On January 6th, the public offering (ICO) for Ranger Finance, a DEX aggregator on the Solana blockchain, officially launched. This public offering is conducted through the MetaDAO platform to raise funds for Ranger's token, RNGR, aiming to expand the team's capabilities and accelerate development.

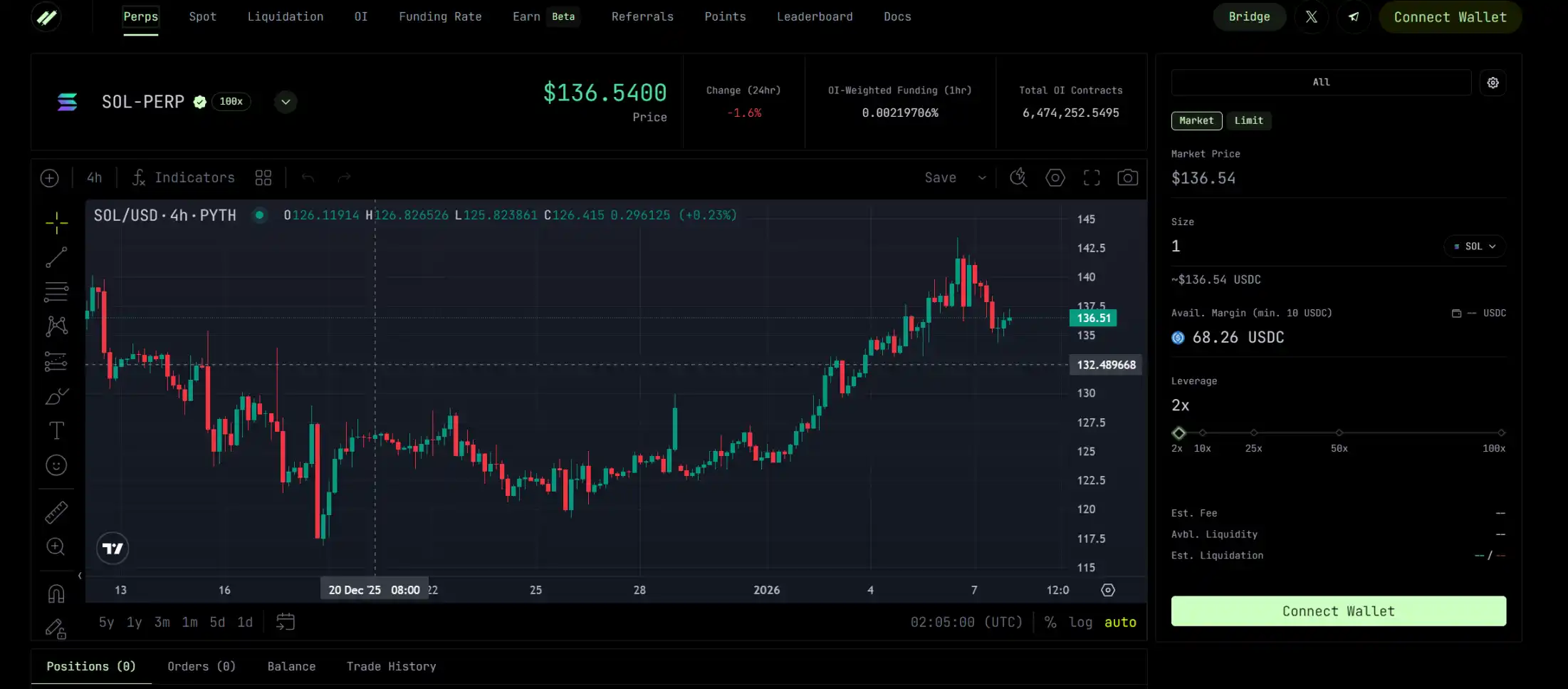

Currently, the daily derivatives trading volume on Solana, Arbitrum, and Hyperliquid reaches approximately $50 billion. However, most trading platforms still lock each order to a single trading venue, leading to fragmented liquidity, reduced execution quality, and ultimately a worse experience for traders. Ranger's core intelligent order routing system scans integrated trading venues in real-time, assesses liquidity depth, intelligently splits large orders, and executes trades at the optimal price.

Ranger Finance also provides an intuitive interface for managing diverse trading positions, all operable on a single platform. The cross-margin support system (coming soon) allows the use of multiple assets in a single wallet as collateral, enabling greater flexibility and capital efficiency.

Public Offering Minimum Target $6 Million, Team Sets Performance-Based Unlock

The public offering runs until January 10th, with the officially announced minimum fundraising target of $6 million and a monthly spending limit of $250,000 (project founders can use this amount at their discretion each month without submitting a DAO proposal. The DAO reserves the right to adjust this amount in the future). Ranger point holders have priority in committing funds to the ICO. This priority is allocated proportionally among all point holders, with the remaining portion then allocated proportionally among non-point committers.

