1.Blockchain Games are Back

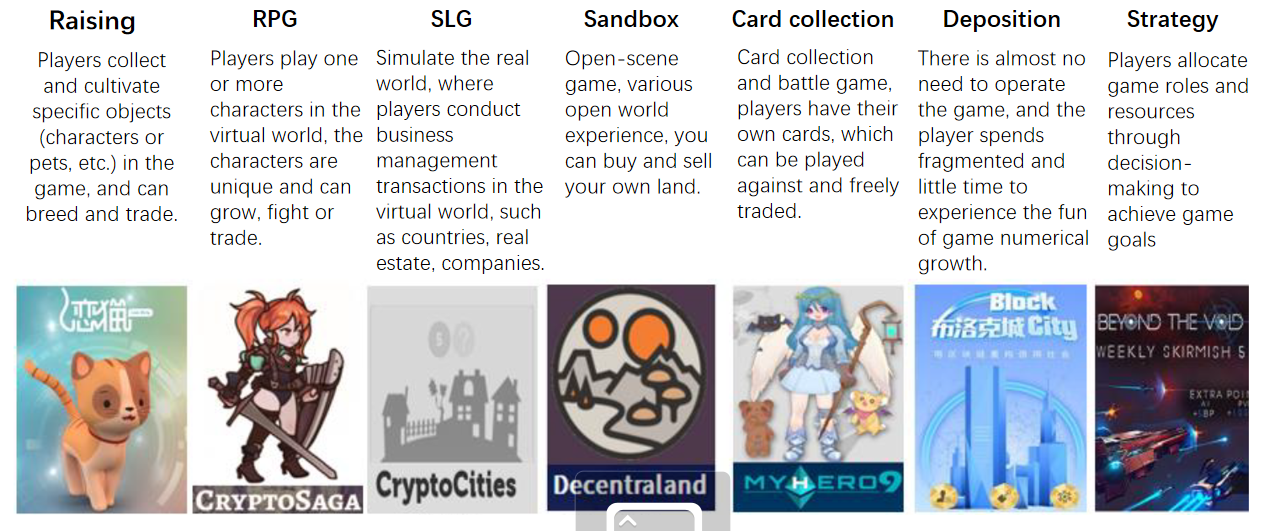

At the end of 2017, a game called CryptoKitties, a pet nurturing game based on Ethereum smart contracts, spread throughout the world. Transaction volumes within the game exceeded $1.9 million in the first seven days after launch, and the game became so popular that it caused congestion on the Ethereum network.

CryptoKitties' success attracted mass attention, with both capital and traditional gaming companies flocking to blockchain gaming. A month later, AxiomZen, CryptoKitties’ game development company, raised a Series A round of $70 million. Since then, a steady stream of strategy, RPG, simulation, and other blockchain games have continued to launch. Today, blockchain games are in the limelight.

Figure 1. "Blockchain Game Fever" in 2017

Source: Huobi Research

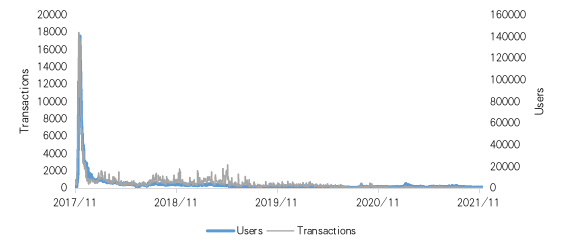

However, early blockchain games suffered from defects such as singular models, simplistic entertainment and poor experiences in general. As the novelty of the games faded, the popularity of blockchain games dipped. CryptoKitties peaked at 140,000 daily active users and 180,000 daily transactions at the end of 2017. Within a few months, however, these two figures fell by over 90%.

