When I graduated from university and applied for my first job in management consulting, I did what many ambitious but timid male graduates do: I chose a firm that specialized in serving financial institutions.

In 2006, banking was 'cool.' Banks were typically housed in the grandest buildings on the most beautiful streets in Western Europe, and I was eager to travel. However, no one told me that this job came with a more hidden, complex condition: I would be 'married' to one of the world's largest yet most specialized industries—banking—indefinitely. The demand for banking experts never disappears. During economic expansions, banks become more creative and need capital; during contractions, they need restructuring and still require capital. I tried to escape this vortex, but like any symbiotic relationship, breaking free was harder than it seemed.

The public generally assumes bankers understand banking. This is a reasonable assumption but a mistaken one. Bankers often silo themselves into industry and product segments. A banker specializing in telecom might know everything about telecom companies (and their financing characteristics) but very little about banking itself. Those who dedicate their lives to serving banks (i.e., the Financial Institutions Group, or FIG, crowd) are a peculiar breed. And they are generally unpopular. They are the 'losers among losers.'

Every investment banker, while tweaking spreadsheets at midnight, dreams of escaping banking for private equity or startups. But FIG bankers are different. Their fate is sealed. Trapped in a gilded 'servitude,' they live in a self-contained industry, largely ignored by others. Banking for banks is deeply philosophical, occasionally beautiful, but mostly invisible. Until decentralized finance (DeFi) emerged.

DeFi made lending fashionable. Suddenly, every marketing genius in fintech felt qualified to comment on topics they barely understood. Thus, this ancient, serious discipline of 'banking for banks' resurfaced. If you arrive in DeFi or crypto with a box of brilliant ideas about reinventing finance and understanding balance sheets, know that in some corner of London's Canary Wharf, Wall Street, or Basel, an anonymous FIG banker probably thought of those ideas two decades ago.

I, too, was a suffering 'banker's banker.' And this article is my revenge.

Tether: Schrödinger's Stablecoin

It has been two and a half years since I last wrote about the most enigmatic topic in crypto—Tether's balance sheet.

Few things capture the imagination of industry insiders like the composition of $USDT's financial reserves. Yet, most discussions still revolve around whether Tether is 'solvent' or 'insolvent,' lacking a framework to make this debate meaningful.

In traditional companies, the concept of solvency is clearly defined: assets must at least match liabilities. However, when applied to financial institutions, this logic becomes less stable. In financial institutions, the importance of cash flow is diminished, and solvency should be understood more as the relationship between the amount of risk carried on the balance sheet and the liabilities owed to depositors and other funding providers. For financial institutions, solvency is more a statistical concept than a simple arithmetic one. If this sounds counterintuitive, don't worry—bank accounting and balance sheet analysis have always been one of the most specialized corners of finance. Watching people improvise their own solvency assessment frameworks is both amusing and frustrating.

