Mr.Abrash

06/07 03:24

ARK Invest Purchases $373M Circle Shares on IPO Da

ARK Invest Purchases $373M Circle Shares on IPO Day

Ark Invest invests $373.4 million into Circle during the latter's IPO on the NYSE. CRCL price rises 200%, reaching a peak of over $96.

Highlights :-

Ark Invest buys 4.5 million shares of Circle, worth a $373.4 million.

The massive investment comes on Circle's IPO on the NYSE.

The Circle stock rose 200%, reaching a peak of over $96, on its first trading day.

Cathie Wood’s ARK Invest has poured $373.4 million into Circle during the stablecoin issuer’s debut on the New York Stock Exchange. With this bold move, Wood’s investment giant has acquired 4,486,560 shares across its Innovation (ARKK), Next Generation Internet (ARKW), and Fintech Innovation (ARKF) funds.

In a bold move, ARK Invest purchased nearly 4.5 million shares of Circle (CRCL), worth a staggering $373.4 million, as the USDC issuer’s initial public offering (IPO) went live on the NYSE. The asset manager added the stablecoin issuer to its portfolio of crypto-exposed companies, joining existing holdings like Coinbase (COIN), Robinhood (HOOD), and Block.

Last day, B4Bit reported Circle’s official beginning as a public company with a vision to enable “frictionless value exchange” through its products like USDC and Circle Payments. Company CEO Jeremy Allaire stated, “Our transformation into being a public company is a significant and powerful milestone — the world is ready to start upgrading and moving to the internet financial system.”

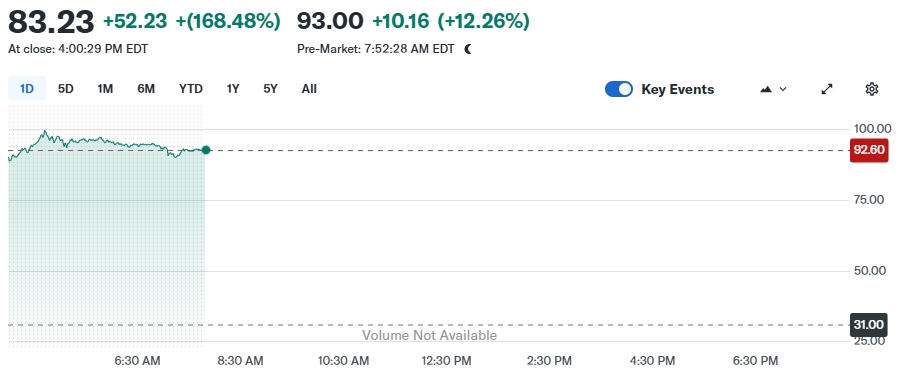

While the Circle stock opened at $69, up 123% from the IPO price, it skyrocketed nearly 200%, reaching a peak of over $96 on its first trading day. Under the ticker CRCL, the stock closed at $83.23, representing a 168.5% gain from its $31 IPO price. This dramatic surge followed an upsized initial public offering that demonstrated robust investor demand

#Share Your Thoughts on Popular Assets in June#Check In Weekly, Win Prizes Weekly — Join the Fun!#Share BTC or ETH Futures Trades

1Поделиться

Все комментарии0НовыеВ тренде