HashKey Group, operator of one of Hong Kong’s licensed crypto exchanges, has opened subscriptions for its initial public offering (IPO) ahead of an expected listing next week.

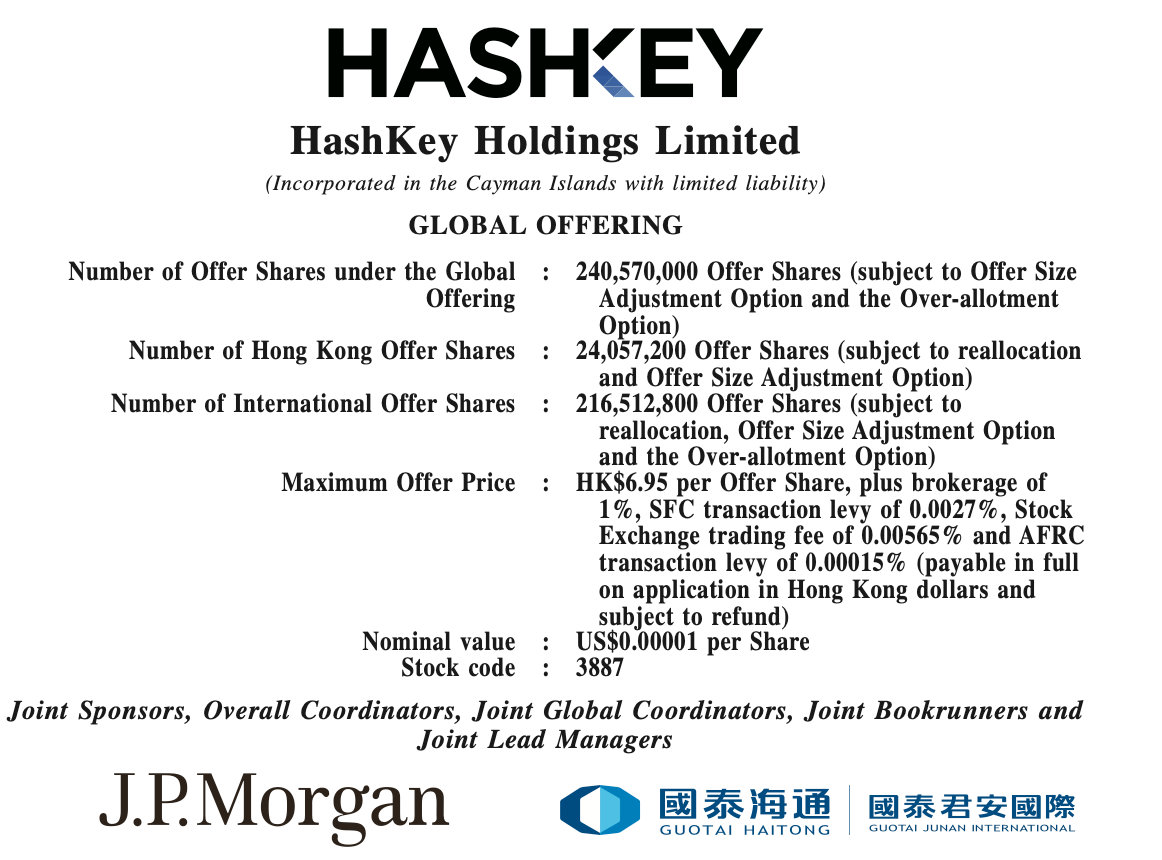

HashKey is seeking to raise up to 1.67 billion Hong Kong dollars ($214.7 million) in an IPO that is scheduled to debut on Dec. 17, according to a prospectus filed with the Hong Kong Stock Exchange (HKEX) on Tuesday.

The company is offering 240.6 million shares at $0.76–$0.89 each, which would bring HashKey’s valuation to $2.46 billion at the top of the range.

With the subscription period beginning today, investors can apply for HashKey shares online through the HK eIPO White Form or using an electronic application via HKEX’s digital IPO settlement platform FINI until Friday.

HashKey’s rapid path to IPO after three years of operation

Founded in 2018, HashKey has grown into Hong Kong’s largest crypto exchange, reportedly capturing a 75% market share, or more than three times that of its nearest competitor.

After commencing operations and obtaining key regulatory approvals in Hong Kong in 2022, HashKey entered full-scale operations in 2023.

According to its prospectus, HashKey had facilitated $167 billion in cumulative spot trading volume as of Sept. 30.

HashKey offers a wide range of digital asset services to both institutional and retail investors, including spot exchange, over-the-counter (OTC) trades, staking and tokenization. It also operates HashKey Chain, an Ethereum layer-2 network designed for real-world assets (RWAs), stablecoins and decentralized applications.

The company has also emerged as the largest Asian, Hong Kong-based asset management provider in 2024, with $1 billion in assets under management as of Sept. 30, the prospectus states.

Related: Bitkub exchange eyes Hong Kong IPO as Thai markets slump to 5-year lows: Report

HashKey’s IPO is backed by high-profile sponsors, including major US investment bank JPMorgan and local financial institutions such as Guotai Junan.

The IPO proceeds are planned to go toward scaling its ecosystem and infrastructure, bolstering risk management and hiring talent, the filing notes.

HashKey’s public offering comes amid a continued IPO boom in Hong Kong, with HKEX reporting a 209% year-on-year increase in funds raised through IPOs in 2025, totaling $27.8 billion in the first months of the year.

Magazine: Animoca’s bet on altcoin upside, analyst eyes $100K Bitcoin: Hodler’s Digest, Nov. 23 – 29