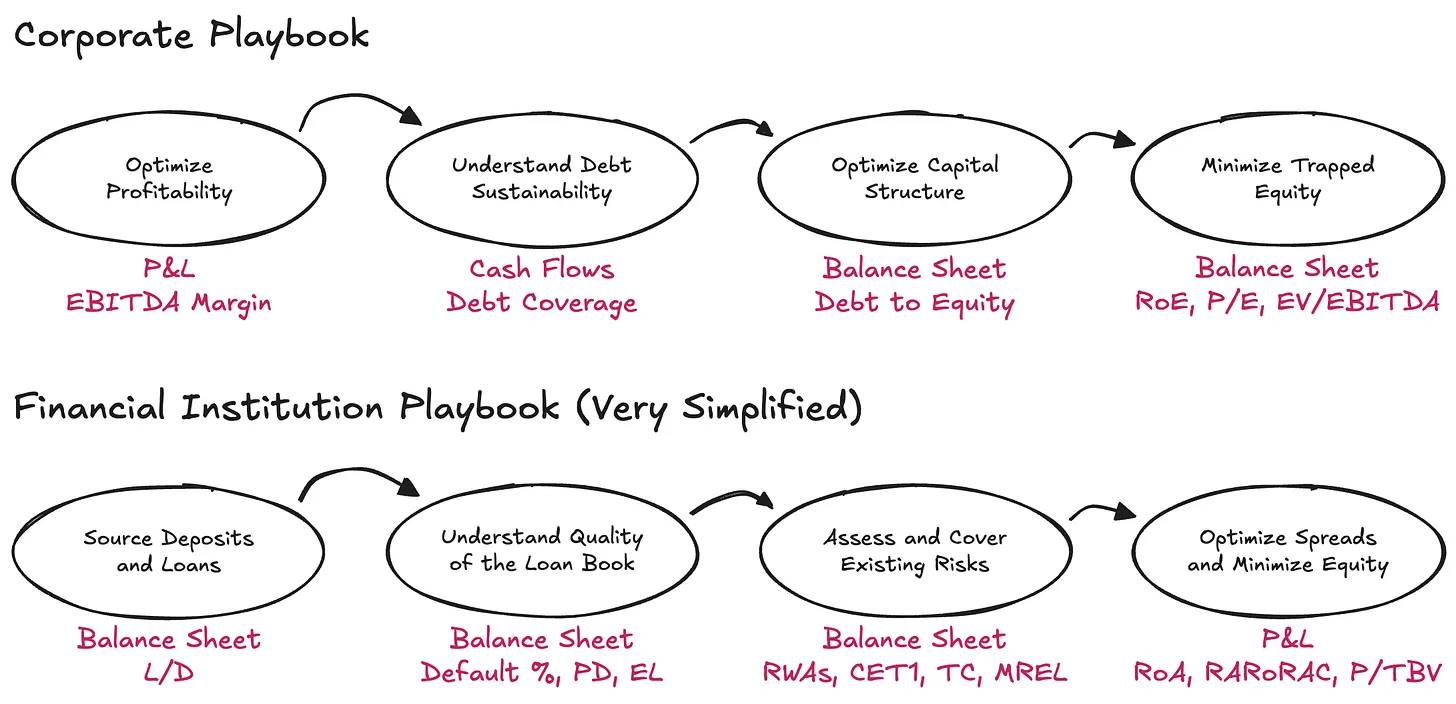

In reality, understanding financial institutions requires inverting the logic of traditional companies. The starting point for analysis is not the profit and loss statement (P&L) but the balance sheet—and cash flow is ignored. Debt here is not a constraint but the raw material of the business. What truly matters is how assets and liabilities are arranged, whether there is enough capital to absorb risks, and whether sufficient returns are left for capital providers.

The topic of Tether ($USDT) was reignited by a recent S&P report. The report itself is simple and mechanical, but the truly interesting part is the attention it garnered, not its content. By the end of Q1 2025, Tether had issued approximately $174.5 billion in digital tokens, mostly USD-pegged stablecoins, with a small amount of digital gold. These tokens provide qualified holders with a 1:1 redemption right. To support these redemption rights, Tether International, S.A. de C.V. holds approximately $181.2 billion in assets, meaning its excess reserves are about $6.8 billion.

Is this net asset figure sufficient? To answer this question (and avoid creating yet another custom assessment framework), we must first ask a more fundamental question: What existing framework should be applied? And to choose the right framework, we must start with the most basic observation: What kind of business is Tether, really?

A Day in the Life of a Bank

At its core, Tether's business involves issuing on-demand digital deposit instruments that circulate freely in crypto markets, while investing these liabilities into a diversified portfolio of assets. I deliberately use 'investing liabilities' rather than 'holding reserves' because Tether does not simply custody the funds in a same-risk/same-maturity manner. Instead, it actively allocates assets and profits from the spread between the yield on its assets and its liabilities (which are nearly zero-cost), all under broadly defined asset usage guidelines.

From this perspective, Tether resembles a bank more than a mere money transmitter—more precisely, an unregulated bank. In the simplest framework, banks are required to hold a certain amount of economic capital (here I treat 'capital' and 'net assets' as synonymous, apologies to my FIG friends) to absorb the impact of expected and unexpected fluctuations in their asset portfolios, among other risks. This requirement exists for a reason: banks enjoy a state-granted monopoly to custody household and corporate funds, a privilege that demands they provide a corresponding buffer for potential risks on their balance sheets.