If the fundraising exceeds the minimum target ($6 million), Ranger will initiate a buyback plan, repurchasing tokens within 90 days based on the difference between the ICO price and the post-listing price. The repurchased tokens will be burned.

Ranger's total token supply is 25,625,000. The ICO token pool consists of 10 million tokens. Existing investors are allocated a total of 4,356,250 tokens (with a 24-month linear vesting period).

Notably, the project has specifically set up performance rewards. Team performance reward package: 7,600,000 tokens (18-month lock-up period, then unlocked based on price, using a 3-month TWAP as a benchmark, unlocking at 2x, 4x, 8x, 16x, and 32x the ICO price).

Ambassadors and ecosystem partners: 768,750 tokens (25% unlocked immediately, remaining 25% vested linearly over 6 months).

The remaining supply is for providing liquidity, with 20% of the raised funds plus 2 million tokens to be deposited into FutarchyAMM, and 900,000 tokens to be deposited unilaterally into Meteora's liquidity pool.

Previously Raised Funding at a $30 Million Valuation

In December 2024, during a period of excitement in the crypto market, Ranger completed a $1.9 million funding round led by RockawayX, with participation from Asymmetric, Big Brain Holdings, RISE Capital, and Anagram, among others.

This year, Ranger not only launched tokenized stocks based on xStocks but also acquired the strategy protocol Voltr in November.

Public information about the Ranger team is relatively limited. Its co-founder, Fathurrahman Faizal, graduated from Singapore Management University and previously served as COO at SolanaFM. Another co-founder, Barrett Williams, is also a co-founder of mtnCapital and has invested in the on-chain order book trading protocol BULK and MetaDAO.

The team allocation accounts for 29.6% of the total supply, unlocking only upon reaching ICO price milestones (e.g., 2x, 4x, 8x, 16x, 32x FDV). This incentive mechanism aligns with investor interests and is one of the few highlights. The team emphasizes "no pre-mining" and transparent governance but lacks specific links for verification, which may raise trust issues. The project claims to be built on TechFlow but does not disclose core developer experience.

Overall, the team's anonymity aligns with DeFi culture, but for a project seeking to raise millions in a public offering, this could be a potential risk point.

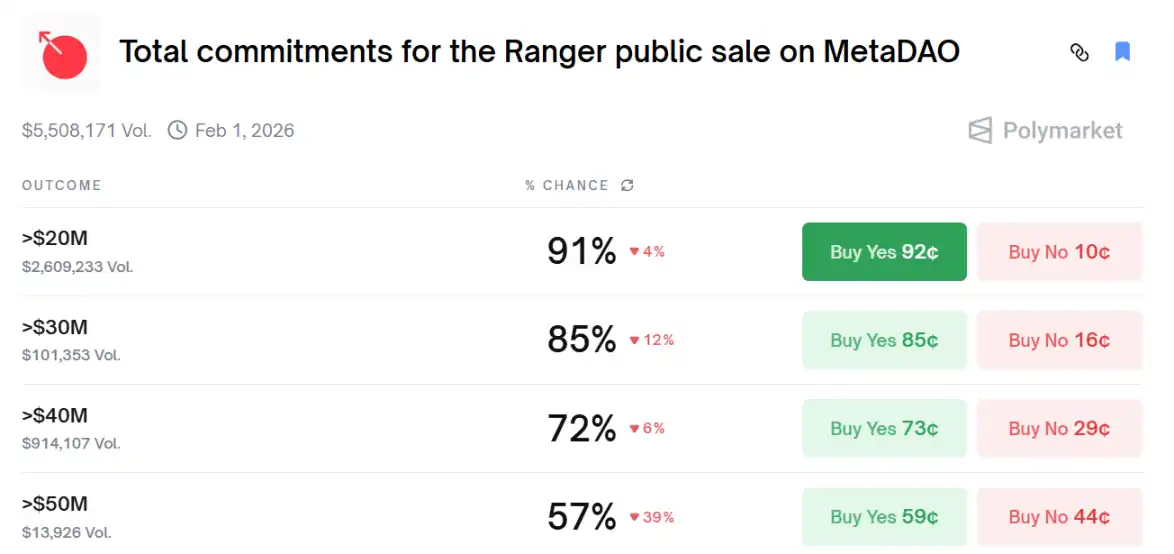

As of now, the official website shows that fundraising has reached $2.9 million, with nearly 1,800 investors participating. Polymarket data indicates an 85% probability that the market is betting on the public offering subscription amount exceeding $30 million.