The Federal Reserve approved a 0.25% rate cut amid internal divisions, but concerns over inflation and economic growth, along with what Glassnode highlights as BTC's "fragile zone," may continue to keep it suppressed below $100,000.

On Wednesday, the U.S. Federal Reserve approved a 25 basis point rate cut, the third such cut this year, in line with market expectations. Mirroring pre-FOMC meeting price action seen previously, Bitcoin had surged past $94,000 on Monday, but a "hawkish" media interpretation of this cut reflects ongoing divisions within the Fed regarding U.S. monetary policy and the economic outlook.

Given this week's rate cut being labeled as "hawkish," Bitcoin's price could see a "sell the news" reaction and continue to trade sideways until new momentum catalysts emerge.

As reported by CNBC, the Fed's decision passed with a 9-3 vote, indicating lingering concerns among members about persistent inflation and expectations for slower economic growth and a more gradual pace of rate cuts through 2026.

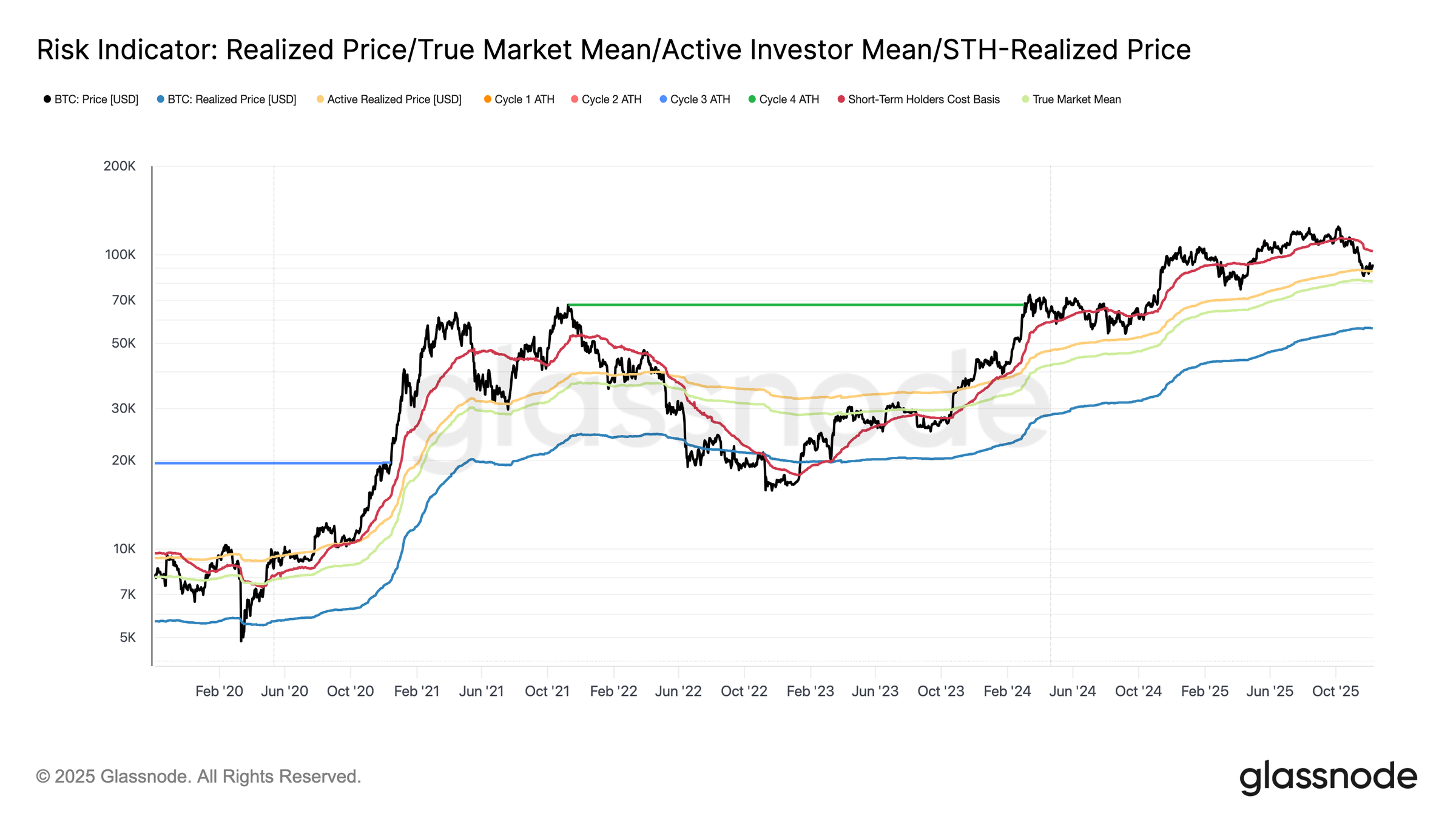

According to Glassnode data, Bitcoin (BTC $92,626) remains trapped in a structurally fragile zone below $100,000, with its price action bounded by the short-term holder cost basis at $102,700 and the "true market mean" at $81,300.

Glassnode's data further shows that Bitcoin continues to be held below $100,000 in an environment of weakening on-chain conditions, reduced futures demand, and persistent selling pressure.

Key Takeaways:

- Bitcoin's structurally fragile zone is stalling the market below $100,000, with mounting unrealized losses.

- Realized losses have surged to $555 million per day, the highest level since the FTX collapse in 2022.