Regulators focus on three key aspects for banks:

- The types of risks a bank must consider

- The nature of what qualifies as capital

- The amount of capital a bank must hold

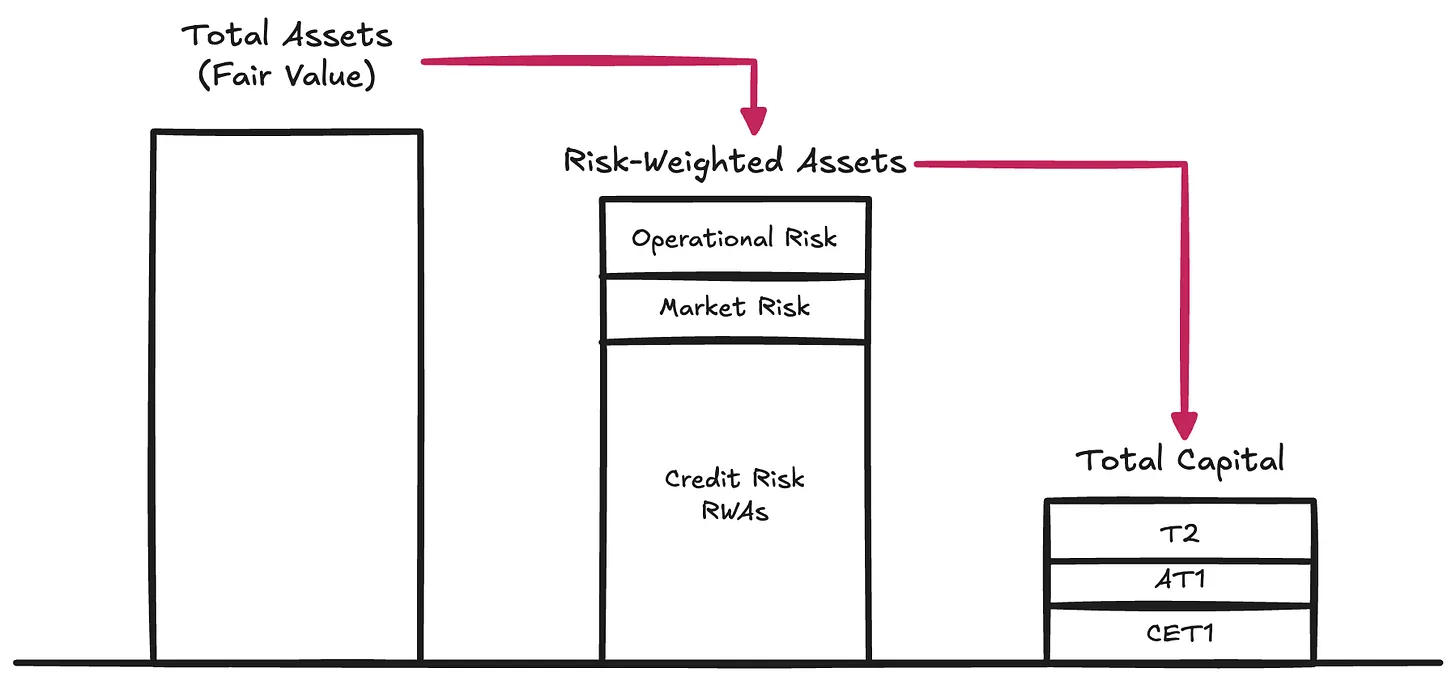

Types of Risk → Regulators standardize the various risks that could erode the redeemable value of a bank's assets, which manifest when assets are ultimately used to repay its liabilities:

Credit Risk → The possibility that a counterparty fails to fulfill its obligations in full when required. This risk typically constitutes 80%-90% of the risk-weighted assets (RWAs) of most Global Systemically Important Banks (G-SIBs).

Market Risk → The risk of an adverse movement in the value of assets relative to the currency in which liabilities are denominated, even without credit or counterparty deterioration. This can occur if depositors expect redemption in USD but the institution holds gold or Bitcoin ($BTC). Interest rate risk also falls into this category. This risk usually accounts for 2%-5% of RWAs.

Operational Risk → The spectrum of potential risks inherent in business operations: fraud, system failures, legal losses, and various internal errors that could damage the balance sheet. This risk typically constitutes the remainder, a low percentage of RWAs.

These requirements form the First Pillar of the Basel Capital Framework, which remains the dominant system for defining prudent capital for regulated institutions. Capital is the essential raw material ensuring the balance sheet holds sufficient value to meet redemptions by liability holders (at typical redemption speeds, i.e., liquidity risk).

The Nature of Capital

Equity is expensive—as the most subordinated form of capital, it is indeed the costliest way for a firm to finance itself. Over the years, banks became exceedingly adept at reducing both the amount of equity required and its cost through various innovations. This gave rise to so-called Hybrid Instruments, financial instruments that behave like debt economically but are structured to meet regulatory requirements to be treated as equity capital. Examples include Perpetual Subordinated Notes, which have no maturity date and can absorb losses; Contingent Convertibles (CoCos), which automatically convert to equity if capital falls below a trigger; and Additional Tier 1 Instruments, which may be written down entirely in stress scenarios. We witnessed the role of these instruments during the restructuring of Credit Suisse. Due to their widespread use, regulators differentiate the quality of capital. Common Equity Tier 1 (CET1) sits at the top—the purest, most loss-absorbing form of economic capital. Below it are other capital instruments of progressively lower purity.

However, for our discussion, we can temporarily ignore these internal classifications and focus directly on the concept of Total Capital—the overall buffer available to absorb losses before liability holders are at risk.

The Amount of Capital

Once a bank has risk-weighted its assets (and according to regulatory capital definitions), regulators require the bank to maintain minimum capital ratios against these Risk-Weighted Assets (RWAs). Under the First Pillar of the Basel Capital Framework, the classic minimum ratio requirements are:

- Common Equity Tier 1 (CET1): 4.5% of RWAs

- Tier 1 Capital: 6.0% of RWAs (includes CET1 capital)

- Total Capital: 8.0% of RWAs (includes CET1 and Tier 1 capital)

On top of this, Basel III overlays additional context-specific buffers:

- Capital Conservation Buffer (CCB): Adds 2.5% to CET1

- Countercyclical Capital Buffer (CCyB): Adds 0–2.5% based on macroeconomic conditions

- G-SIB Surcharge: Adds 1–3.5% for systemically important banks

In practice, this means that under normal First Pillar conditions, large banks must maintain 7–12%+ CET1 and 10–15%+ Total Capital. However, regulators don't stop at the First Pillar. They also implement stress testing regimes and add extra capital requirements if necessary (the Second Pillar, Pillar II). Thus, actual capital requirements can easily exceed 15%.

If you want to delve deep into a bank's balance sheet composition, risk management practices, and capital held, you can check its Pillar III disclosures—this is not a joke.

For reference, 2024 data showed that G-SIBs averaged a CET1 ratio of around 14.5% and a Total Capital ratio of around 17.5% to 18.5% of RWAs.

Tether: The Unregulated Bank

Now we can understand that debates about whether Tether is 'good' or 'bad,' 'solvent' or 'insolvent,' 'FUD' or 'fraud' miss the point. The real issue is simpler and more structural: Does Tether hold sufficient Total Capital to absorb the volatility of its asset portfolio?

