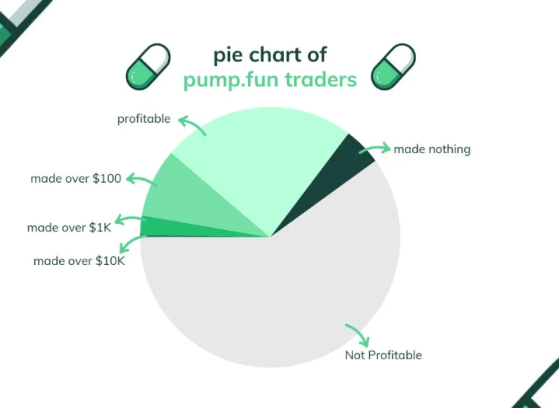

Happycoin.club - Только 3% трейдеров, торгующих мемными токенами на платформе pump.fun, заработали более $1000. Менее 0,8% пользователей площадки получили прибыль свыше $10 000.

Согласно данным аналитического сервиса Dune, у большинства трейдеров на pump.fun не было ни одной прибыльной сделки, несмотря на то, что ежедневно на платформе запускаются тысячи мемкоинов.

Главная проблема платформы для генерации мемкоинов на базе Solana состоит в том, что процент запуска созданных там токенов составляет всего 1,21%-1,41%. Другим словами, более 98% шуточных активов не получают дальнейшего развития.

Так, за последние 24 часа менее 160 из 10 700 мемных токенов, созданных на pump.fun, попали из сервиса в децентрализованный протокол Raydium на базе Solana. Большая часть сгенерированных за сутки активов либо осталась на прежнем уровне, либо потеряла объём и ликвидность, поскольку трейдеры поспешили зафиксировать прибыль или сократить свои убытки.

Это означает, что большинство токенов не смогли бы даже достичь рыночной капитализации в $60000, которая необходима, чтобы актив попал в пул ликвидности Raydium. Только в этом случае мемкоин считается запущенным.

Слабые показатели трейдеров и маленький процент запуска мемкоинов не мешает pump.fun зарабатывать – с 10 по 17 августа доходы платформы составили $6,3 млн. Это более чем в два раза больше апрельского показателя в $2,5 млн и на 50% больше доходов, полученных в мае.

Читайте оригинальную статью на сайте Happycoin.club