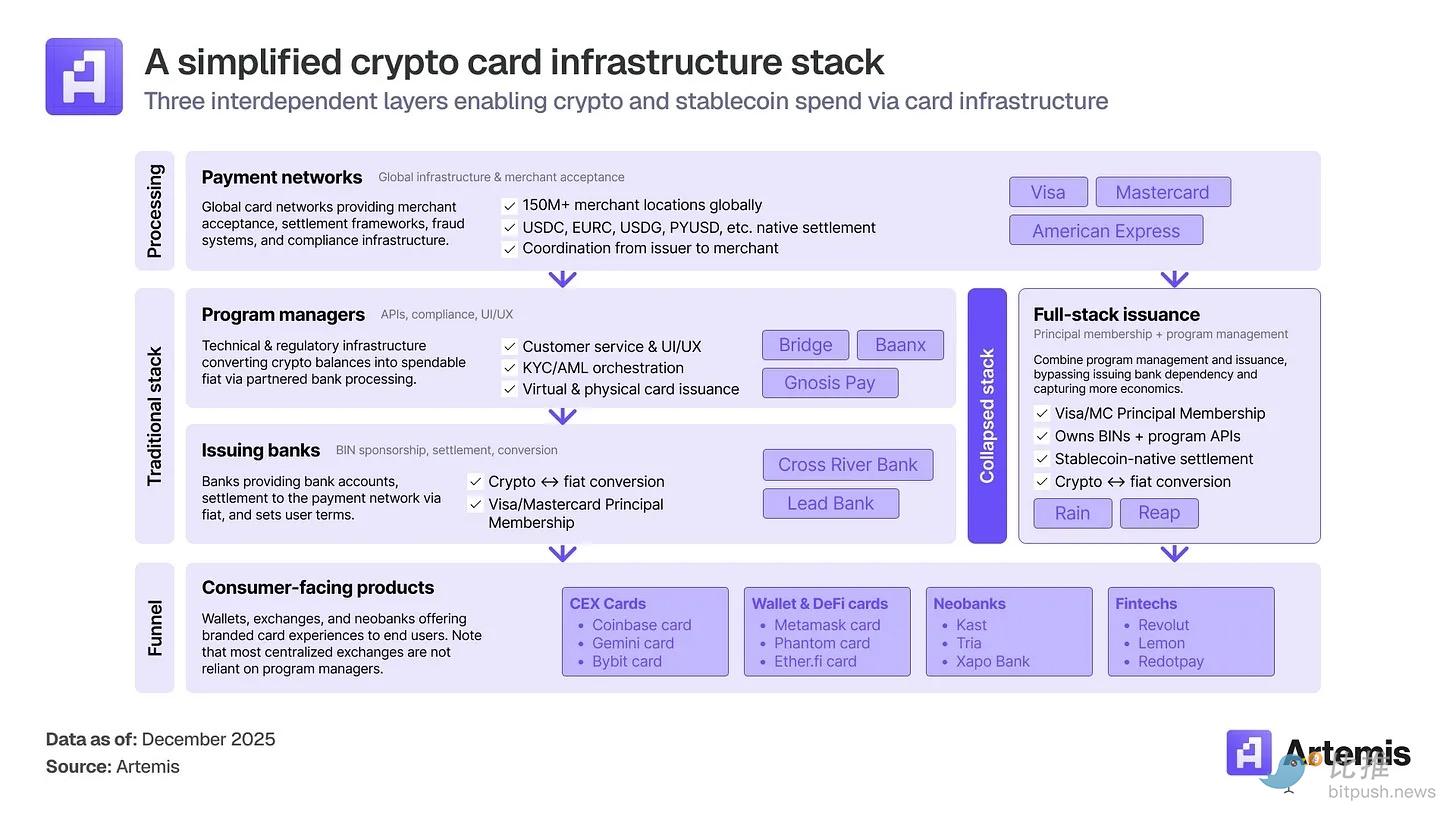

This move is not surprising. Over the past year, other players like Rain (which integrates stablecoin payments with Visa via a BaaS solution) have also seen significant success. The company recently completed a $250 million funding round, with payment volume growing 38-fold within a year.

Unlike Polygon, Rain does not provide a public chain but instead offers the underlying technology for payment cards that use stablecoins in the physical world. Polygon's acquisition reveals its strategic intent: to capture the value currently flowing to these specialized middleware providers.

Market Effect: Lowering Barriers, Reshaping the Narrative

By bundling Coinme's nationwide licenses with Sequence's smart wallet technology stack, Polygon lowers the entry barrier for a new generation of developers and simplifies its own positioning—transitioning from a former "media and NFT public chain" to a "money public chain."

This will have a dual market effect:

1. With Polygon's out-of-the-box compliant on-ramp and user experience tools, it will be easier to birth the next "Rain";

2. Large fintech companies can directly integrate with Polygon's "open money stack," completely bypassing third-party BaaS providers.