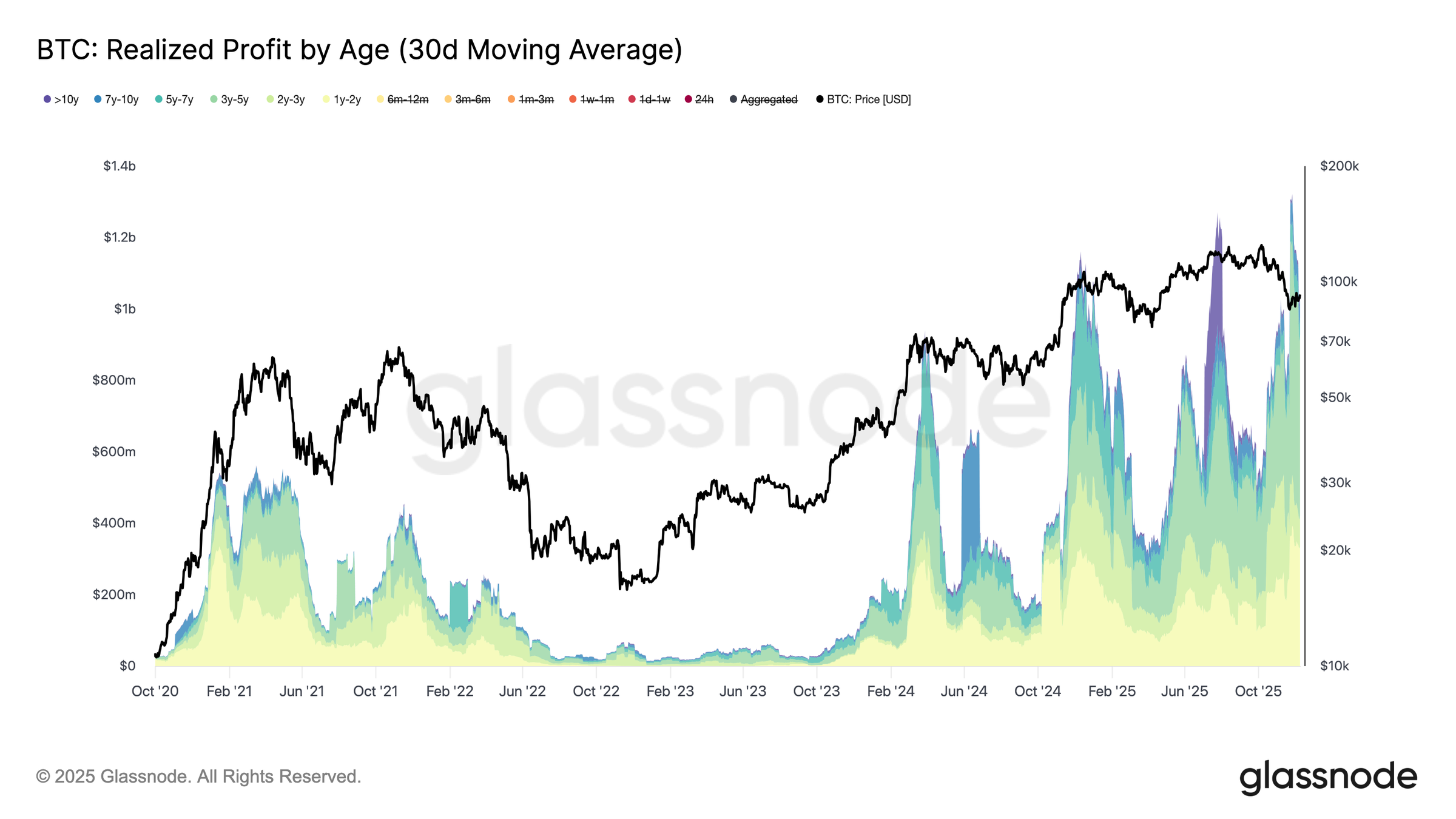

- Massive profit-taking by holders of one year or more, coupled with capitulation from top buyers, is preventing Bitcoin from reclaiming the STH (Short-Term Holder) cost basis.

- The Fed's rate cut may not provide significant near-term upside momentum for Bitcoin.

Time is Running Out for Bitcoin to Reclaim $100,000

According to Glassnode, Bitcoin's failure to break above $100,000 reflects intensifying structural pressure: time is working against the bulls. The longer the price remains stuck in this fragile zone, the more unrealized losses accumulate, increasing the likelihood of forced selling.

Realized price and true market mean for Bitcoin. Source: Glassnode

The 30-day simple moving average (SMA) of relative unrealized loss has risen to 4.4%, breaking out of a two-year sub-2% range and signaling an entry into a higher-stress market environment. Despite Bitcoin's rebound from the November 22 low to around $92,700, the entity-adjusted realized loss continues to climb, reaching $555 million per day, levels consistent with the FTX capitulation period.

Simultaneously, long-term holders (holding for over one year) are realizing over $1 billion in profits daily, with peaks hitting a record $1.3 billion. Capitulation from top buyers combined with massive distribution by long-term holders will likely keep BTC suppressed below key cost bases, preventing a reclaim of the $95,000–$102,000 resistance zone, which marks the upper bound of the fragile zone.

