Bitcoin is holding firm above the $92,000 level after rebounding from last week’s dip toward $90,000, offering bulls a brief moment of relief. Yet despite this stabilization, market sentiment remains decisively bearish, with many traders expecting further downside unless a clear shift in momentum emerges. The timing couldn’t be more crucial: the Federal Reserve’s upcoming rate decision has become the central focus for investors, and the market is bracing for heightened volatility.

According to a new CryptoQuant report, Bitcoin’s historical behavior around rate cuts offers meaningful context. Over the years, Fed interest rate cuts have generally aligned with upward movements in BTC, largely because lower rates weaken the US dollar, stimulate liquidity, and support risk assets. However, the report highlights an important nuance—the immediate reaction is rarely straightforward.

In several past instances, Bitcoin rallied ahead of rate cuts, only to show muted or even negative price action once the decision was announced, indicating that markets had already priced in the move.

This dynamic creates a layer of uncertainty heading into the FOMC meeting. While macro conditions align with long-term bullish trends for Bitcoin, the short-term outlook remains fragile, shaped by sentiment, positioning, and the market’s anticipation rather than the announcement itself.

Historical Patterns Signal Caution Ahead of the FOMC

According to the report by GugaOnChain on CryptoQuant, Bitcoin’s past reactions to Federal Reserve rate cuts offer a clear framework for understanding the risks heading into this week’s FOMC meeting. The historical data paints a picture of mixed and often counterintuitive behavior.

For example, following the 25 basis point cuts in September 2025, Bitcoin barely reacted at all. In another instance, BTC surged to a four-week high—only to drop nearly $2,000 shortly after, settling into a period of muted stability. These reactions underscore how quickly sentiment can shift once policy decisions are fully priced in.

Volatility has also played a defining role. Both the September and October rate decisions triggered brief pre-FOMC rallies, followed by notable declines once the announcements were made. After the September cut, volatility spiked sharply as traders unwound leveraged positions, revealing how sensitive Bitcoin remains to event-driven positioning.

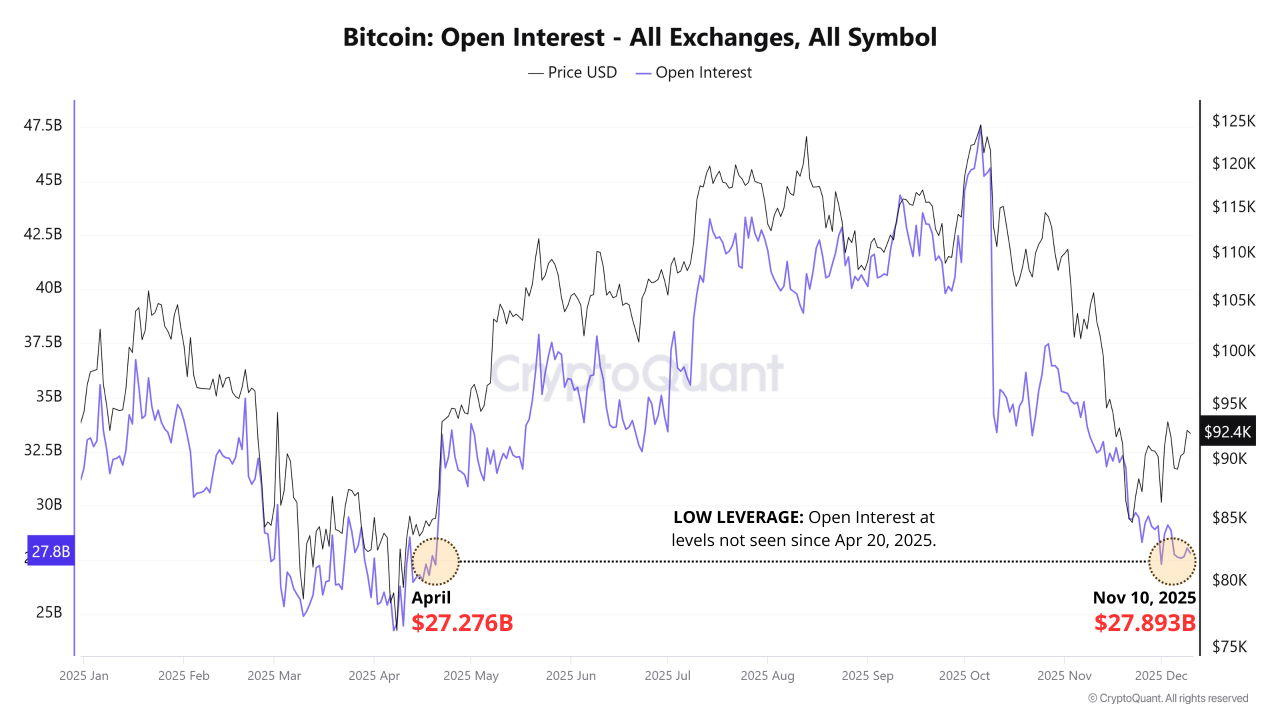

This leads to the recurring “buy the rumor, sell the news” pattern, a dynamic that GugaOnChain warns could repeat. Because of this, monitoring market leverage—including funding rates and open interest—is crucial. Equally important are liquidity flows, such as exchange reserves and ETF activity. Together, these indicators help traders anticipate short-term price movements as Bitcoin prepares for another potentially volatile macro event.