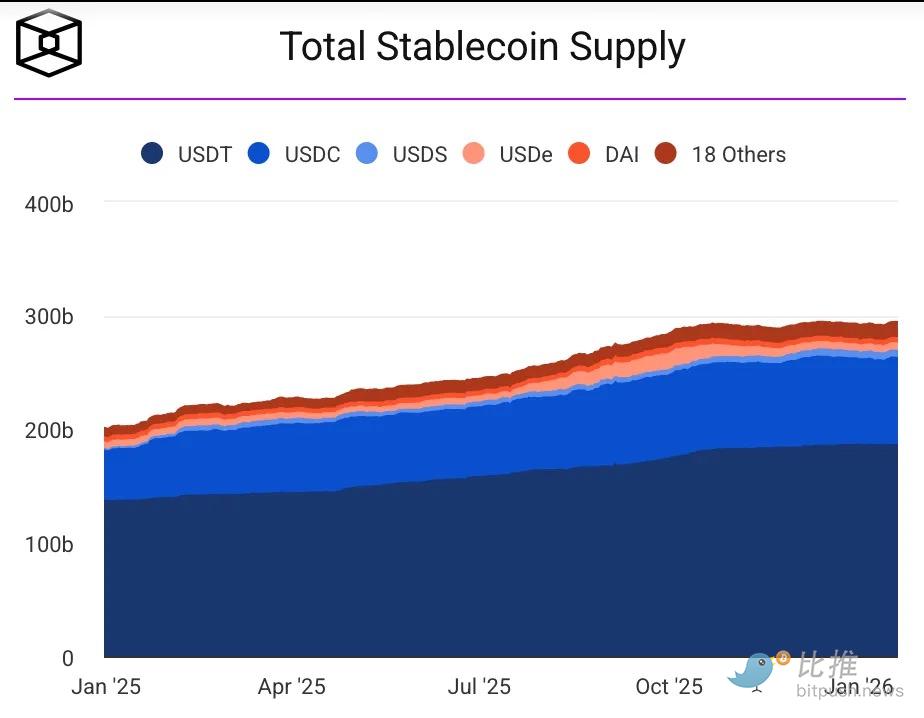

Total Addressable Market: $300 billion.

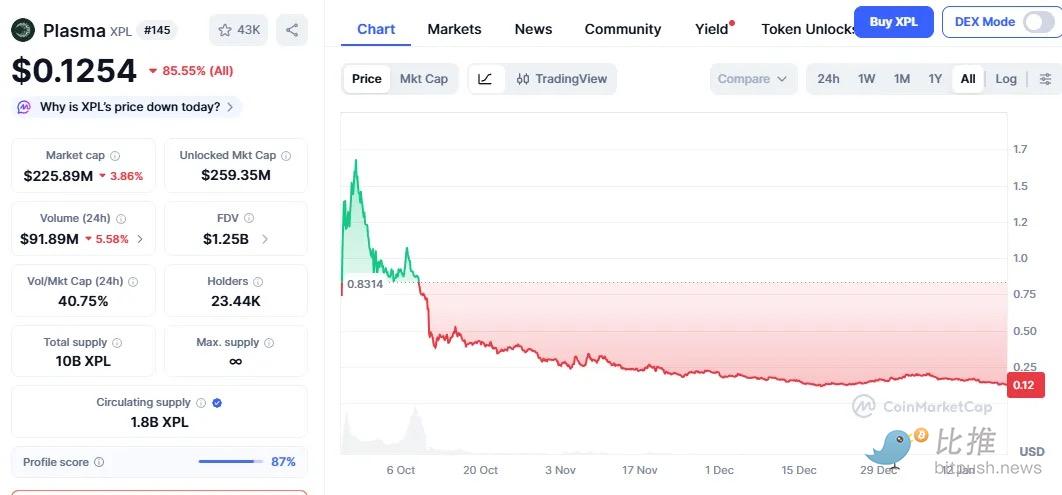

Precedent: The Failure of Tether Plasma (XPL)

Tether's Plasma (XPL) also attempted to become the preferred stablecoin network, but its flawed token economic model led to excessive mining and aggressive selling. The XPL token, designed to secure the network, plummeted 80% in price, as the market realized the chain's "zero-fee" utility did not require holding a volatile native asset. By the time staking was expected to launch in early 2026, the speculative bottom had long since collapsed, validator incentives vanished, and the network's long-term viability was in doubt.

Polygon faces a similar contradiction. To avoid repeating this mistake, it must ensure its new integrated tech stack provides a stable business environment, decoupled from the price performance of its native token, POL. Instead of consumer-centric incentives, Polygon has chosen to attract user attention and activity through partnerships.