Realized profit by age. Source: Glassnode

Spot-Led Rally Meets a Shrinking Futures Market

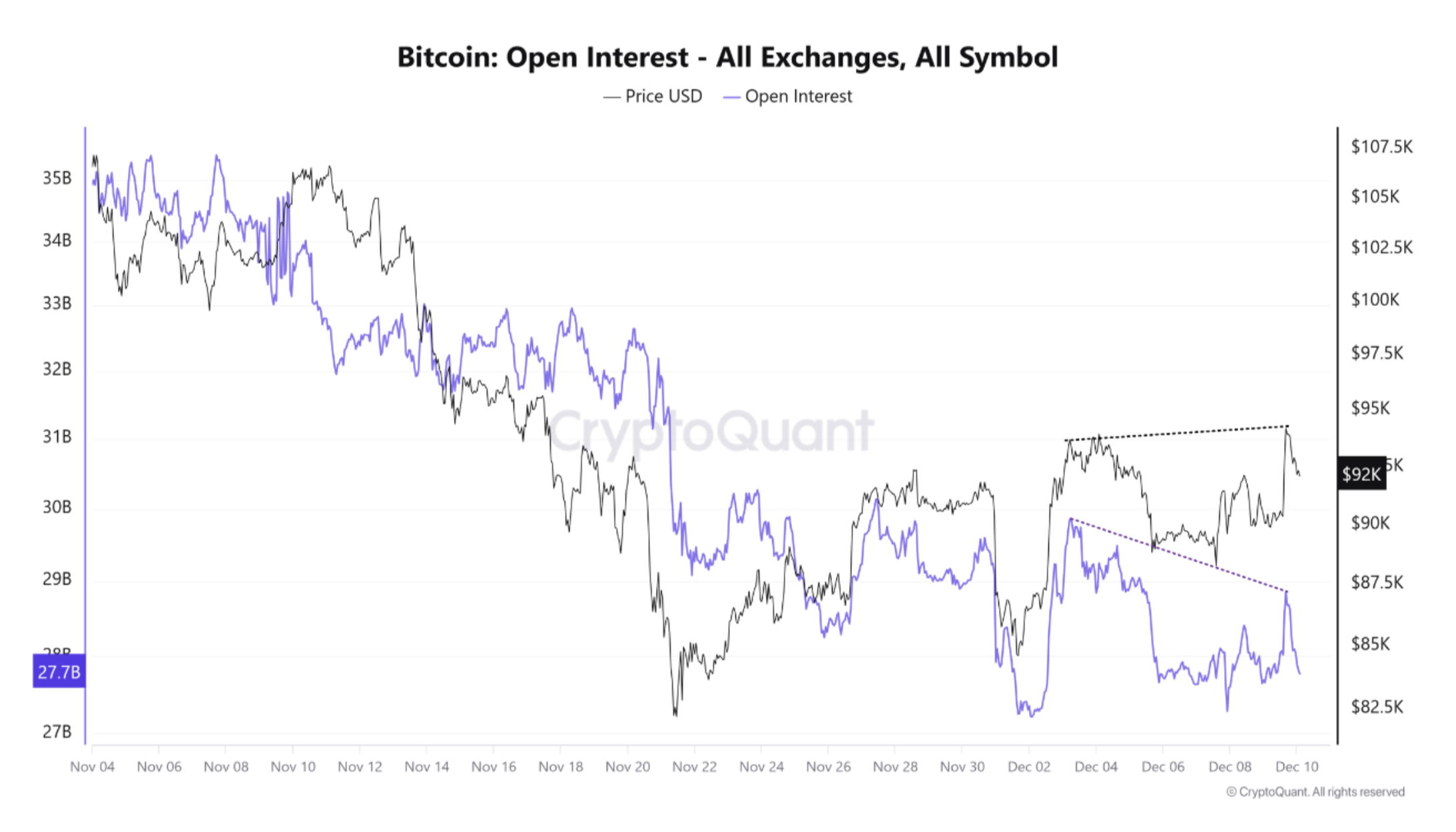

Data from CryptoQuant shows that crypto markets typically rally ahead of FOMC meetings, but a significant divergence has recently appeared: Bitcoin's price is rising while open interest (OI) continues to decline.

Bitcoin price versus open interest divergence. Source: CryptoQuant

Open interest has been declining throughout the correction since October, and even as Bitcoin found a bottom on November 21st and prices moved higher, OI continued to fall. This suggests the current rally is primarily driven by spot demand, not leveraged speculation.

CryptoQuant added that while spot-driven advances are generally healthier, sustained bullish momentum historically still requires a rise in leveraged positions. Given that derivatives trading volume structurally dominates the market—with spot volume accounting for only about 10% of derivatives activity—this spot-driven strength could be difficult to sustain if market expectations for future rate cuts weaken ahead of the meetings.