Figure 2. Changes in CryptoKitties daily active users and trading volume

Source: DappRadar, Huobi Research

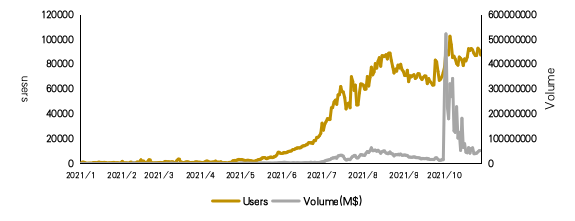

Since June of this year, numerous blockchain games incorporating NFTs, DeFi, and other elements under the concept of "Play to Earn" have emerged. The most prominent example is Axie Infinity, a pet game whose single-day income of $9.72 million surpassed that of Tencent’s popular mobile game "Honor of Kings" within just a few short months. Its tokens AXS and SLP appreciated in value over three times over the course of just two months.

Figure 3: Axie Infinity User Numbers and Transaction Volumes

Source: Dappradar, Huobi Research

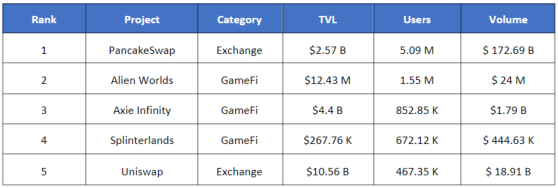

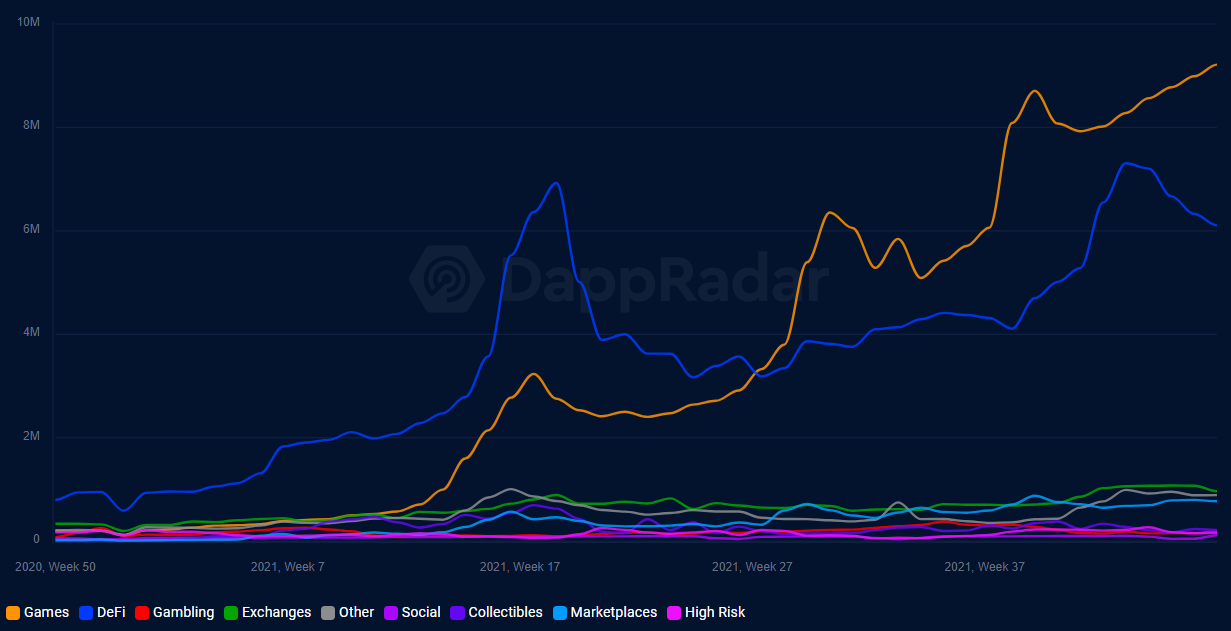

This new type of blockchain game, also known as GameFi, integrated finance and commerce with games. Judging from on-chain data, the number of GameFi games has skyrocketed since this past summer. DApp rankings show that five of the top nine apps are GameFi apps. Since this summer, GameFi's number of unique users has surpassed that of DeFi’s, becoming the main contributor to the total number of Dapp users. As of early December, GameFi's weekly active users have reached 9.21 million, a record high.

Table 2: Dapp Ranking List, December 2021

Source: DappRadar, Huobi Research

Figure 4: Change in the number of active independent wallet addresses on Dapps over the last year.

Source: DappRadar, Huobi Research

2. What are the reasons behind the rise of GameFi?

Many credit GameFi's success to its "Play To Earn" model, where players make money as they progress throughout the game. However, the "Play To Earn" concept has long been incorporated into the gaming industry - from acquiring equipment by killing monsters in World of Warcraft to playing games to acquire skin fragments or blue essence in League of Legends. So what is the real reason for GameFi's success?

The success of GameFi can be summed up in a simple equation: GameFi = Game + DeFi.

Transaction costs are an important concept in new institutional economics. In a broad sense, transaction costs refers to any costs generated by the existence of an economic system. The Coase Theorem elaborates that when there are transaction costs, the definition of property rights and the organizational form of the economy will impact resource allocation efficiency.

As a result, if all macro transaction costs are zero, the expectations of gamers can be met at no cost, thus game developers can collect and disseminate all information about development and consumption for free. Even without fair market pricing, users could be satisfied with the optimal outcome from the revenue model, which could be produced free of charge according to the user's time consumption, energy input and other measurements of input. However, the existence of transaction costs has become a determining factor for the choice of economic system-the society tends to choose the system with the lowest transaction costs to operate.

However, with special DeFi mechanisms, GameFi has enormously reduced transaction costs and improved user experience through the following two aspects:

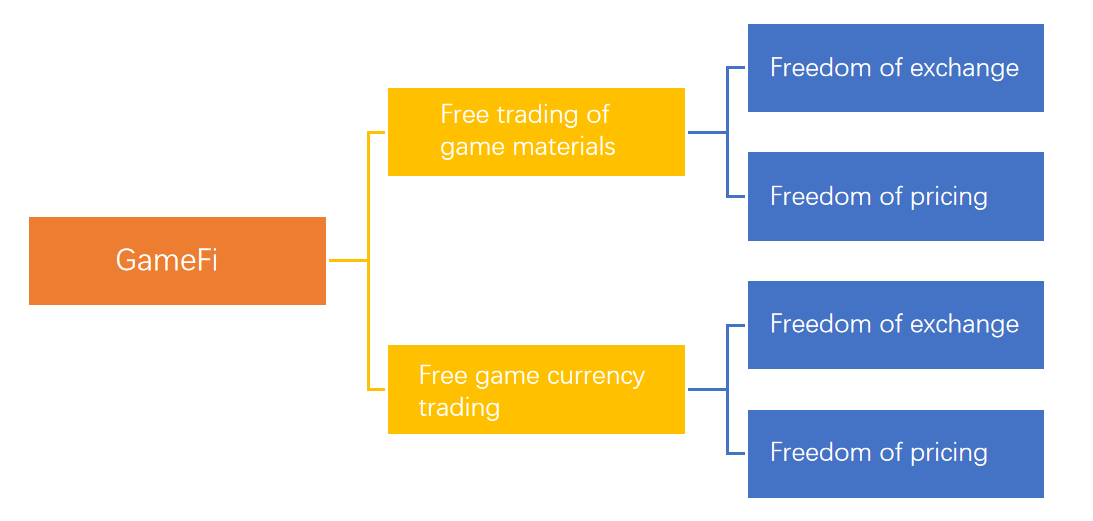

Figure 5. Ways that GameFi Reduces Transaction Fees

Source: Huobi Research

The first is the free trading of game materials, which is not only reflected by the freedom of exchange in trading objects, but also by the freedom of transaction prices. Transactions in traditional gaming models is similar to those of planned economies to a certain extent. For example, in terms of the object being transacted, it can only be exchanged with official channels; pricing is fixed at a uniform price by authorities, which severely limits the type and quantity of goods users can choose when making decisions.

As generally accepted in economics, when making production decisions, the wider range of available technologies and methods, the lower the transaction costs. GameFi further reduces transaction costs and improves the user experience by elevating the degree of freedom to trade.

The second factor is the free trading and pricing of game currencies. It has been overlooked by many analysts because, for traditional games, it is possible to make real money from game currency by selling in-game items or props for cash on underground black markets, even though game currencies cannot be directly monetized through official channels. However, this incurs large transaction costs: as we have seen in reality, no one buys apples with fiat currency and then exchanges apples for pears; they’d rather directly buy pears with money on hand. Because in each transaction, huge counterparty costs will emerge through the process of contracting, negotiating, and supervising transactions.

Therefore, the popularity of GameFi should not solely be credited to the "Play To Earn" model, especially given that gold farming has been present in the gaming industry for quite some time already. But rather, it is GameFi's ability to significantly reduce transaction fees for "gold farming" that enables users to make enormous profits at lower costs that makes it more appealing than other games.

Finally, GameFi's success cannot be achieved without the protection of property rights. Here’s a quote from the founder of Ethereum, Vitalik:

“From 2007 to 2010, I was obsessed with playing "World of Warcraft" till one day, blizzard removed the damage from my favorite warlock's Siphon Life ability. I cried myself to sleep. From that day on, I realized the terrible consequences of centralized servers. I quickly decided to quit the whole thing...”

Vitalik attributes the failure of traditional games to "centralized servers", but in fact, it is the absence of private property rights protection in traditional games that he is referring to. Vitalik would not be so desperate if game developers showed him respect and embraced his private property rights; this has nothing to do with "centralization" or "decentralization". For most traditional games, assets, such as characters and game props, don't really belong to the user unless the following three conditions are met:

1) Right to use: only the owner has the right to decide how to use these resources, and has the right to stop others from using them;

2) Right to earn, or the right to utilize assets to earn private income;

3) Right to transfer, or the right to transfer or sell resources to any person.

The above three properties are integral and form the private property rights framework. For most traditional games, revenue and transfer rights are not guaranteed. However, recall that the Coase theorem indicates that when there is a transaction cost, the definition of property rights and the choice of economic form will impact resource allocation efficiency.

Therefore, in order to optimize the allocation of resources, the arrangement of a property rights system is crucial. According to Steven N.S. Cheung, only a property rights system can (1) utilize the choice of multiple business models to save transaction costs; (2) facilitate transfer or sale for promotion of competition, thereby saving transaction costs.

Why has GameFi come so far? Because it effectively secured users' private property rights. In GameFi, the owners have the right to decide whether to sell certain resources or not, which lifts the degree of user independence and stimulates market competition, thus saving transaction costs. However, in traditional games, people's options are severely limited, resulting in high transaction costs. In some traditional games, there is no official platform where players can trade game props, but there is huge demand, which leads to a thriving underground market characterized by high transaction costs: high prices, fraud, and queuing, etc..

Since the arrangement of a property rights system is so vital to resource allocation efficiency and lowering transaction costs, why didn't traditional game companies institute such private property rights beforehand? The reason is that there are also transaction costs in switching the economic system. Before that, the costs of establishing a system of property rights was so high that game developers did not want to do it, so there were no incentives to update the property rights system.

However, with the development of blockchain technology and the diffusion of NFT technology, GameFi is now capable of deploying a nearly perfect private property rights system on the public chain with rather low costs. This not only is a comparative advantage that traditional game developers never had, but also reflects the intrinsic value of blockchain technology in the gaming industry.

Then, how should we evaluate the investment value of a GameFi game? For GameFi, it consists of two parts: traditional games and cutting-edge DeFi. GameFi first exists as a game, so we have to analyze its game characteristics. The value of a game can be assessed from two dimensions: product (content) and operations. Secondly, the significance of DeFi in GameFi games lies in the reduction of transaction costs and the protection of property rights. Therefore, a GameFi valuation model can be constructed based on the above two dimensions. We may elaborate more on GameFi valuation models in a future report, please stay tuned.