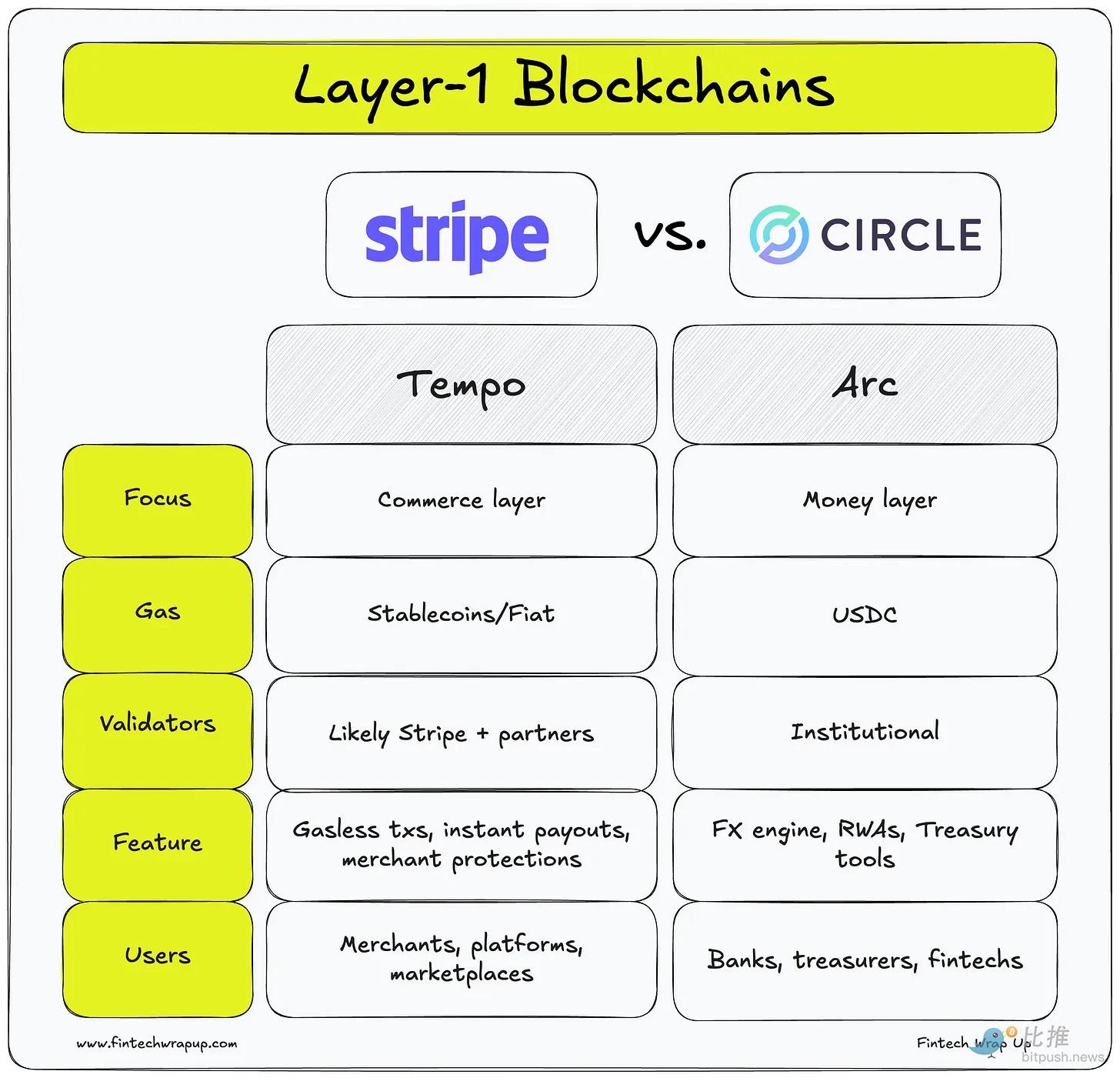

The crypto payments space also features two other integrated models vying for dominance: Stripe's Tempo and Circle's Arc. So far, each has its focus:

Circle Arc is a closed ecosystem. By making USDC the native gas token, Arc allows businesses to avoid exposure to volatile cryptocurrencies entirely. For banks, Arc, being built by the asset issuer, ensures the strictest compliance loop; it resembles an institutional settlement center more than a general-purpose blockchain.

Stripe's Tempo is more neutral—it doesn't care which stablecoin you use; it just wants to be the network that processes them. Tempo's unique advantage is its vast fintech distribution network, acting as an internet-scale SWIFT system that integrates with existing Stripe dashboards. It targets developers who already have a business and simply want to add "pay with stablecoins" as a feature.

Polygon is an infrastructure toolkit. Unlike Circle and Stripe, which focus on service provision, Polygon has long existed as an open ecosystem. The acquisition of Coinme and Sequence shifts its value proposition from a "high-speed public chain" to a "licensed payments-as-a-toolbox."

Among the three, Polygon is the only solution offering a physical cash bridge. This makes it a superior choice in certain real-world fintech scenarios (such as cross-border remittances, cash-dominant economies, payroll applications)—because the funds in these scenarios often originate as physical cash, flowing within a compliant environment spanning 48 states.

We look forward to the competition shifting more towards real-world application, rather than endless speculative casinos.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush