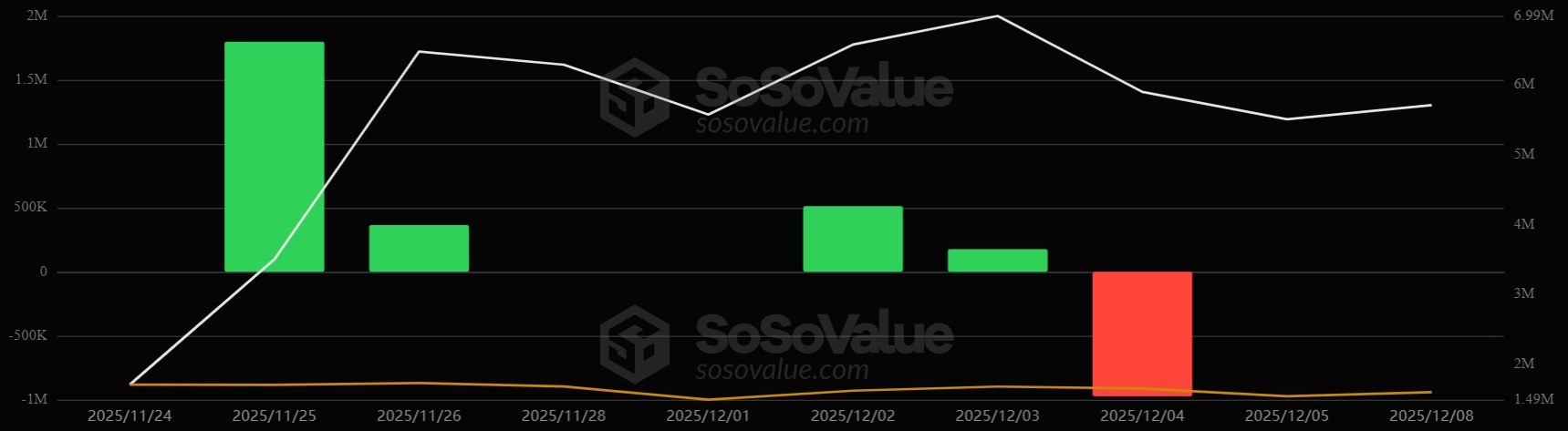

US spot Dogecoin exchange-traded funds (ETFs) are showing early signs of cooling demand, as total value traded (TVT) has fallen to its lowest level since launch.

SoSoValue data shows that on Monday, Dogecoin ETFs’ TVT fell to just $142,000, the lowest since launch. This marks a sharp retreat from late November, when the funds saw days where value traded topped $3.23 million.

Total value traded refers to the total dollar amount of ETF shares bought and sold over a given period. It serves as a gauge of market activity and practical liquidity, indicating the amount of money that has moved through the funds.

The contrast is stark when compared to Dogecoin (DOGE) activity in the broader crypto market. CoinGecko data shows that in the last 24 hours, DOGE recorded over $1.1 billion in spot trading volume and has a market capitalization of $22.6 billion.

This shows that the underlying asset remains highly liquid, but not through its ETF wrappers. This discrepancy suggests that traders are accessing DOGE directly through exchanges rather than traditional market vehicles.

Grayscale’s Dogecoin ETF made its debut in November but fell well short of initial volume expectations. ETF analyst Eric Balchunas predicted at the time that the ETFs would get at least $12 million in volume. However, the ETF only saw $1.4 million on its first day.

Related: BlackRock files with SEC for listing of staked Ether ETF

Bitcoin and Ether dominate ETF trading as alt-ETFs trail behind

On Dec. 8, ETF trading activity remained concentrated on Bitcoin (BTC) and Ether (ETH)-based products. According to SoSoValue, Bitcoin ETFs posted $3.1 billion in TVT, while Ether ETFs recorded $1.3 billion.

Solana (SOL) ETFs saw $22 million in value traded, while XRP products recorded $21 million in value traded. Further down the curve, the recently-launched Chainlink ETFs recorded a $3.1 million TVT on the same day, while Canary’s Litecoin (LTC) ETF had about $526,000.

The data suggests that ETF capital still overwhelmingly flows toward the two largest digital assets, continuing their lead as the core liquidity centers of regulated crypto exchange-traded products.

In terms of inflows, XRP (XRP) remains strong. On Monday, XRP ETFs’ inflow streak remains unbroken since its launch. Meanwhile, Solana ETFs, which first had their inflow streak broken in November, are on a three-day inflow streak after seeing $32 million in outflows on Dec. 3.

Magazine: Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express