Matrixdock, the RWA platform under Matrixport, recently released its semi-annual physical gold audit report for the second half (H2) of 2025. The report discloses details about the physical gold reserves corresponding to the XAUm token, reflecting Matrixdock's ongoing commitment to physical asset verification and information transparency.

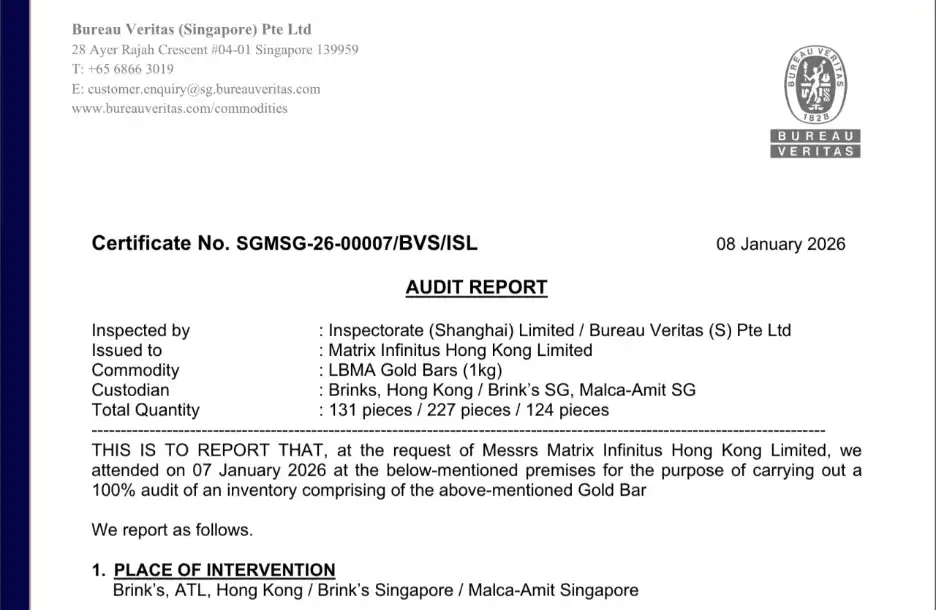

The audit was conducted by an independent third-party professional agency according to institutional-grade standards, providing a comprehensive inspection of the physical gold reserves corresponding to the XAUm token. The audit strictly followed leading industry standards for gold ETF audits, covering all elements including weight, purity, serial numbers, and vault custody information, achieving item-by-item verification of each physical gold bar.

Matrixdock's XAUm gold token employs a "dual-layer verification" mechanism: on one hand, it relies on an independent physical audit process; on the other hand, it combines on-chain real-time verification tools, enabling investors to transparently and continuously observe the mapping relationship between token supply and the corresponding gold reserves.

Audit Coverage and Key Data

● Audit execution date: January 7, 2026

● Physical gold reserves: 482 LBMA-approved 1-kilogram gold bars

● Total weight: 482 kilograms (approximately 15,595.336 ounces)

● Custody vaults: Brink’s Hong Kong, Brink’s Singapore, Malca-Amit Singapore

● Market value of the relevant physical gold, estimated at the audit time point: approximately $71.75 million

● The audit results showed no discrepancies between the physical gold and the related records.

Furthermore, compared to the audit for the first half of 2025, the number of physical gold bars covered in this audit increased by 61.

Enhancing the Verifiability of Tokenized Gold Through On-Chain Tools

Additionally, Matrixdock's gold allocation query tool allows XAUm holders to view the specific gold bar information corresponding to their tokens via a Web3 wallet. For example, one standard 1-kilogram gold bar corresponds to approximately 32.148 XAUm tokens, providing a more intuitive asset mapping method for tokenized gold.

As tokenized assets transition from innovation to infrastructure building, investor trust will increasingly rely on verifiable facts rather than verbal promises. Matrixdock stated that it will continue to advance reserve transparency and institutionalized operational standards, committed to providing global investors with more trustworthy and secure digital asset solutions for gold.

Audit report link: https://matrixdock.gitbook.io/matrixdock-docs/english/gold-token-xaum/physical-gold-vault-audit