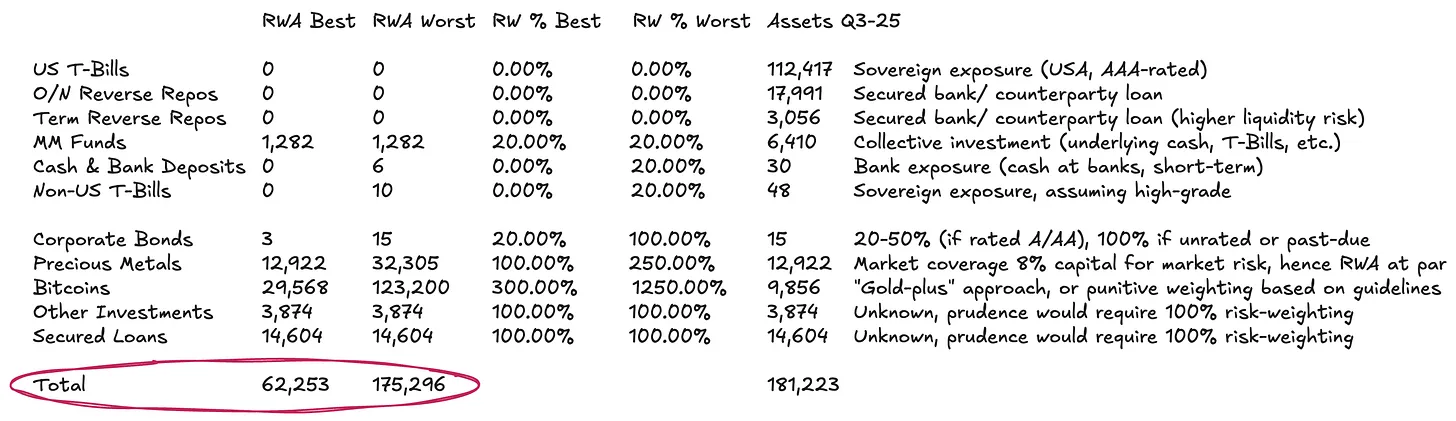

Tether does not publish disclosures akin to a Pillar III report (for reference, here is UniCredit's); instead, it provides only an abbreviated reserve report—this is its latest version. While extremely limited by Basel standards, it is sufficient to attempt a rough estimate of Tether's Risk-Weighted Assets.

Tether's balance sheet is relatively simple:

- Approximately 77% is invested in money market instruments and other USD-denominated cash equivalents—under the standardized approach, these assets require little to no risk weighting or carry very low risk weights.

- Approximately 13% is invested in physical and digital commodities.

- The remainder consists of loans and other miscellaneous investments not detailed in the disclosure.

Risk-Weighting Category (2) requires careful handling.

Under standard Basel guidance, Bitcoin ($BTC) is assigned a risk weight as high as 1,250%. Combined with the 8% Total Capital requirement for RWAs (see above), this effectively means regulators require full reserve backing for $BTC—a 1:1 capital deduction, assuming it has no loss-absorbing capacity whatsoever. We include this in our worst-case scenario, although this requirement is clearly outdated—especially for an issuer whose liabilities circulate in crypto markets. We believe $BTC should be more consistently treated as a digital commodity.

Currently, there are clear frameworks and common practices for treating physical commodities like gold—Tether holds a significant amount of gold: if held directly in custody (as some of Tether's gold is, $BTC likely is too), there is no inherent credit or counterparty risk. The risk is purely market risk, as liabilities are denominated in USD, not the commodity. Banks typically hold 8%–20% capital against gold positions to buffer price fluctuations—equivalent to a 100%–250% risk weight. Similar logic could be applied to $BTC, adjusted for its drastically different volatility profile. Since Bitcoin ETF approval, $BTC's annualized volatility has been 45%–70%, compared to gold's 12%–15%. Thus, a simple benchmark approach would be to scale $BTC's risk weight relative to gold's by roughly a factor of 3.

Risk-Weighting Category (3), the loan book, is completely opaque. For the loan portfolio, transparency is nearly zero. With no information on borrowers, maturities, or collateral, the only reasonable option is to apply a 100% risk weight. Even this remains a relatively lenient assumption, given the complete lack of any credit information.

Based on the above assumptions, for Tether's total assets of approximately $181.2 billion, its Risk-Weighted Assets (RWAs) could range from approximately $62.3 billion to $175.3 billion, depending on the treatment of its commodity portfolio.

