Darknet marketplace Silk Road-linked cryptocurrency wallets are moving again, less than a year after US President Donald Trump granted its founder, Ross Ulbricht, a full pardon.

Silk Road-tagged cryptocurrency wallets awoke Tuesday to transfer approximately $3.14 million worth of Bitcoin (BTC), according to blockchain data platform Arkham.

The 176 transfers mark the wallet’s most significant activity in five years. Silk Road-related wallets executed only three small test transactions earlier this year.

The transfers were all made to an unknown cryptocurrency wallet “bc1qn.” The primary Silk Road–tagged wallets still hold about $38.4 million in Bitcoin, while the newly created address is holding only the $3.14 million received in the recent transactions.

Cointelegraph was unable to independently verify the owner of the new wallet and has reached out to Ulbricht for comment.

Related: Crypto nears its ‘Netscape moment’ as industry approaches inflection point

In January, Trump gave a full pardon to Silk Road founder Ross Ulbricht, who had been serving a double life sentence without parole.

Ulbricht was convicted in 2015 for his role in creating and operating Silk Road, a darknet marketplace that facilitated the anonymous trade of illicit goods using Bitcoin.

Following the pardon, supporters have contributed approximately $270,000 in Bitcoin donations to the Free Ross campaign, according to onchain data.

Related: ‘Elite’ traders hunt dopamine-seeking retail on prediction markets: 10x Research

Silk Road founder may still hold millions in unseized crypto wallets

While the US government seized at least $3.36 billion in Bitcoin from Silk Road, some industry watchers claim that Ross had multiple other Bitcoin wallets that weren’t discovered during the asset seizure.

Coinbase exchange director Conor Grogan revealed that 430 BTC, worth about $47 million, remains untouched in wallets likely linked to Ulbricht, which have been dormant for over 13 years.

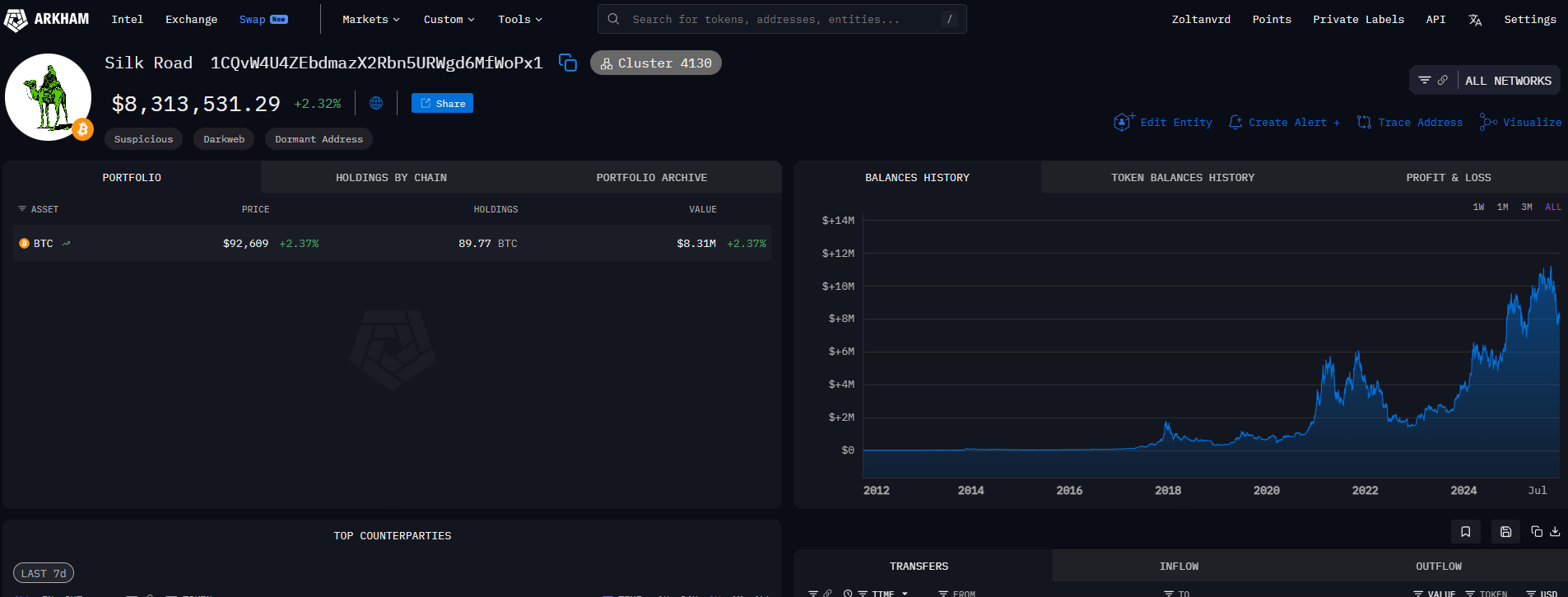

Another Silk Road-tagged wallet likely belonging to Ulbricht holds $8.3 million in Bitcoin. Barring three small test transactions in the past 10 months, the wallet has been inactive for 14 years, according to Arkham.

Magazine: $3.4B of Bitcoin in a popcorn tin — The Silk Road hacker’s story