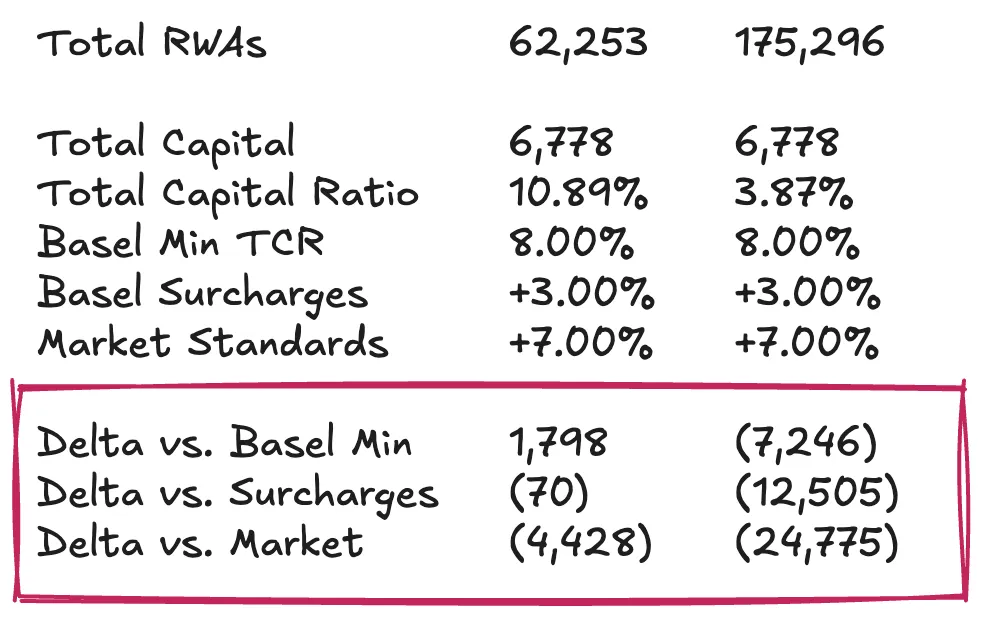

Tether's Capital Position

Now we can put the final piece in place by examining Tether's equity, or excess reserves, relative to its Risk-Weighted Assets (RWAs). In other words, we need to calculate Tether's Total Capital Ratio (TCR) and compare it to regulatory minimums and market conventions. This step of the analysis is inevitably subjective. Therefore, my goal is not to give a final verdict on whether Tether has enough capital to make $USDT holders feel secure, but to provide a framework to help readers break down the issue into digestible parts and form their own assessment in the absence of a formal prudential regulatory framework.

Assuming Tether's excess reserves are approximately $6.8 billion, its Total Capital Ratio (TCR) would range from 10.89% to 3.87%, heavily dependent on how we treat its $BTC exposure and our level of price volatility. In my view, while full reserve backing for $BTC aligns with the strictest Basel interpretation, it seems overly conservative. A more reasonable baseline assumption is to hold enough capital buffer to withstand a 30%-50% price move in $BTC, a range well within historical volatility.

Under the baseline assumptions above, Tether's collateralization level is borderline adequate against minimum regulatory requirements. However, compared to market benchmarks (e.g., well-capitalized large banks), its performance is less satisfactory. By these higher standards, Tether might need approximately an additional $4.5 billion in capital to maintain its current $USDT issuance scale. If a more punitive, fully penal treatment of $BTC is applied, the capital shortfall could be in the range of $12.5 to $25 billion. I consider this requirement overly harsh and ultimately not practical.

Standalone vs. Group: Tether's Rebuttal and the Counter-Argument

Tether's standard rebuttal on collateralization is that, at the group level, it has a large pool of retained earnings acting as a buffer. The numbers are indeed significant: as of the end of 2024, Tether reported annual net profits exceeding $13 billion, with group equity surpassing $20 billion. More recent Q3 2025 attestations show year-to-date profits exceeding $10 billion.

However, the counter to this rebuttal is that, strictly speaking, these figures cannot be considered regulatory capital for $USDT holders. These retained profits (on the liability side) and proprietary investments (on the asset side) reside at the group level, outside the segregated reserves. While Tether has the ability to downstream these funds to the issuing entity if problems arise, there is no legal obligation to do so. It is this liability isolation arrangement that gives management the option, but not a hard commitment, to recapitalize the token business if necessary. Therefore, treating group retained earnings as fully available to absorb $USDT losses is an overly optimistic assumption.

A rigorous assessment would require examining the group's balance sheet, including its stakes in renewable energy projects, Bitcoin mining, AI and data infrastructure, peer-to-peer telecommunications, education, land, and gold mining and concession companies. The performance and liquidity of these risky assets, and Tether's willingness to sacrifice them in a crisis to ensure token holder interests, would determine the fair value of its equity buffer.

If you were expecting a definitive answer, I apologize for the potential disappointment. But this is precisely the style of Dirt Roads: the journey itself is the greatest reward.